The market developments for about 20% of the time and ranges for about 80% of the time. Most merchants select to commerce pattern following methods. That is very comprehensible as a result of pattern following methods are a few of the best kinds of buying and selling methods. Personally, I discover extra success buying and selling throughout trending market situations and buying and selling pattern continuation commerce setups.

Nonetheless, regardless of the convenience of buying and selling pattern following methods, it does have a obvious setback. It’s that the market developments for less than 20% of the time. Which means more often than not pattern following merchants are simply sitting idly on their desks ready for the market to pattern. Typically the market would pattern whereas the dealer shouldn’t be taking a look at a foreign money pair or when he’s observing a special chart. This happens too typically for pattern following merchants due to the truth that the market ranges extra typically than it will pattern. Buying and selling pattern following methods requires quite a lot of self-discipline. Merchants ought to management the urge to not commerce when the market is ranging, which happens extra typically than a trending market.

Vary buying and selling then again opens an entire lot of alternatives. Though pattern following methods are usually simpler, vary buying and selling methods opens up an entire lot of latest alternatives for merchants due to the truth that the market ranges extra typically than it will pattern.

Zone Vary Foreign exchange Day Buying and selling Technique is a variety buying and selling technique that enables merchants to commerce throughout bounces from a help or resistance degree. It makes use of an indicator to assist merchants determine the help or resistance ranges mechanically. It additionally makes use of a few different indicators to substantiate the bounce based mostly on a short-term momentum reversal.

Breakout Zones

Breakout Zones is an indicator which helps merchants determine the present day’s vary.

It plots help and resistance zones based mostly on the best excessive and lowest low of the start of a buying and selling day. It then extends the help and resistance traces to the appropriate finish of the chart till a preset time.

The settings on the indicator enable merchants to vary the time to be thought of as the start of the day. This enables merchants to vary the premise of the help and resistance line in accordance with the buying and selling session they’d wish to base it on. For instance, merchants can set the excessive and low of the Asian session as the premise of the vary. They then may look ahead to breakouts from the mentioned vary. One other instance could be to make use of the London session as the premise for the vary and look ahead to worth to reverse on these ranges throughout the US session.

Stochastic Oscillator

The Stochastic Oscillator is a momentum indicator which signifies the course of the short-term pattern or momentum by utilizing oscillators.

This indicator makes an attempt to foretell short-term momentum reversals based mostly on the historic worth actions. It plots two oscillator traces with one being sooner than the opposite. These two traces oscillate throughout the vary of 0 to 100.

Development or momentum reversals are indicated each time the 2 traces crossover. If the sooner line crosses above the slower line, the market is alleged to be in a bullish momentum reversal. If the sooner line is crossing under the slower line, then the market is alleged to be in a bearish momentum reversal.

The indicator additionally has markers at degree 20 and 80. Value is alleged to be oversold each time the traces are under 20 and overbought when the traces are above 80. Crossovers occurring on these areas are likely to have the next reliability since these crossovers are trigger by overbought or oversold situations.

Arrow Sign

Arrow Sign is a short-term pattern reversal sign indicator which is predicated on swing highs and swing lows.

This indicator mechanically identifies swing highs and swing lows based mostly on fractals. As quickly because it identifies a swing excessive or swing low, it plots an arrow pointing the course of the short-term pattern reversal.

Merchants can use this sign as an early indication of a possible short-term pattern reversal.

Buying and selling Technique

This buying and selling technique is a variety buying and selling technique that trades on reversals from the help or resistance line plotted by the Breakout Zones indicator.

We will probably be utilizing confluences of the Stochastic Oscillator and the Arrow Sign indicator to substantiate a bounce from the help or resistance line.

On the Stochastic Oscillator, reversal alerts are thought of legitimate solely when the Stochastic Oscillator traces crossover whereas oversold or overbought.

On the Arrow Sign indicator, reversal alerts are generated merely based mostly on the arrows being plotted which are in confluence with the Stochastic Oscillator alerts.

Indicators:

- Arrow_Signal

- Breakout-zones

- Stochastic Oscillator

- %Ok Interval: 12

- %D Interval: 10

- Slowing: 15

Most popular Time Frames: 5-minute and 15-minute charts solely

Forex Pairs: FX majors, minors and crosses

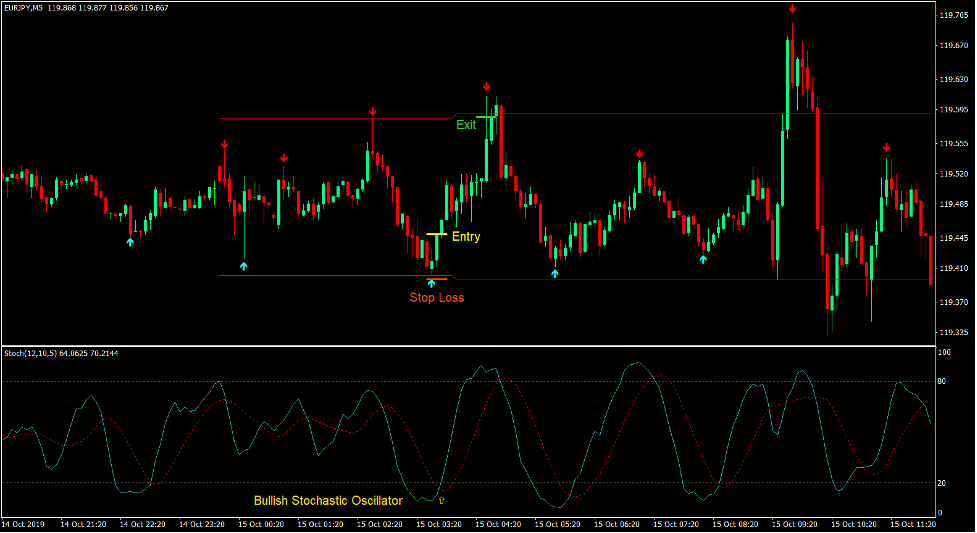

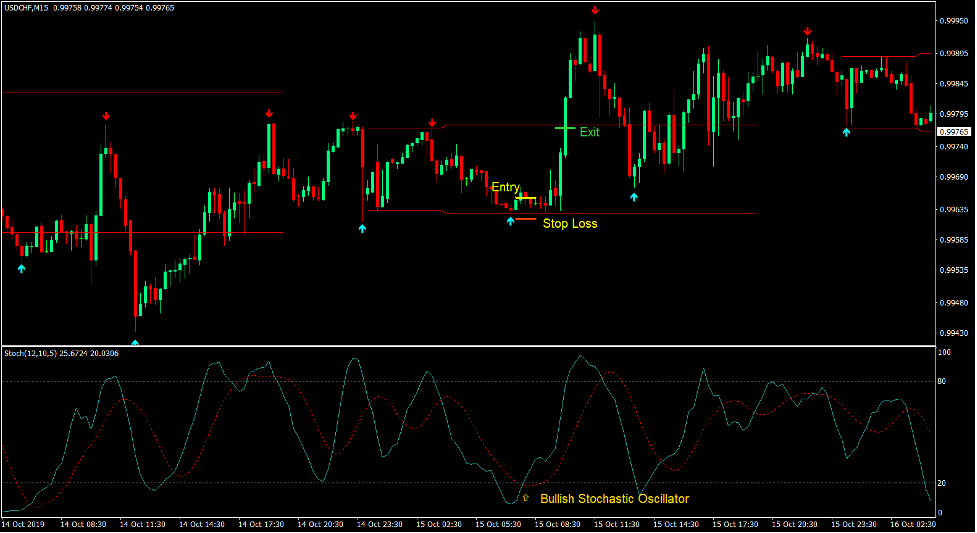

Purchase Commerce Setup

Entry

- The Stochastic Oscillator traces ought to be under 20.

- Value ought to bounce off the help degree of the Breakout Zones indicator.

- The Arrow Sign indicator ought to plot an arrow pointing up.

- The sooner Stochastic Oscillator line ought to cross above the slower line.

- Enter a purchase order on the affirmation of those situations.

Cease Loss

- Set the cease loss on the help degree under the entry candle.

Exit

- Set the take revenue goal under the resistance degree of the Breakout Zones indicator.

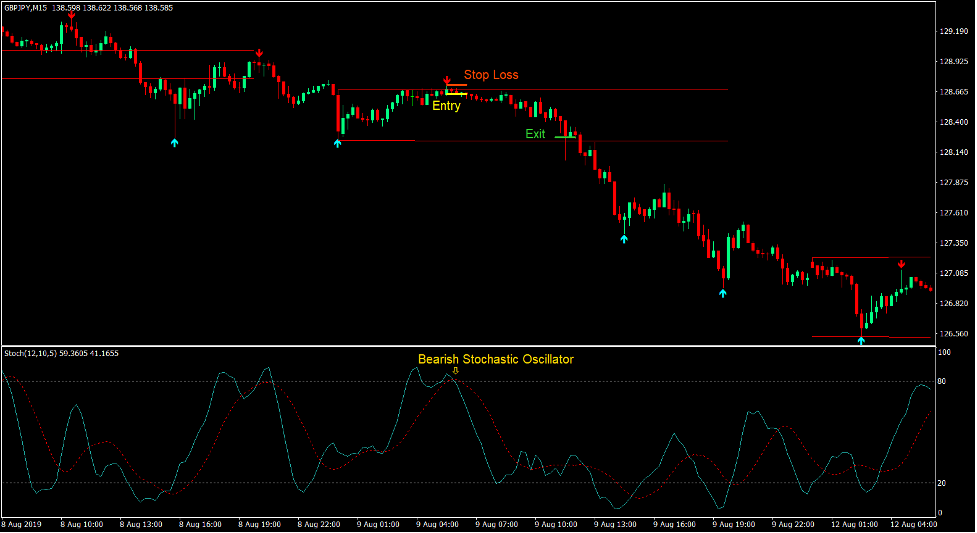

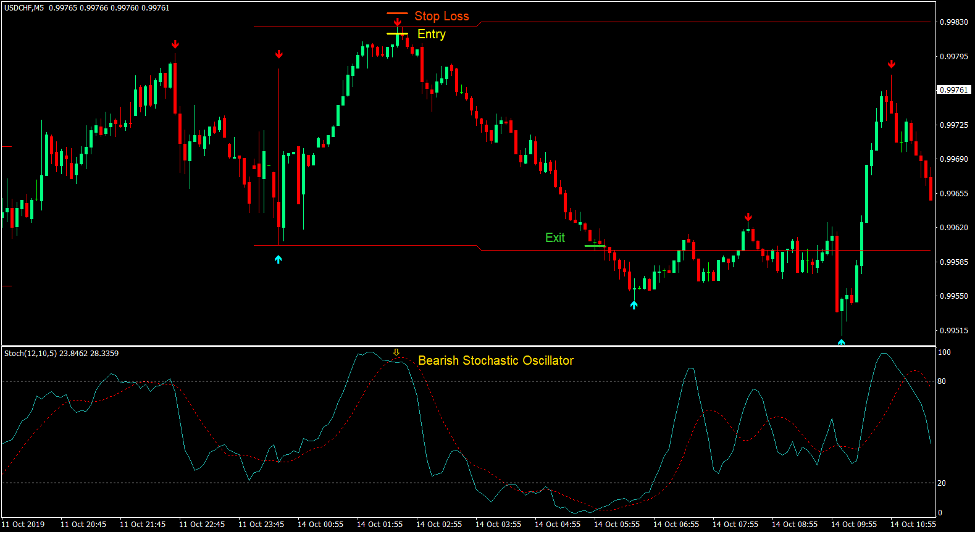

Promote Commerce Setup

Entry

- The Stochastic Oscillator traces ought to be above 80.

- Value ought to bounce off the resistance degree of the Breakout Zones indicator.

- The Arrow Sign indicator ought to plot an arrow pointing down.

- The sooner Stochastic Oscillator line ought to cross under the slower line.

- Enter a promote order on the affirmation of those situations.

Cease Loss

- Set the cease loss on the resistance degree above the entry candle.

Exit

- Set the take revenue goal above the help degree of the Breakout Zones indicator.

Conclusion

Buying and selling vary commerce setups normally should not have as excessive a win fee as pattern following methods. Nonetheless, it happens extra typically giving merchants extra alternative to develop their earnings. If traded with the appropriate indicator affirmation, vary commerce setups can have an improved win fee.

As a result of this technique trades on bounces from help and resistance ranges whereas in confluence with an oversold or overbought reversal, these commerce setups are likely to have the next likelihood in comparison with the standard anticipation of reversals coming from a variety degree.

Merchants can systematically commerce this technique on confirmed ranging market situations with the next diploma of confidence.

Foreign exchange Buying and selling Methods Set up Directions

Zone Vary Foreign exchange Day Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the amassed historical past information and buying and selling alerts.

Zone Vary Foreign exchange Day Buying and selling Technique gives a possibility to detect numerous peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Based mostly on this info, merchants can assume additional worth motion and alter this technique accordingly.

Really useful Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

Methods to set up Zone Vary Foreign exchange Day Buying and selling Technique?

- Obtain Zone Vary Foreign exchange Day Buying and selling Technique.zip

- *Copy mq4 and ex4 recordsdata to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you wish to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick Zone Vary Foreign exchange Day Buying and selling Technique

- You will notice Zone Vary Foreign exchange Day Buying and selling Technique is accessible in your Chart

*Word: Not all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain: