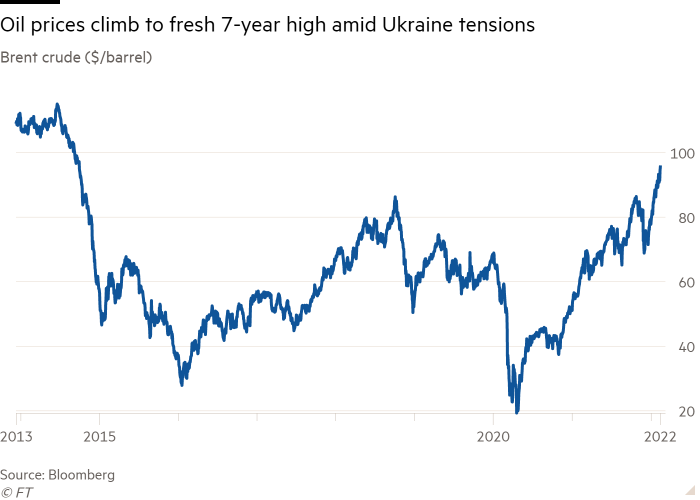

Oil costs rose to a recent seven-year excessive and European and Asian equities fell on Monday after US officers warned a Russian assault on Ukraine could possibly be imminent.

The regional Stoxx Europe 600 index fell 1.9 per cent in early dealings, whereas the UK’s FTSE 100 declined 1.2 per cent. Russia’s Moex share index fell 2.6 per cent to the bottom degree since late January.

The newest volatility in world inventory markets, which have dropped this 12 months as central banks tighten financial coverage, got here as German chancellor Olaf Scholz ready to journey to Moscow to induce Vladimir Putin from launching an invasion of Ukraine.

US President Joe Biden on Sunday spoke to his Ukrainian counterpart and mentioned Washington would reply “swiftly and aggressively” to any Russian army motion, in keeping with the White Home.

The last-ditch effort by Scholz comes as western nations withdrew diplomatic and army personnel from Ukraine and a few European international locations braced for an inflow of refugees within the occasion of army motion.

On Monday, vitality costs climbed as buyers centered on the most recent Ukraine developments. Brent crude, the worldwide benchmark, rose as a lot as 1.8 per cent to $96.16 a barrel, marking the highest degree since September 2014 and reflecting a year-to-date rise of about 23 per cent.

European pure fuel contracts for next-month supply jumped 12 per cent greater to €83.41 per megawatt hour.

European bonds rallied as merchants sought shelter within the lower-risk belongings.

Germany’s benchmark 10-year Bund yield, which has risen sharply in current weeks on prospects of the European Central Financial institution rolling again its pandemic-era stimulus, declined by 0.05 proportion factors to 0.24 per cent. The equal UK gilt yield fell 0.06 proportion factors to 1.49 per cent.

“The entire state of affairs stays fairly fluid,” mentioned Marcella Chow, world markets strategist at JPMorgan Asset Administration in Hong Kong. Chow added that vitality markets specifically remained on edge as Russia was liable for a 3rd of Europe’s pure fuel and 10 per cent of world oil manufacturing.

“If there are any disruptions or threats of shutdowns for provide, that may naturally push costs greater from the already elevated ranges we’ve seen thus far,” she mentioned.

The falls for world shares got here on the again of a sell-off for Wall Road on Friday, the place the S&P 500 dropped nearly 2 per cent. In Asian equities, Hong Kong’s benchmark Grasp Seng fell 1.4 per cent, whereas Japan’s Topix and South Korea’s Kospi each closed 1.6 per cent decrease.

Unhedged — Markets, finance and robust opinion

Robert Armstrong dissects crucial market developments and discusses how Wall Road’s finest minds reply to them. Enroll right here to get the publication despatched straight to your inbox each weekday