Income is the primary metric that seems on an revenue assertion, and for good cause. It is the start line for calculating revenue, and producing sufficient of it means what you are promoting can cowl working bills and keep afloat in the long term.

But, regardless of income’s significance, there’s a whole lot of confusion round it. What does (and does not) rely as income? Is it the identical as revenue? And does it assure optimistic money move?

Let’s get into the fundamentals of income, find out how to calculate it, and the way it differs from revenue and money move.

What’s income?

Income is the revenue a enterprise generates via the sale of services or products, curiosity, royalties, or different revenue sources throughout a hard and fast time period. The determine is typically known as ‘gross sales’ or ‘the highest line.’

Income is usually the primary determine reported on an revenue assertion — that is the place the “prime line” nickname comes from.

How what you are promoting calculates its income rests on the accounting methodology you utilize. If what you are promoting employs accrual accounting, income will embody gross sales made on credit score — accounting for cash owed along with funds which have already come via. If what you are promoting makes use of money accounting, the one income you may report is from funds you’ve got already obtained.

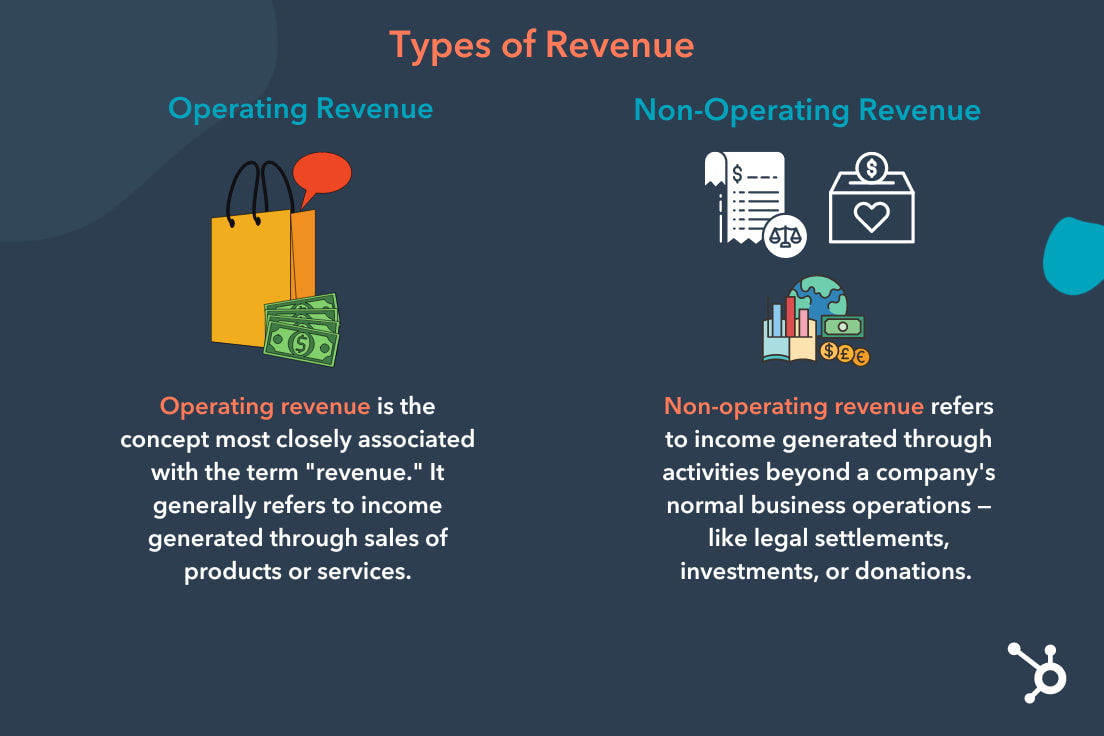

There are two predominant sorts of income companies want to contemplate — working and non-operating. Let’s take a better have a look at these two ideas and the variations between them.

Sorts of Income

Working

When you concentrate on what you are promoting’s income, working income is the idea that usually involves thoughts. It is what an organization produces from its main income-generating actions — mostly gross sales.

Working Income Instance

A clothes model generates most of its working income via merchandise gross sales at storefronts.

Non-Working

There’s additionally one other sort of income — non-operating income — which happens exterior of a enterprise’ main operations. One of these income is usually decrease than working income and consists of revenue sources like authorized settlements, funding revenue, or donations.

Non-Working Income Instance

That clothes model from the earlier part generates non-operating income by way of a authorized settlement with one other firm over mental property.

Is income revenue?

Whereas each income and revenue are robust indicators of what you are promoting’s monetary well being and efficiency, they aren’t the identical — and that distinction stems primarily from how every pertains to bills.

Merely put, income is what you are promoting’ revenue earlier than bills, whereas revenue is what you are promoting’ revenue after them. The time period “bills” covers any prices related to working a enterprise.

These can embody workers’ salaries, hire for workplace area, insurance coverage, prices of products offered, journey, promoting, authorized charges, or another prices a enterprise incurs when producing, promoting, or selling its services or products.

Revenue takes income and deducts any of these bills from the identical interval. Ideally, after subtracting all of your bills you continue to have revenue remaining — making what you are promoting worthwhile.

What’s the income system?

Calculating income is a comparatively simple course of. Use one of many following formulation:

For product-based companies, multiply the variety of models offered in a press release interval by the typical worth.

For service-based companies, multiply the variety of clients or contracts in a press release interval by the typical service worth.

Does income = money move?

If you happen to’re producing income, you are additionally producing chilly onerous money — proper? Not essentially. Many new enterprise house owners make that assumption, and it may be pricey.

Companies ought to by no means conflate excessive income with optimistic money move. In reality, it is doable to your income to be excessive, whereas your money move is destructive.

This is an instance: Suppose what you are promoting sells a $5,000 forklift to a development firm on Could 1st. Technically, you will have $5,000 in income — however the development firm has till Could thirty first to pay the bill.

In the meantime, the associated fee to ship the forklift is $500 — so what you are promoting has $500 in money outflow earlier than it might gather the $5,000 in income on Could thirty first.

Generally the trade of services and products with money isn’t simultaneous, which is why it is vital to do not forget that excessive income means your services or products are promoting effectively — not that what you are promoting is making liquid money.

Income on the Revenue Assertion: Prime vs. Backside Line

The highest and backside strains of your revenue assertion are usually thought-about the 2 most important figures on it.

The highest line is your organization’s gross income, which is the mixture of your working and non-operating income throughout a press release interval.

Subsequently, when an organization has “top-line progress,” it usually means it is seeing an uptick in gross sales or income. That mentioned, gross income is not essentially indicative of your capability to generate revenue.

The underside line is your organization’s web revenue, which is your gross income minus any bills, allowances, refunds, and reductions throughout the identical assertion interval.

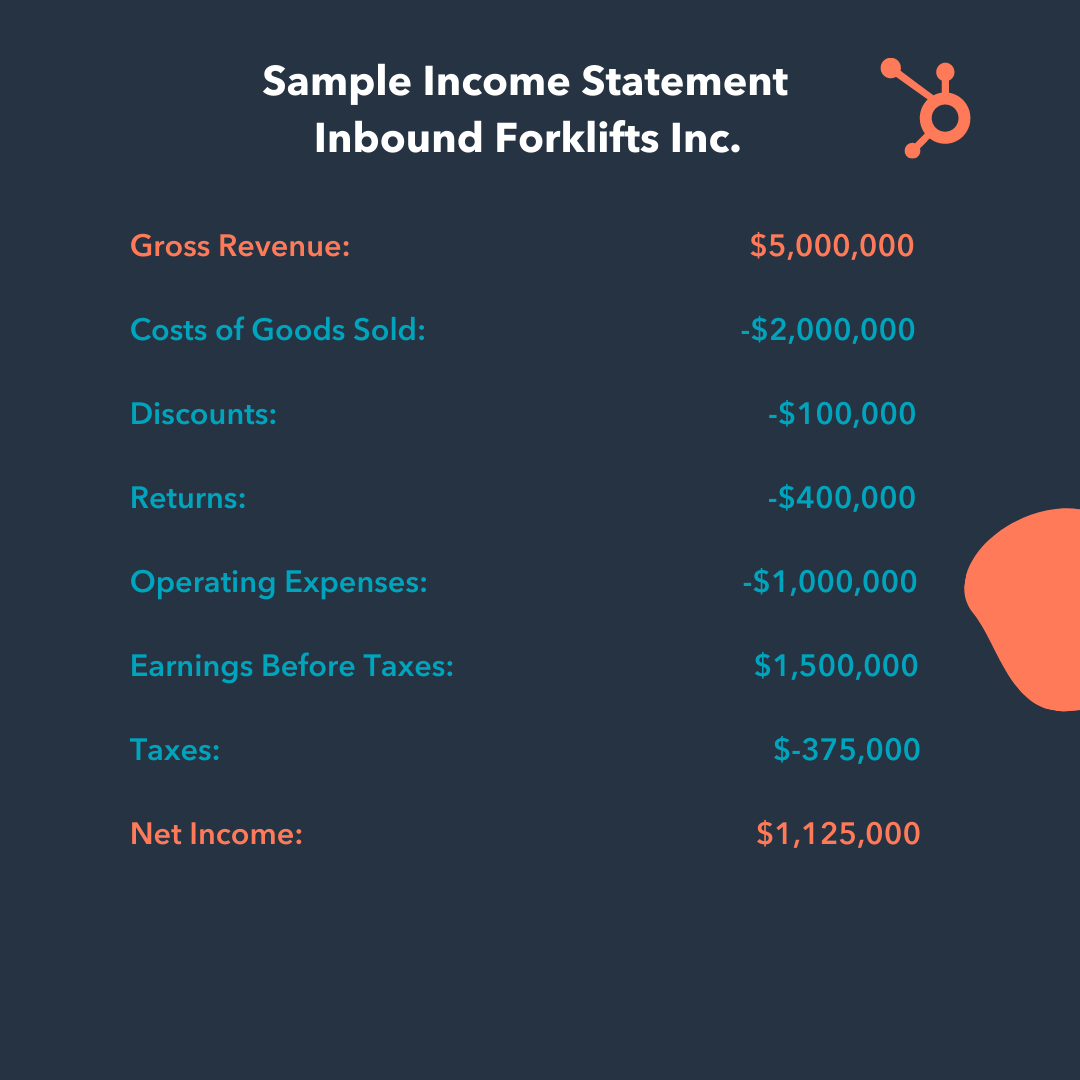

For the sake of instance, let’s contemplate that forklift firm from earlier. For example the corporate sells 1,000 forklifts at $5,000 every.

- That may make its gross income $5,000,000.

- To assist transfer the final of its stock, the corporate determined to supply a $500 low cost on the final 200 forklifts it offered — which means it took a $100,000 hit on reductions.

- 100 of the forklifts have been returned for an 80% refund — so it noticed $400,000 in returns.

- The prices of products offered (COGS) required to supply every forklift is $2,000 — so the enterprise has to account for $2,000,000 value of these bills.

- The sum of its working bills for the interval — together with workers’ salaries, hire for workplace area, advertising, worker journey, and authorized charges — was $1,000,000.

- These bills add as much as $3,500,000 — making the corporate’s earnings earlier than taxes $1,500,000.

- The enterprise’s complete tax fee provides as much as 25% — amounting to a $375,000 deduction.

That provides as much as a $3,875,000 hit to the corporate’s gross income — making its web revenue (or backside line) for the interval $1,125,000.

Let’s take a look at what that may all seem like on an revenue assertion.

Remaining Ideas

Income is the magic metric for assessing the monetary well being of your organization. Since firms usually develop by growing income, it is also an ideal indicator of future progress. However income is simply the start line — companies should additionally contemplate how their bills and working prices are (or aren’t) impacting their backside line.

![Download Now: Sales Conversion Rate Calculator [Free Template]](https://no-cache.hubspot.com/cta/default/53/059a7eef-8ad9-4bee-9c08-4dae23549a29.png)