World shares pushed larger on Tuesday, whereas the greenback declined, as merchants moved again into riskier belongings after the worst streak of weekly losses for equities since 2008.

Wall Avenue’s S&P 500 index was up 1.4 per cent by the late morning in New York, at the same time as shares in Walmart — the world’s largest bricks-and-mortar retailer — slid 11 per cent after inflationary pressures pressured it to minimize current-quarter earnings forecasts. The technology-heavy Nasdaq Composite added 2 per cent, after closing 1.2 per cent decrease on Monday. In Europe, the Stoxx 600 index ended the session 1.2 per cent larger.

These strikes adopted a 3.3 per cent ascent for Hong Kong’s Hold Seng gauge. The area’s tech-focused sub-index rose 5.8 per cent because the heads of huge Chinese language expertise corporations met regulators to debate the nation’s digital economic system.

Analysts at JPMorgan recommended that fairness markets had priced in an excessive amount of recession threat, saying shares “stand to recuperate if a recession doesn’t come by way of, given already substantial a number of derating, decreased positioning and downbeat sentiment”. The US financial institution is “sceptical” that April’s fairness fund outflow — the best since March 2020 — was the beginning of a protracted part of outflows.

The FTSE All World index, which concluded six consecutive weeks of declines final Friday, rose 1.6 per cent on Tuesday.

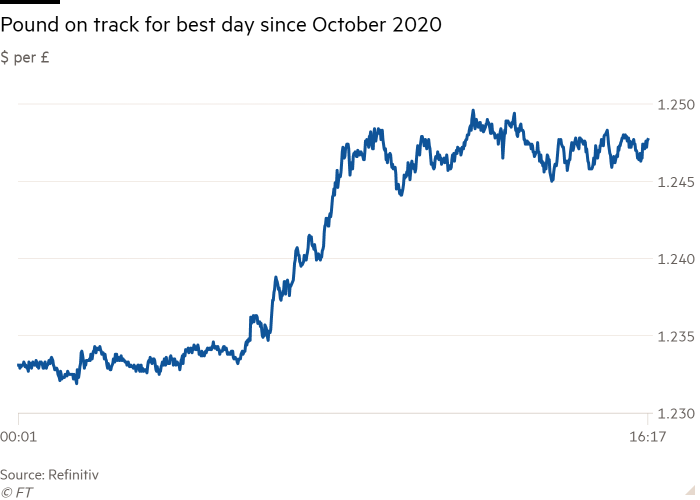

In the meantime, the greenback index — a measure of the US forex in opposition to six others — dropped 0.8 per cent, in a 3rd day of falls, having hit multiyear highs final month. Compounding the buck’s weak spot, sterling rallied 1.3 per cent to simply below $1.25, placing the pound on monitor for its greatest every day rise since October 2020. The euro rose by its most in additional than two months, up 1.1 per cent to $1.05.

The widespread forex added to its positive aspects after Dutch central financial institution chief Klaas Knot recommended that the European Central Financial institution ought to elevate rates of interest by 0.25 proportion factors in July, but in addition stay open to a bigger improve if inflation worsens. Markets at the moment are pricing in a full proportion level of charge will increase by the top of 2022, up from 0.93 proportion factors on Monday.

As inventory markets rose on Tuesday, eurozone debt was hit by a renewed wave of promoting, sending yields larger. The yield on the 10-year German Bund, seen as a proxy for borrowing prices throughout the bloc, rose 0.11 proportion factors to 1.05 per cent. The equal Italian yield added 0.12 proportion factors.

US debt additionally got here below stress, with the yield on the 10-year Treasury observe including 0.08 proportion factors to 2.96 per cent and the policy-sensitive two-year yield rising 0.09 proportion factors to 2.66 per cent.

The Federal Reserve raised rates of interest by 0.5 proportion factors this month, with similar-sized will increase anticipated on the central financial institution’s subsequent three conferences because it strikes aggressively to curb stubbornly excessive inflation.

“We nonetheless suppose the market is just too aggressive on Fed mountain climbing expectations,” stated Steve Englander at Commonplace Chartered. The ECB is “simply starting to step up its language on normalisation and that could be a huge a part of the greenback weak spot that we anticipate in [the second half].”

Further reporting by Ian Johnston