Immediately, on the final buying and selling day of the week and month, buyers will take note of the publication at 12:30 and 14:00 (GMT) of one other block of vital macro statistics for the USA, amongst which is the core private spending worth index (PCE) for April (Fed makes use of the PCE annual core worth index as the primary indicator of inflation) and the ultimate estimate of the College of Michigan Client Confidence Index. This indicator displays the boldness of American customers within the financial growth of the nation. A excessive stage signifies progress within the financial system, whereas a low stage signifies stagnation. The preliminary estimate was 65.7 (after 59.4 in March, 62.8 in February, 67.2 in January 2022, 70.6 in December, 67.4 in November, 71.7 in October, 72.8 in September 2021). The ultimate rating is 62.0, which can even have a unfavorable impression on the greenback.

Additionally at 12:30 pm (GMT), Statistics Canada is to launch its February GDP report. GDP is taken into account an indicator of the general well being of the Canadian financial system, and is predicted to develop by +0.8% (from +0.1% in December and +0.2% in January). The relative progress of the indicator might assist the quotes of the Canadian greenback, together with within the USD/CAD pair.

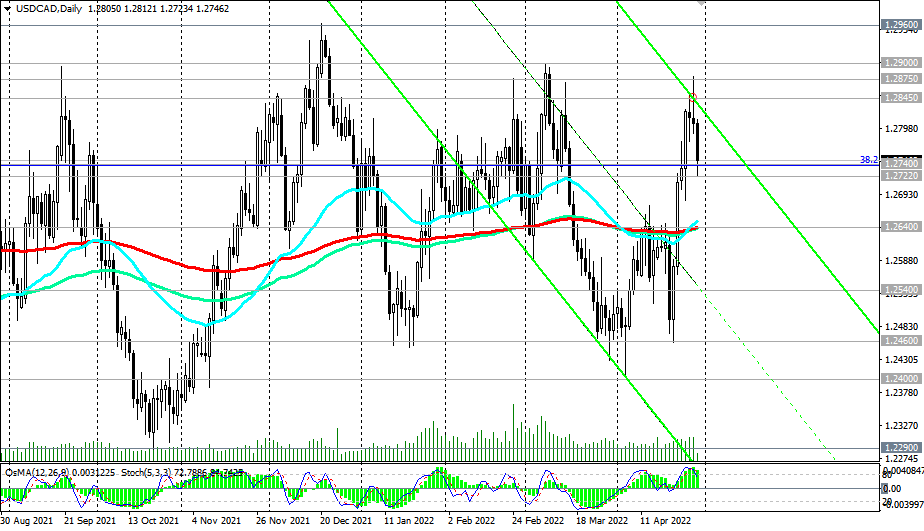

Immediately, in opposition to the backdrop of weakening USD, the USD/CAD pair is declining, buying and selling on the time of publication of this text close to the 1.2745 mark.

Total, it may be mentioned that USD/CAD is attempting to totally restore the long-term development, strengthening from the lows close to 1.2000, reached in Might 2021.

Above assist at 1.2540, that is nonetheless a bull market. A break of USD/CAD into the zone above the resistance stage of 1.2845 will imply the ultimate completion of the downward correction and the exit, so to talk, “to the operational house” for additional progress

Assist ranges: 1.2740, 1.2722, 1.2640, 1.2540, 1.2460, 1.2400, 1.2290, 1.2165, 1.2050, 1.2000

Resistance ranges: 1.2800, 1.2845, 1.2875, 1.2900, 1.2960, 1.3000, 1.3100

*) see additionally “Technical evaluation and buying and selling suggestions” -> Telegram

**) Get no deposit StartUp bonus as much as 1500.00 USD

Supply: InstaForex