I used to be chatting with a buddy the opposite day and requested him why the gold shares have gone nowhere for about 15 years regardless of gold performing “okay”. (I believe my phrasing was “why are gold shares such a dumpster fireplace?”)

He remarked that many gold firms are large money incinerators, and you actually need to personal the businesses with producing mines the place the CEOs are considerate with capital allocation and deal with shareholders kindly.

Kind of jogs my memory of when Mark Twain supposedly stated, “A gold mine is a gap within the floor owned by a liar.”

To which I responded, “properly, I do know a sure funding philosophy that likes to spend money on firms that ooze money movement, the place administration returns money to shareholders and should not serial diluters… shareholder yield! I ponder if the technique works to display screen for miners too…”

This straightforward dialog set my thoughts down the wandering path in the direction of the query of whether or not the shareholder yield method works to pick shares in numerous sectors and industries.

For these unfamiliar, we wrote a ebook on the broad shareholder yield subject nearly a decade in the past, and it’s free right here.

As a reminder, at its core, shareholder yield is just rating shares by how a lot money movement an organization is distributing through dividends and NET buybacks. (Essential to incorporate the share issuance.) Specializing in simply dividends or buybacks alone usually can miss the larger image for a inventory.

There are numerous variations on this theme, and we embody valuation measures as properly in our lively methods. Some further components can embody debt paydown, high quality metrics, and many others and many others.

And we additionally didn’t invent the thought. Many, many others have written at size on shareholder yield together with Priest, Griffin, O’Shaughnessy, Buffett, and lots of others (see the ebook for extra particulars in addition to this white paper, webinar, video, and hyperlinks under).

The factor is, anybody can devise a backtest that appears good. The secret is “will it carry out properly sooner or later?”

I as soon as heard somebody describe me as “the King of Backtests”. The comment was presupposed to be disparaging however I took it as a praise!

I believe you may get round many of the widespread errors when designing backtests with a number of key standards…

- Does it move the widespread sense odor take a look at?

- Is there ample theoretical, educational, or practitioner analysis that helps the idea?

- Does it work throughout time, in most markets, and after prices?

- Is it one thing I’d need to put my very own cash into?

The historic proof for the shareholder yield technique, to me, appears overwhelming vs. any market cap index or dividend earnings technique we are able to discover anyplace.

After publication of the ebook we launched a sequence of public methods, now nearly a decade outdated, which have carried out nice out of pattern submit publication. Not solely in the US but additionally in overseas developed and rising markets.

Cool!

So, it might motive that the technique may match inside sectors and industries too.

So, I rang up one in all my very favourite quants, Jack Vogel over at Alpha Architect, and requested if he may help. I think about myself a “quant gentle” whereas these guys are the true deal PhD heavy hitters.

I posed my concept with hopes he’d assist out, and after sufficient pestering, he did!

So, again to the miners. Did it work? Does it work?

Listed below are the outcomes….drumroll….

It really works!

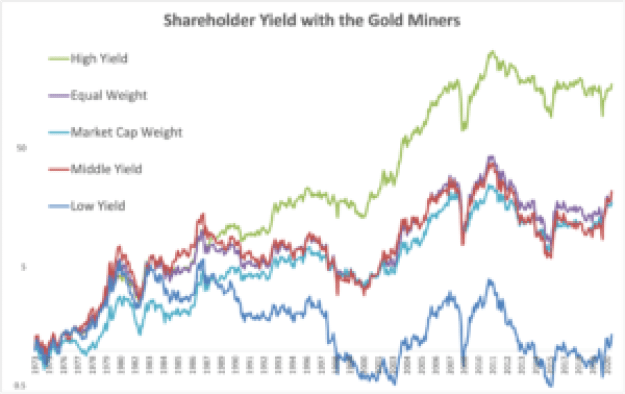

The equal weight returns for the mining business have been 6.79% per 12 months from 1974-2020.

The excessive shareholder yield bucket (Jack tossed them into three fractiles) was 11.61% per 12 months. Good!

(The center bucket was 6.77% and the low bucket was 0.64%).

Supply: Jack at Alpha Architect, French Fama

The market cap weighted outcomes verify this outperformance as properly. (Facet be aware: teachers wish to name this weighting worth weight, which at all times confuses the hell out of me and everybody else as they suppose you’re sorting on P/E ratios or one thing.)

Supply: Jack at Alpha Architect, French Fama

However does it work in different sectors and industries too?

For the 12 sectors, a excessive shareholder yield kind leads to common outperformance of two.91% over purchase and maintain. For market cap weight, the result’s related however decrease at 2.22%.

The very best half? It really works in ALL 12 sectors.

Supply: Jack at Alpha Architect, French Fama

What if we go a bit extra granular and cut back it to 30 industries, absolutely it might not work in all of these? (Jack provided a warning right here as you progress to smaller subsets a few of these teams would have had low inventory numbers 50 years in the past…)

It seems it really works in ALL 30. The consequence was much more pronounced right here, the place we noticed a 3.35% outperformance for equal weight and a couple of.50% efficiency for market cap weighting.

Anyhow, nothing earth shattering right here, however given the truth that most all buyers don’t use a shareholder yield methodology, we thought it might be helpful to move alongside the analysis. Notably now, because the market appears to be rotating away from excessive priced shares to prime quality worth ones.

As you concentrate on methods to kind the shares you purchase, maybe a typical sense method the place you choose money flowing firms that return the money to shareholders as a viable alternative….

Now, did I inform you about this new mining venture I heard about up in British Columbia…..?

Sources:

- Shareholder Yield – Meb Faber

- The right way to lookup fund valuations on Morningstar

- The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success– Thorndike

- “Buyback Derangement Syndrome” – AQR

- Annual letter – Warren Buffett

- “Inventory Buybacks: Minunderstood, Misanalyzed, and Misdiagnosed”, (Additionally knowledge obtain ) – Aswath Damodaran

- “The Case for Shareholder Yield” – EPOCH

- “High of Thoughts: Buyback Realities” – Goldman Sachs

- Annual Report – JP Morgan

- “STOCK BUYBACKS: FREEING THE INVISIBLE HAND, OR LEGITIMISING THE FAT FINGER” – Man GLG

- “Disbursing Money to Shareholders, Regularly Requested Questions on Buybacks and Dividends”, “Share Repurchases from All Angles” – Michael Mauboussin:

- “Blaming Buybacks” – Ned Davis

- “The Energy of Share Repurchases”, 2014, “Excessive Conviction Buybacks”, 2015, “Buyback Bulls and Bears”, 2016 – OSAM

- “Share Buybacks: A Transient Investigation” – Two Sigma

- “Inventory Buybacks: The True Story”, 2019 and charts right here Ed Yardeni

- “The Fireworks Over Share Buybacks Are Duds”, 2019 – Jason Zweig

- “The Excessive Dividend Return Benefit” – Tweedy Browne

- 2011 World Funding Returns Yearbook

- “The Significance of Dividend Yields in Nation Choice” – Michael Keppler

- “Dividends, Share Repurchases, and the Substitution Speculation” – Grullon and Michaely

- “Disappearing Dividends: Altering Agency Traits or Decrease Propensity to Pay?” – French Fama

- “Taxation, Dividends and Share Repurchases: Taking Proof World,”—Jacob and Jacob

- “The Significance of Dividends and Buybacks Ratios for Gauging Fairness Values” and “When Will Apple and Google Begin Paying Dividends” – Jeremy Schwartz

- What Works on Wall Road – James O’Shaughnessy

- “Enhancing the Funding Efficiency of Yield-Primarily based Methods” – Grey and Vogel

- “The Dividend Problem” – Faber

- “What You Don’t Wish to Hear About Dividend Shares” – Faber

- “The Case for World Dividends” – OSAM

- “Buybacks Beat the Market” – Hulbert

- Here’s a dialogue summarizing Buffett’s ideas on dividends in his 2012 letter to shareholders

- “When Measures Change into Targets: How Index Investing Adjustments Indexes” – OSAM

- “Will Dividends go the way in which of the Dinosaur?” – Skinner

- Free Money Circulate and Shareholder Yield – William Priest

- “On the Significance of Measuring Payout Yield: Implications for Empirical Asset Pricing” Griffin

- “Asset Progress and the Cross-Part of Inventory Returns” – Schill, Gulen, and Cooper

- “How Tax Environment friendly are Fairness Types?” – Israel and Moskowitz