Massive retailers, notably those who function in a couple of geography, need to assist an array of funds strategies. Every cost integration requires in-house technical work and the transforming of 1’s platform to suit their plugins.

It’s an intensive course of that has seen some Huge Tech firms construct devoted groups to handle completely different connections, information and cycles with the funds gateways within the markets the place they’re current.

Within the U.S., U.Okay. and Europe, cost orchestration platforms equivalent to Spreedly, Zooz and Primer deal with plenty of the heavy lifting on behalf of retailers by way of a unified funds API. However there stays an untapped alternative in Africa and the Center East, the place considerably few firms convey transparency to retailers’ cost stacks.

Egypt and U.S.-based MoneyHash is one such firm, rising from beta with $3 million in pre-seed funding. The corporate describes itself because the Center East and Africa’s “first super-API for cost orchestration and income operations.”

The pre-seed spherical is an extension of an undisclosed six-figure increase MoneyHash introduced final June from traders Ventures Platform, Kepple Africa Ventures, LoftyInc Capital and lead COTU Ventures. The Center Japanese early-stage fund additionally led this extension, with participation from earlier backers within the preliminary pre-seed spherical and others like VentureSouq, VentureFriends, The Continent Enterprise Companions and First Verify Africa. Angel traders embrace NerdWallet’s Tim Chen, Jake Gibson and Belvo’s Oriol Tintore.

When retailers or firms get their platforms off the bottom, they primarily work with one or two cost processing suppliers. Over time, these retailers onboard extra cost suppliers to fulfill their rising wants as they get larger and increase throughout a number of areas.

However integrating completely different cost stacks isn’t any imply feat. Except for the operational inefficiencies and technicalities concerned, an in-house tech crew can take three to 10 weeks to finish integrations. In Africa and the Center East, these issues are magnified resulting from variations in cost strategies, currencies and isolations between international locations.

Nader Abdelrazik, Mustafa Eid and Anisha Sekar — with a mixed expertise of over 30 years working for firms equivalent to Microsoft, UpWork, NerdWallet and Sigfig — based MoneyHash in late 2020.

MoneyHash sits on prime of cost suppliers and gives its infrastructure as an extension of firms’ product backend. This extension turns into their connection to all the cost ecosystem within the markets they function.

“The thought of the super-API is that you just consolidate the completely different cost accounts and construct all of those options on prime of it. MoneyHash turns into this one-stop-shop product, or funds stack that you just put in your product and handle all of those completely different integrations and checkout expertise in every of the African and Center Japanese international locations and have all of your info on one dashboard,” CEO Abdelrazik mentioned on a name with TechCrunch.

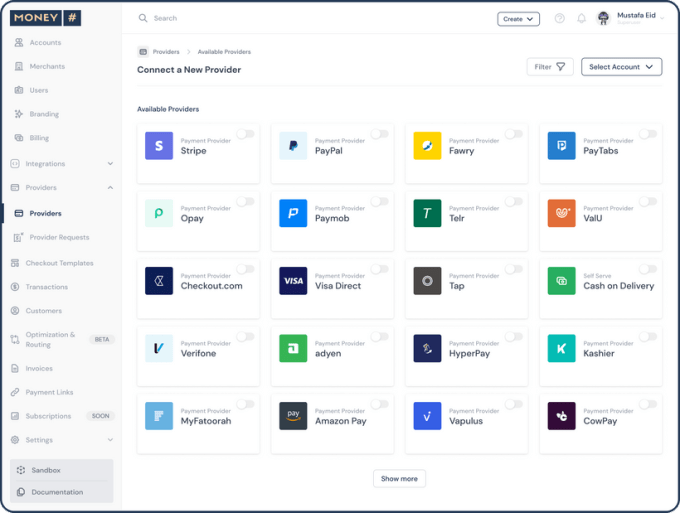

In early 2021, MoneyHash began in Egypt, permitting 17 firms to make use of its sandbox surroundings to attach with its API and entry funds gateways equivalent to Fawry, Paymob and PayTabs.

MoneyHash will plug into completely different funds gateways and processors lively within the Center East and North Africa post-beta. Some embrace Checkout, Stripe, Ayden, Amazon Pay, Faucet and ValU.

Integration with cost suppliers in sub-Saharan Africa (primarily serving Nigeria, Kenya and South Africa) like Yoco, Paystack and Flutterwave will comply with swimsuit, mentioned the chief government, with out giving specifics about when it will roll out the product for the area.

MoneyHash shoppers lower throughout completely different industries: e-commerce, journey and tourism, and remittances, amongst others. They will combine cost suppliers with just a few clicks, embed a unified checkout system, and entry micro-services equivalent to transaction routing, subscription administration and invoicing on the platform.

And of the 17 firms testing its sandbox without spending a dime, 5 are lively and paying prospects. MoneyHash fees these firms between $150 and $1,000 per 30 days, relying on the variety of cost suppliers they hook up with. The platform additionally takes transaction charges that begin at 10 cents and go down as funds quantity will increase.

Abdelrazik mentioned MoneyHash plans to grow to be the AWS. of funds within the Center East and Africa. “What AWS did to the cloud, the place it made it straightforward for firms to construct as many providers on prime of the infrastructure, we predict the cost business, particularly in rising markets, may be very fragmented and wishes an AWS for cash, which MoneyHash is doing while you join with it and construct as a lot as you want without having to alter something,” he mentioned.

MoneyHash will use the funds to turbocharge its progress within the Center East and Africa, it mentioned in a press release. The corporate additionally plans to increase its crew — at the moment 15 throughout the U.S., Egypt, the UAE, Nigeria and a few components of Europe — and rent mid-level and senior software program engineers.

“MoneyHash is led by three exceptional founders with deep data of funds and acumen for product-led execution,” Amir Farha, founding father of lead investor COTU Ventures, mentioned in a press release. “They’re attracting an awesome crew of expertise, and after their spectacular beta run, their product is prepared for prime time. We’re excited to be a part of their journey.”