About retail merchants:

There are on common virtually $4 billion of foreign exchange spot transactions every day.

With evaluation of brokers, experiences embrace knowledge from over 6000 merchants throughout the globe in addition to insights and predictions from our main merchants, It exhibits us statistically, 85%-95% of Foreign exchange retail merchants don’t succeed of their trades.

Sadly, one of many most important causes for this loss, is that the vast majority of retail merchants, are development fighters and take positions towards the market development. this seems to be human nature greater than logic as this sample continues to play out. And These merchants try to name tops and bottoms available in the market by buying and selling reversals in robust trending markets. This goes fully towards the basic idea of, The development is your good friend.

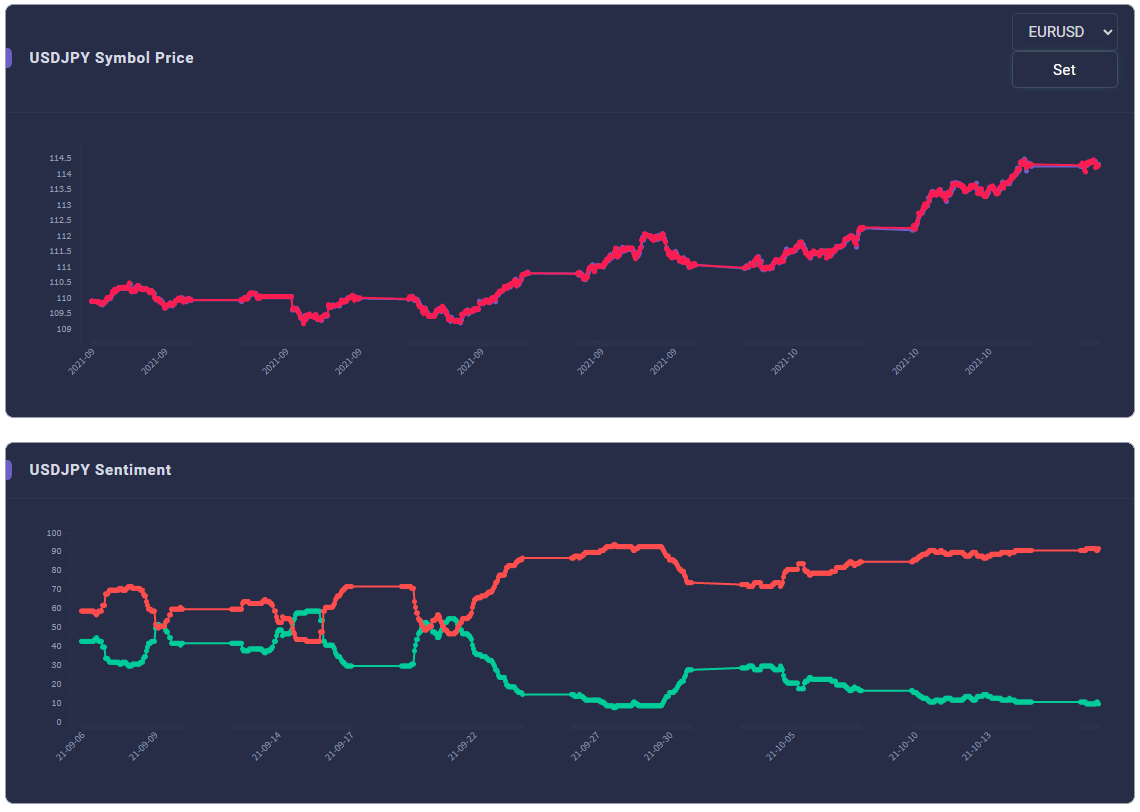

The development momentum will profit too when the merchants which can be towards the development exit from the market. You possibly can see the correlation between this knowledge with value altering and actual market sentiment beneath for USDJPY for example.

What’s our Retail merchants indicator:

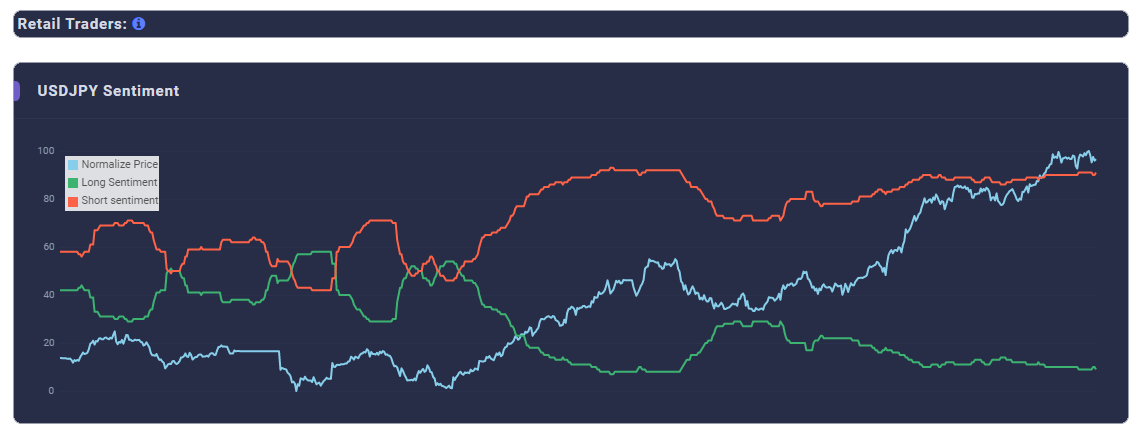

The Retail Merchants indicator is likely one of the Ziwox terminal elements that exhibits the confrontation ratio between patrons and sellers collected from hundreds of thousands of merchants over the foreign exchange, CFTC market. It may be used as a market sentiment that determines the purchase and promote place throughout a variety of property. Primarily, it exhibits the place the vast majority of merchants are positioned and the way a lot within the proportion they’re going lengthy and quick.

This sentiment is a contrarian indicator, As a result of, As we speak about it on the first of this text, The vast majority of retail merchants are development fighters and take positions towards the market development, and provided that 85% of merchants, commerce incorrect, So to make use of this sentiment, search for markets exhibiting extremes in positioning. Sturdy up-trend or down-trend momentum mixed with excessive net-short or net-long retail merchants positioning, leads to a bullish/bearish sign.

Ideas to be used:

- Use it just for Medium-term choices/trades

- This Indicator can present you trades path

- Decide when the merchants are in a development struggle

- This indicator just isn’t your commerce sign singly. use it as a affirmation of your choice

- About 90% of merchants lose their cash available in the market. Subsequently, buying and selling in the wrong way from most merchants will be worthwhile.

- Don’t commerce when the Lengthy and Brief ratios are shut to one another. (Log or quick place between 40% and 60% )

- If most retail merchants anticipate to drop within the value of an asset, it is best to contemplate an extended place, and conversely for lengthy anticipating it is best to search for a brief alternative

- Retail merchants Indicator provides you BUY affirmation when you’re within the Sturdy up-trend with most retail merchants within the quick positions

- Technical development exhibits long-trend, However greater than 60% of retail merchants are in brief

SELL affirmation:

- You’ve a SELL affirmation when you’re within the Sturdy Dow-trend with most retail merchants are within the Log positions

- Pattern is Promote, However greater than 60% of retail merchants are in Lengthy

article supply: ziwox.com

We have now a greate indicator to indicate you What’s the Actual-Time retail dealer ration by the pairs with our EAs: