- USDIndex – Slips (108.00 examined) for a fifth straight day, lifting EUR & GBP. Fed Funds Futures again to 90% probability of 75 bp (third consecutive) hike. 10-yr Bond Public sale was weak, solely crammed after it hit 3.33% (2.76% final time). “Larger for longer” mantra from Reuters Poll¹. Has Inflation peaked ?

- EUR – Trades at 1.0135 now from a check of 1.0200 yesterday.

- JPY markets not satisfied BOJ intervention is imminent. Though Yen up as we speak in opposition to others nonetheless weak vs. USD, touched 143.50 yesterday and holds 142.30 now.

- GBP traded over 1.1700 yesterday and holds 1.1723 now, following good jobs knowledge. London stays muted (politics suspended) however open forward of Queen’s funeral September 19 (Financial institution Vacation).

- Shares US shares moved larger once more as Greenback & Yields cooled (S&P500 +1.06% 4110) FUTS commerce at 4121. Nasdaq finest performer (APPL +3.85%, PTON +7.18%). Asian inventory markets have rallied too, and European FUTS are larger pre-open.

- USOil topped at $89.00 on Monday on extra chatter of provide points and doable easing of geopolitical tensions. Trades at $86.75 now. 20-day transferring common sits at $89.00.

- Gold – additionally rallied to $1735 and holds over $1720 now.

- BTC – rallied larger too and holds at $22.3k.

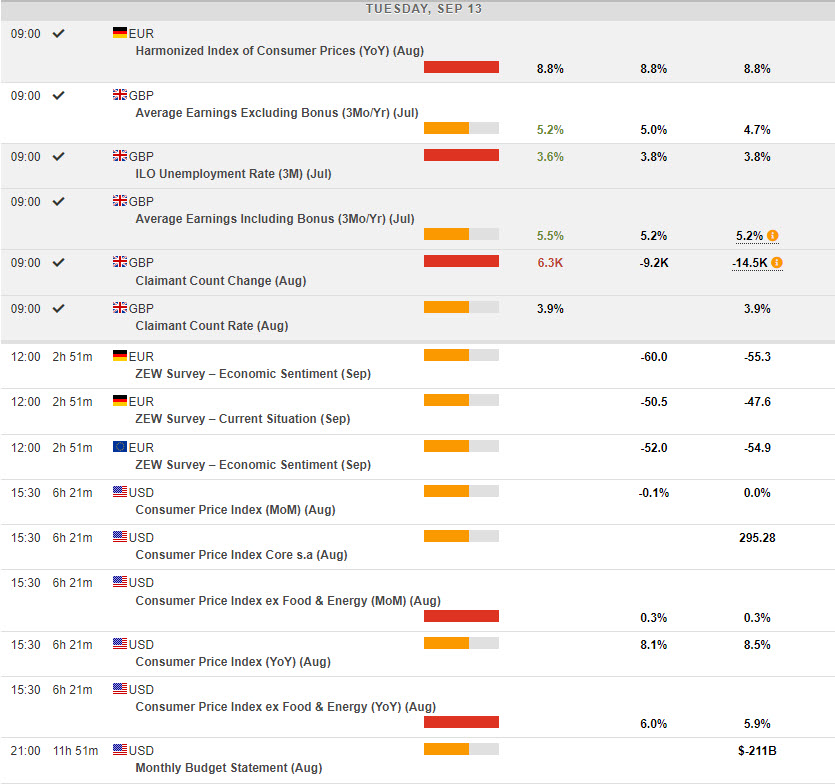

In a single day & Right now – UK Jobs, (Wages beat & Unemployment Charge fell again, Claimant Rely reversed sharply (+20.8k) German HICP (regular at 8.8%). To return German ZEW and US CPI.

Largest FX Mover @ (06:30 GMT) AUDJPY (-0.51%) Indicators the 6-week rally from 90.00, perhaps cooling. Topped at 98.45 earlier again underneath 98.00 to 97.76 now. MAs aligning decrease, MACD histogram & sign line optimistic however falling, RSI impartial 43.20, H1 ATR 0.174, Every day ATR 0.972.

Click on right here to entry our Financial Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This materials is supplied as a normal advertising and marketing communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or ought to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.