2022 has been a transparent bear market part for danger belongings, significantly the fairness markets. The indicators have been constructing in January, appeared validated by a brand new low in February, then have been completely confirmed with the failed breakout above 4600 in late March.

Someplace within the first three months of the yr, buyers seem to have broadly transitioned from the “disbelief” part (“There is not any method this market goes decrease.”) to the “acceptance” part (“Oh my, that is positively a bear market!”). The problem at this level? Bear market rallies, just like the one we skilled this week.

Countertrend rallies in bear markets may be normally described as sudden, extreme and seductive. They occur all of a sudden, with the market making new swing lows someday after which ripping again to the upside instantly after. This explicit rally was punctuated by hammer candles, together with different bullish candlestick patterns. They’re additionally normally extreme, that means they make up numerous floor in a comparatively small period of time. And why do they have a tendency to bounce increased so rapidly?

That is the seductive nature of those fast countertrend rallies. The “FOMO” is palpable as buyers are afraid of lacking the underside. As if 200 S&P factors can be the distinction between an incredible yr and a mediocre yr once you look again at 2022!

As soon as this sudden inflow of consumers has carried out their shopping for, the market kind of wakes as much as the truth that situations actually have not modified a lot within the final couple weeks. All the headwinds which have induced shares to broadly decline from January into Might are nonetheless there.

The Fed has transitioned from an accommodative coverage to a coverage a lot much less supreme for danger belongings. Inflation remains to be a problem that impacts customers, as evidenced by the variety of corporations previously couple weeks which have harassed its affect on their outlooks.

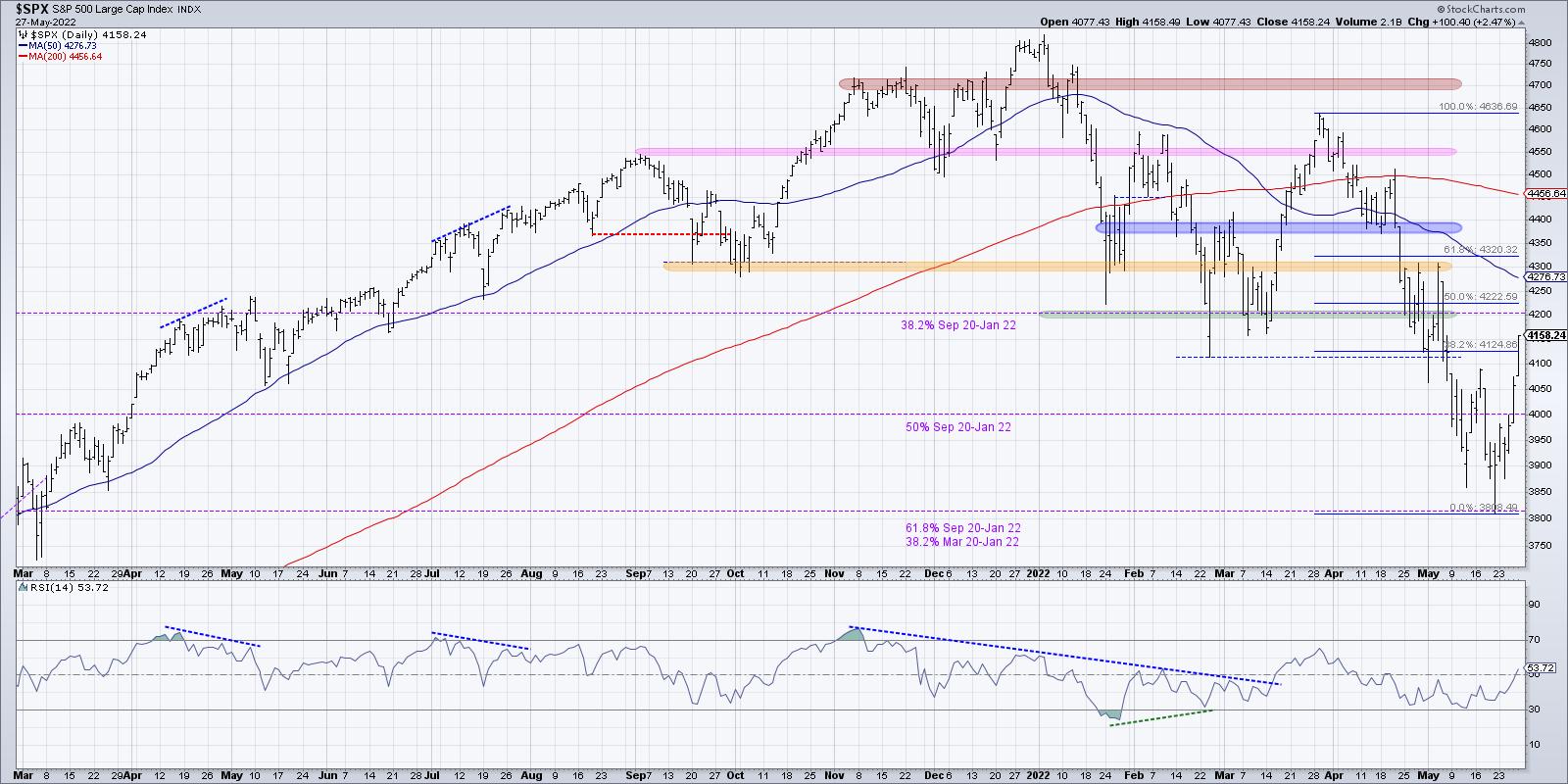

So what is definitely taking place right here? To be sincere, this week’s rally simply is smart. The S&P 500 reached the 38.2% retracement of the March 2020-January 2022 uptrend nearly precisely. I’d have been extremely shocked if we had not rallied off the 3815-3820 degree.

How can we differentiate a bear market rally from the start of a extra significant restoration for the S&P 500? First, we would want to see the SPX break above key resistance ranges. And I must admit that Friday’s shut above 4125 is kind of spectacular, because it takes the index above a 38.2% retracement of the March to Might downtrend.

Now I’m targeted on the 50-day transferring common (round 4275) and the 61.8% retracement degree (4320). If we see the S&P 500 shut break above 4320, then I imagine you’d need to label this wave as one thing aside from a bear market rally.

Second, I must see an inflow of optimistic momentum. Whereas this week ended on a excessive word, the every day RSI nonetheless sits under 54 for the S&P 500. Throughout bear market phases, the RSI tends to stall out round 60 in a rally part. The height from late March is a good instance of what tends to occur. So a break above the previously-mentioned resistance, together with the RSI reaching above the important thing 60 degree, would verify sufficient upside momentum {that a} extra bullish outlook could possibly be warranted.

Lastly, you would need to see an enchancment in breadth situations. Once I have a look at the cumulative advance-decline traces for the foremost fairness averages, I am unable to assist however discover that the S&P 500 A-D line was the one one which didn’t make a brand new low in Might.

Now, this huge cap breadth indicator is threatening to eclipse its increased from February and March. If these 4 advance-decline traces could make new swing highs, then we are able to say that this can be a broader advance and never only a fast upside reversal.

Bear market rallies may be difficult. Simply bear in mind, make short-term choices utilizing short-term information, and long-term choices utilizing long-term information!

RR#6,

Dave

P.S. Able to improve your funding course of? Try my YouTube channel!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator, and don’t in any method characterize the views or opinions of every other individual or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps buyers decrease behavioral biases by way of technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness strategies to investor choice making in his weblog, The Conscious Investor.

David can be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency targeted on managing danger by way of market consciousness. He combines the strengths of technical evaluation, behavioral finance, and information visualization to determine funding alternatives and enrich relationships between advisors and purchasers.

Be taught Extra