What a surreal expertise it was waking up on Thursday morning. Switching on the information and seeing that Russia has truly invaded Ukraine. For us Europeans, wars since WWII have all the time been fought distant from residence in Afghanistan, former Yugoslavia, Iraq, Iran, Kuwait, and so forth. However that is actually in our yard on the Japanese border of Europe.

And though Ukraine isn’t a member of NATO, it is rattling shut…

US Shares Are Weakening vs Relaxation Of The World

In final week’s episode of Sector Highlight, I already had taken a fast take a look at international markets, primarily to see if there have been/are any alternate options to the US market, which was and nonetheless is in a corrective sample.

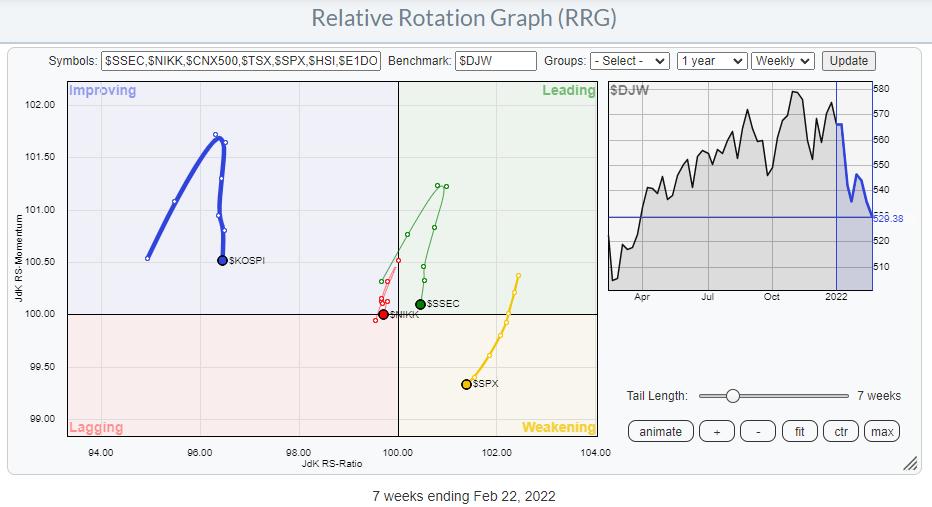

Once we begin by trying on the rotation of SPY vs the Dow Jones World Index ($DJW), we discover its tail contained in the weakening quadrant and heading decrease on each axes, leading to a unfavorable RRG-Heading.

The one different markets which have tails at a unfavorable RRG-Heading are Korea ($KOSPI), Japan ($NIKK), and China ($SSEC). Wanting on the world from an even bigger perspective, these are the markets which are at present higher prevented, as they’re exhibiting unfavorable relative tendencies.

All different tails on this universe are exhibiting tails at a optimistic RRG-Heading, apart from Russia ($RTSI) contained in the lagging quadrant.

Battle is Damaging Russian Inventory Market

Isolating the tail for Russia exhibits the deterioration beginning within the final weeks of November and choosing up pace firstly of November, subsequently quickly pushing into the lagging quadrant. Over the previous few weeks, the Russian tail has crept up on the RS-Momentum scale whereas nonetheless shedding relative power vs. the remainder of the world.

Given the very low studying on the JdK RS-Ratio scale, the space from the middle, and the disconnect from different markets, it is rather unlikely that this rotation would be the begin of a long-lasting enhancing rotation. A extra possible state of affairs might be a rotation on the left-hand facet of the RRG, underscoring the weak spot of the $RTSI.

The month-to-month chart of the $RTSI index exhibits how a lot injury was achieved to the chart this month up to now. What strikes me is that the low of the month up to now is just about precisely on the lows of 2014 and 2016 and near, or within the space of, the bottoms in 2008/9 and 2004/5. It stays astonishing, imho, how markets search and are attracted again to ranges that had been set a few years in the past.

We’re already seeing some massive bounces however, given the magnitude of the decline, these are nonetheless very restricted. I am afraid this market will want plenty of time to digest all this promoting stress. Sufficient motive, amongst others, to go on investments in Russia in the interim.

Alternate options?

After all, particularly for retail traders, money is an alternate. However if you need to maintain some allocation to shares, it’s a good suggestion to broaden your horizon exterior the US.

The third RRG above, exhibiting the tails which are touring at a optimistic RRG-Heading, offers you with prospects which are value an extra investigation. Going over their particular person charts, I discovered two markets that will provide a substitute for the US.

Indonesia

On the Relative Rotation Graph, $IDDOW has the very best studying on the RS-Ratio scale and has simply returned into the main quadrant after a rotation via weakening. This makes it an fascinating tail to have a look at. Citing the value chart for the Indonesian inventory market exhibits that $IDDOW has simply damaged from a brief consolidation sample and is now pushing towards falling resistance, which is working over the main highs of the final 4 years.

The RS-line has already taken out its overhead resistance stage after breaking its falling resistance again in October of final yr. This places Indonesia on the forefront of worldwide inventory markets; a break above resistance within the worth chart will very possible add extra gas to the (relative) rally.

Canada

According to different worldwide inventory markets, the Canadian TSX index began to maneuver roughly sideways on the finish of final yr. Nevertheless it didn’t full a topping formation. Not but, that’s, as a break under horizontal help close to 20000 would injury the image when it comes to worth.

Like $IDDOW, $TSX has additionally accomplished a rotation via weakening, re-entering the main quadrant six weeks in the past. Particularly with the rising RRG-Velocity, that is an fascinating tail/market to look at, because it appears poised to push increased on a relative foundation. The present power of commodities, particularly energy-related, might be a great push within the again for this index.

Inventory markets, on the whole, stay susceptible. Indonesia and Canada could provide (relative) alternate options. As a US-based investor, the iShares MSCI Indonesia ETF (EIDO) and the iShares MSCI Canada (EWC), each quoted in USD, are devices that can be utilized to create publicity to those markets.

Please keep in mind that they’re quoted in USD, so the forex alternate charge between the Indonesian rupiah and the US greenback, in addition to the Canadian greenback vs. the US greenback, will have an effect on efficiency. With the present power of the USD vs. most different world currencies, this may increasingly truly be a further supply of efficiency.

Have an incredible weekend and #StaySafe, –Julius

My common weblog is the RRG Charts weblog. If you want to obtain a notification when a brand new article is printed there, “Subscribe” together with your e-mail tackle.

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels beneath the Bio under.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can not promise to reply to each message, however I’ll definitely learn them and, the place moderately attainable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive technique to visualise relative power inside a universe of securities was first launched on Bloomberg skilled companies terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Army Academy, Julius served within the Dutch Air Pressure in a number of officer ranks. He retired from the army as a captain in 1990 to enter the monetary trade as a portfolio supervisor for Fairness & Legislation (now a part of AXA Funding Managers).

Be taught Extra