Monday primarily confirmed consolidation throughout the main indices. The Russell 2000 (IWM) spent most of its time inside Friday’s worth vary, together with the S&P 500 (SPY) and the Nasdaq 100 (QQQ) having inside day chart patterns. Together with the inventory markets’ inconclusive worth motion, the Excessive Yield Company debt ETF (JNK) is confirming that the perfect plan for buying and selling is to attend for Tuesday.

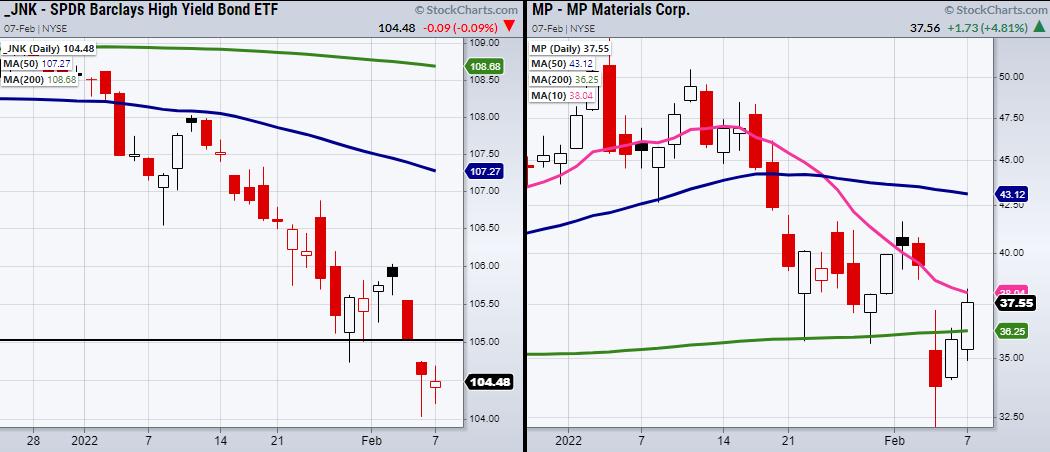

Wanting on the above chart of the JNK ETF, we will see an inside day chart sample is created from Monday’s buying and selling vary, becoming contained in the buying and selling vary from final Friday. With that stated, if Monday was going to indicate a reversal sample, it might have closed over Friday’s highs at $104.75. Moreover, we’re nonetheless expecting JNK to fill its worth hole from final Thursday’s low, as proven by the black line within the above chart.

Within the shorter time period, we will now watch JNK to clear Friday’s excessive as a small breakout from Tuesday’s consolidative worth motion. This can provide us confidence in taking trades that are inclined to intently comply with the final markets’ worth motion as JNK is an efficient risk-on or -off indicator.

For commerce concepts, MP Supplies (MP) has an fascinating setup. Although it just lately broke beneath its 200-Day transferring common at $36.25, MP is now again over the foremost transferring common and trying to clear the 10-DMA subsequent at $38.04. Essentially, MP sits in a powerful area, because it’s one among North America’s largest mines for uncommon earth supplies utilized in many units from telephones to electrical automobiles.

With that stated, technical evaluation is essential. Subsequently, look ahead to MP to clear and maintain over its 10-DMA together with JNK to both clear $104.75 or fill its hole for a powerful purchase sign at $105.02.

Comply with Mish on Twitter @marketminute for inventory picks and extra. Comply with Mish on Instagram (mishschneider) for each day morning movies. To see up to date media clips, click on right here.

- S&P 500 (SPY): Inside day. 472 to clear.

- Russell 2000 (IWM): Holding the 10-DMA at 198.28.

- Dow (DIA): 353.25 to clear.

- Nasdaq (QQQ): 362 resistance.

- KRE (Regional Banks): Now wants to carry over its 50-DMA at 72.16.

- SMH (Semiconductors): 284 resistance. 270 to carry.

- IYT (Transportation): Holding the 10-DMA however wants to shut again over the 200-DMA at 262.85.

- IBB (Biotechnology): 134.32 to clear.

- XRT (Retail): Must clear the 10-DMA at 79.62.

Forrest Crist-Ruiz

MarketGauge.com

Assistant Director of Buying and selling Analysis and Training

Mish Schneider serves as Director of Buying and selling Training at MarketGauge.com. For practically 20 years, MarketGauge.com has offered monetary data and training to 1000’s of people, in addition to to massive monetary establishments and publications resembling Barron’s, Constancy, ILX Programs, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many prime 50 monetary individuals to comply with on Twitter. In 2018, Mish was the winner of the Prime Inventory Decide of the yr for RealVision.