If in case you have workers, you’re liable for dealing with and paying Medicare tax. Like all issues tax-related, Medicare tax can get difficult rapidly. Learn on to study what’s Medicare tax, what it funds, and the way a lot it prices.

What’s Medicare tax?

Medicare tax is a payroll tax employers and workers share. You could withhold a certain quantity from an worker’s wages and make an identical contribution.

Medicare and Social Safety taxes make up FICA (Federal Insurance coverage Contributions Act) tax and profit the general public. Each Medicare and Social Safety are worker and employer payroll taxes. In different phrases, you withhold the right quantity from an worker’s paycheck and make an identical contribution for each Medicare insurance coverage and Social Safety.

FICA tax has a flat charge of 15.3%. Right here’s the way it breaks down:

- 6.2% of worker gross wages go to Social Safety tax

- Employers make an identical 6.2% Social Safety contribution

- 1.45% of worker gross wages go to Medicare tax

- Employers make an identical 1.45% Medicare contribution

Medicare tax applies to a variety of compensation, together with common wages, ideas, commissions, bonuses, extra time, and a few fringe advantages.

See IRS Publication 15 for extra info on particular courses of employment and varieties of funds which may be exempt from Medicare tax withholding.

What is roofed in Medicare?

Medicare taxes fund Medicare medical health insurance, a federal program benefitting individuals 65 years or older and people youthful than 65 with qualifying situations.

There are 4 components of Medicare protection. Every half offers totally different providers for Medicare recipients:

- Medicare Half A presents hospital insurance coverage to cowl inpatient care in hospitals, expert nursing facility care, hospice care, and residential well being care.

- Medicare Half B offers medical insurance coverage that helps with outpatient care, house well being care, and preventative providers.

- Medicare Half C presents Medicare Benefit plans as a non-public different to Unique Medicare.

- Medicare Half D helps cut back the price of prescribed drugs.

What’s the Medicare tax charge?

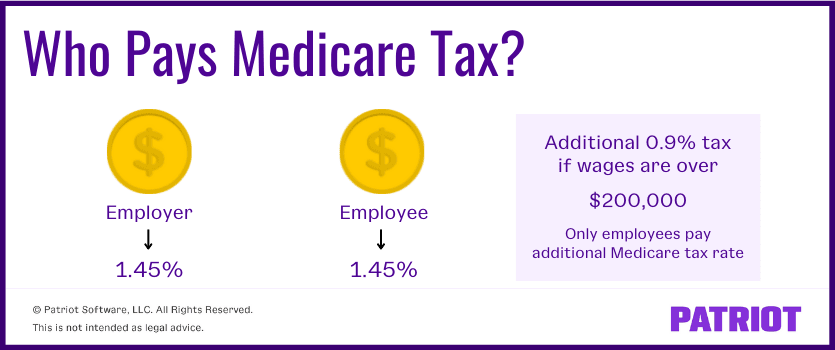

Once more, the Medicare tax charge is 1.45% of an worker’s wages. As a result of Medicare is an worker and employer tax, you have to withhold 1.45% from an worker’s wages and contribute an identical 1.45%.

Medicare makes up 2.9% of the FICA tax charge of 15.3%, and Social Safety covers the remaining.

So, what does Medicare tax seem like in motion? Let’s say an worker earns $1,000 in gross wages throughout a pay interval. You’d take out $14.50 from the worker’s paycheck for Medicare ($1,000 X 0.0145) and contribute an identical $14.50.

Bear in mind there are a number of variations between Social Safety and Medicare taxes. An necessary distinction is the Social Safety wage base—a restrict based mostly on worker wages when you need to cease withholding. Medicare has no restrict. You could proceed withholding Medicare taxes no matter what your workers earn.

In truth, if workers earn above a certain quantity, they’re topic to an extra Medicare tax.

Extra Medicare tax

An further Medicare tax happens when an worker earns greater than a certain quantity (relying on their submitting standing). You aren’t liable for matching the extra Medicare tax charge.

The extra Medicare tax charge is 0.9%. Staff should pay this extra tax after they attain one of many following thresholds:

- Married submitting collectively incomes greater than $250,000

- Married submitting individually incomes greater than $125,000

- All different taxpayers (e.g., single, head of family, widow(er) with baby) incomes greater than $200,000

You don’t have to fret about an worker’s submitting standing. Merely withhold the extra Medicare tax from wages that exceed $200,000.

For instance, when a single worker earns greater than $200,000, you have to withhold 2.35% (1.45% + 0.9%) from their wages and match their 1.45% contribution. Once more, you don’t want to match the extra Medicare tax, paid solely by the worker.

What if workers owe roughly than you withhold?

You will have workers who owe roughly in further Medicare tax than what you’ve withheld from their wages. There are a number of totally different causes this will likely happen. For instance, the worker might file individually, which suggests they owe further Medicare tax on wages over $125,000. However, you gained’t begin withholding the tax till the worker’s wages are greater than $200,000.

To right the issue, your workers should take particular steps.

Your worker owes extra

What if an worker owes greater than the quantity withheld due to their submitting standing, wages, compensation, or self-employment revenue?

If an worker is below the edge based mostly on the wages they earn with you however has different sources of revenue (e.g., self-employment), they could have to make estimated tax funds.

Your worker owes much less

There’s an opportunity that an worker will seem to fulfill a requirement for added Medicare tax, however surely, they don’t.

For those who withhold the Extra Medicare tax from an worker who doesn’t truly meet the edge, they’ll declare a credit score through the use of Type 1040 or 1040 SR.

For instance, an worker meets the edge of $200,000 to mechanically qualify for Extra Medicare tax. However the worker is married, recordsdata collectively with their partner, and their mixed wages don’t meet the $250,000 threshold for married submitting collectively. On this case, the worker can’t ask you to cease withholding Extra Medicare tax. The worker should declare a credit score utilizing their applicable Type 1040 or 1040 SR.

For extra info on further Medicare tax, go to the IRS’s web site.

Depositing and reporting taxes

To make Medicare tax deposits, observe your depositing schedule, which is both month-to-month or semi-weekly. Your schedule is decided by your reported tax legal responsibility utilizing a four-quarter IRS lookback interval.

Use the Digital Federal Tax Fee System (EFTPS) to deposit Medicare taxes, Social Safety, and federal revenue taxes. Ensure that your funds are on time. In any other case, the IRS can cost you penalties in case you make late deposits.

Medicare taxes for the self-employed

What in case you’re self-employed? Do you need to pay Medicare tax?

The brief reply is sure. For those who’re self-employed, you have to pay self-employment tax. Consider self-employment tax as a FICA tax you pay by yourself. Self-employment tax contributes to Medicare insurance coverage and Social Safety and is 15.3% of your wages—identical to the FICA tax.

Of the 15.3% self-employment tax charge, Medicare tax makes up 2.9%. And, you have to pay the extra Medicare tax once you earn above $200,000 (single), $250,000 (married submitting collectively), or $125,000 (married submitting individually).

For extra info on self-employment tax, go to the IRS web site.

Would you like a neater approach to calculate and remit payroll taxes? While you run payroll with Patriot’s Full Service Payroll, we are going to calculate, withhold, and submit payroll taxes for you. Strive it at no cost right now!

This text has been up to date from its unique publish date of Might 07, 2018

This isn’t meant as authorized recommendation; for extra info, please click on right here.