Assist and resistance are key ideas that merchants ought to study when they’re doing technical evaluation. It’s because main helps and resistances are areas the place worth motion may presumably make an fascinating transfer. Value may both bounce off, break by way of, or stutter with indecisiveness as worth reaches these main ranges.

Merchants who know the best way to determine these key assist and resistance ranges may make some huge cash buying and selling based mostly on both reversals or breakouts occurring on these ranges. Merchants who don’t know the place the important thing assist and resistance ranges are run the danger of buying and selling towards such ranges which may end in a dropping commerce.

Assist and resistance ranges are crucial. Nonetheless, figuring out these main assist and resistance ranges could be very troublesome for brand new merchants. The assorted varieties of assist and resistance ranges alone could cause a lot confusion. Merchants may very well be taking a look at horizontal assist and resistance ranges based mostly on swing factors or diagonal helps and resistances that kind channels. Then, there are the dynamic assist and resistance ranges based mostly on technical indicators. So, how will we objectively determine key assist and resistance ranges with out the added guess work?

Weekly Pivot Cross Sign Foreign exchange Buying and selling Technique, we might be taking a look at how we may use Pivot Factors as an goal foundation for assist and resistance ranges.

Weekly Pivot Factors or Pivot Weekly

Pivot Level is a key technical indicator which {many professional} and institutional merchants are keen on utilizing. Pivot Factors are worth ranges that merchants use to determine key assist and resistance ranges.

Pivot Level indicators sometimes plot 5 traces, which act as assist and resistance ranges. Some variations plot seven. The primary line is named the Pivot Level (PP), the 2 assist ranges are known as Assist 1 (S1) and Assist 2 (S2), whereas the 2 resistance ranges are known as Resistance (R1) and Resistance 2 (R2).

The primary Pivot Level (PP) line is mainly the common of the excessive low and shut of the earlier interval. The opposite assist and resistance ranges are derived primarily from the PP.

Pivot Factors are distinctive as a result of these ranges are objectively plotted by an indicator, but on the similar time it’s static. Chances are high merchants are trying on the similar degree as a result of the excessive, low and shut of the earlier interval mustn’t differ an excessive amount of. This creates assist and resistance ranges which many merchants would agree on.

The Weekly Pivot Level is an fascinating pivot level degree. It’s merely a pivot level which is predicated on the excessive, low and shut of the earlier week. That is particularly helpful in foreign currency trading. It’s because varied brokers, relying on their open and shut time, might have assorted excessive, low and shut ranges utilizing the Every day Pivot Level as a result of the foreign exchange market is open 24 hours a day with brokers stationed in varied time zones. The Weekly Pivot Level nonetheless wouldn’t have this downside. This enables merchants to make use of the identical assist and resistance ranges as the opposite large gamers are utilizing, making it extra dependable.

The Weekly Pivot Level indicator is particularly helpful when traded in a day buying and selling or swing buying and selling technique.

This model of the Weekly Pivot Level plots blue traces to signify the resistance ranges, crimson traces to signify the assist ranges, and a goldenrod line to signify the pivot level.

EMA Crossover Sign

EMA Crossover Sign is a pattern reversal sign indicator which is predicated on transferring common crossovers.

One of the fashionable pattern reversal strategies that merchants use is buying and selling as two transferring common traces crossover. This typically signifies the reversal of a pattern. The method is to attend for a shorter-period transferring common line to cross over a longer-period transferring common line and commerce within the route the place the quicker transferring common line is transferring to.

The EMA Crossover Sign indicator is predicated on the identical transferring common crossover idea. It’s based mostly on the Exponential Transferring Common (EMA) line, which is a really efficient transferring common line. The EMA is characteristically clean and responsive. This enables for a line that doesn’t produce an excessive amount of false indicators but on the similar time shouldn’t be too lagging.

This indicator merely plots an arrow pointing the route of the brand new pattern because it detects a crossover of its underlying transferring common traces. Merchants can merely use these arrows as a pattern reversal entry sign.

Buying and selling Technique

This buying and selling technique is a day buying and selling technique which trades on the reversals coming kind the assist and resistance ranges of the Weekly Pivot Factors.

Trades are taken as the value motion begins to point out indicators of reversal after rejecting a assist or resistance degree based mostly on the Weekly Pivot Factors. Commerce entries are confirmed based mostly on the sign supplied by the EMA Crossover Sign indicator.

Indicators:

- EMA Crossover Sign

- Sooner EMA: 7

- Slower EMA: 21

- PivotWeekly

Most popular Time Frames: 5-minute chart solely

Forex Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York classes

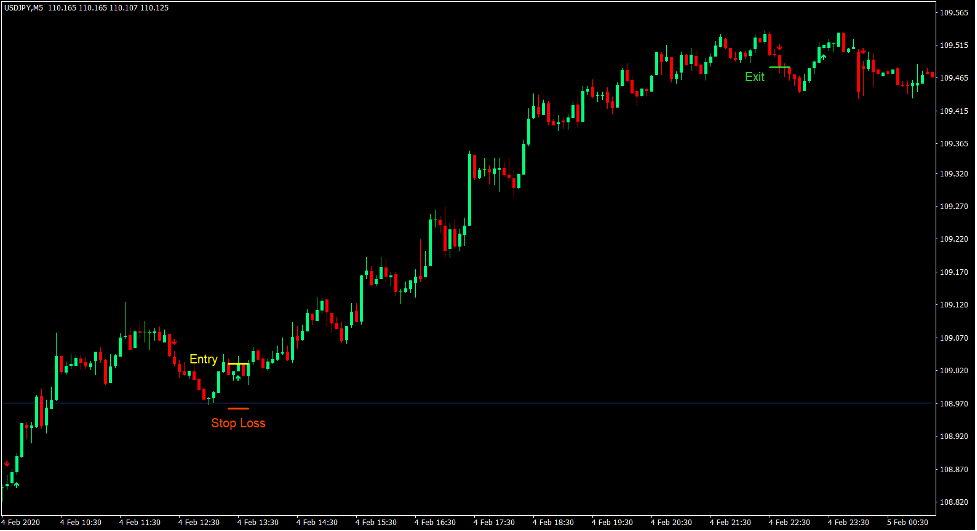

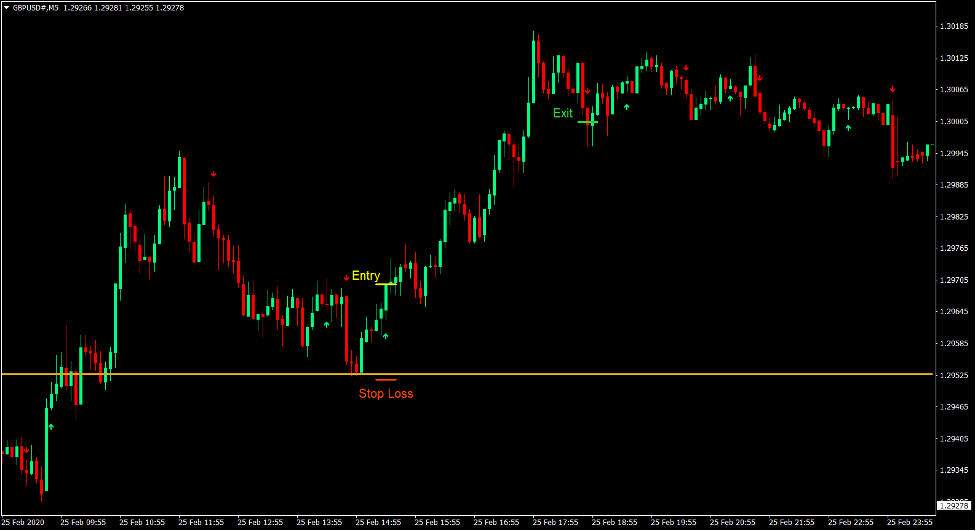

Purchase Commerce Setup

Entry

- Value motion ought to reject a pivot level degree, assist degree or resistance degree that turned assist from under.

- Enter a purchase order as quickly because the EMA Crossover Sign indicator plots an arrow pointing up.

Cease Loss

- Set the cease loss on a assist under the entry candle.

Exit

- Shut the commerce as quickly because the EMA Crossover Sign indicator plots an arrow pointing down.

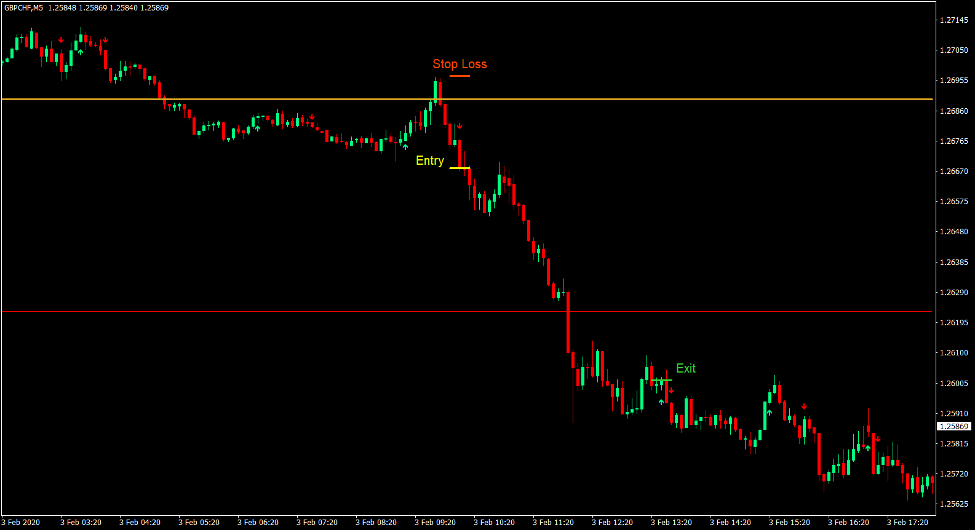

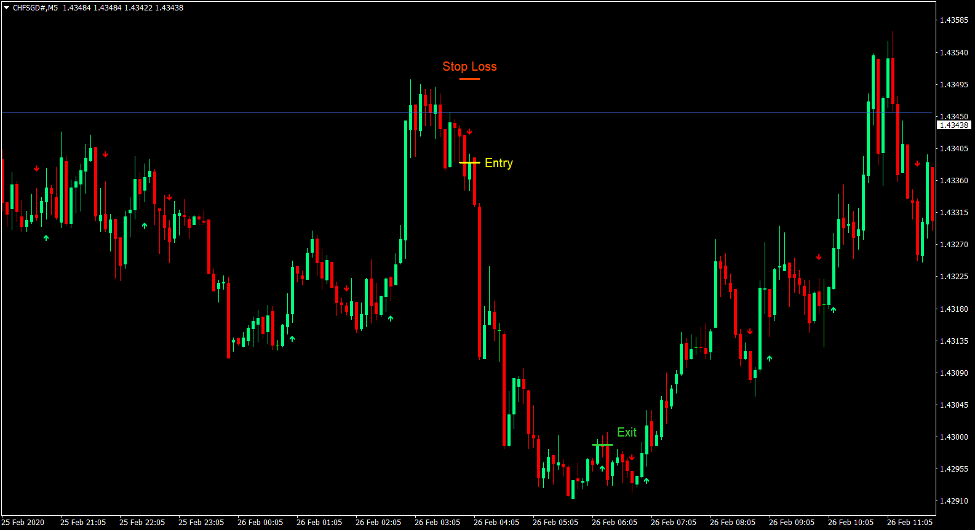

Promote Commerce Setup

Entry

- Value motion ought to reject a pivot level degree, resistance degree or assist degree that turned resistance from above.

- Enter a promote order as quickly because the EMA Crossover Sign indicator plots an arrow pointing down.

Cease Loss

- Set the cease loss on a resistance above the entry candle.

Exit

- Shut the commerce as quickly because the EMA Crossover Sign indicator plots an arrow pointing up.

Conclusion

This buying and selling technique is a simplistic technique of buying and selling assist and resistances based mostly on Pivot Factors.

It’s no secret that worth does are inclined to respect Pivot Level ranges as assist and resistance ranges. Nonetheless, the query is which amongst these ranges will worth bounce off from. Some merchants choose to guess or anticipate. This technique nonetheless waits for a sign after a bounce from any of those ranges. If the bounce is powerful, merchants might discover themselves buying and selling within the route of the pattern based mostly on the decrease timeframe. That is the place merchants can earn cash out of this kind of technique.

Foreign exchange Buying and selling Methods Set up Directions

Weekly Pivot Cross Sign Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the gathered historical past information and buying and selling indicators.

Weekly Pivot Cross Sign Foreign exchange Buying and selling Technique supplies a possibility to detect varied peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Primarily based on this info, merchants can assume additional worth motion and modify this technique accordingly.

Advisable Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

Advisable Choices Buying and selling Platform

- Free +50% Bonus To Begin Buying and selling Immediately

- 9.6 General Ranking!

- Mechanically Credited To Your Account

- No Hidden Phrases

- Settle for USA Residents

Find out how to set up Weekly Pivot Cross Sign Foreign exchange Buying and selling Technique?

- Obtain Weekly Pivot Cross Sign Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 recordsdata to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you need to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick Weekly Pivot Cross Sign Foreign exchange Buying and selling Technique

- You will notice Weekly Pivot Cross Sign Foreign exchange Buying and selling Technique is on the market in your Chart

*Notice: Not all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain:

<p fashion=”text-align: left;”><span class=”td_btn td_btn_lg td_round_btn” fashion=”background-color: #e30000;”><a href=”https://www.forexmt4indicators.com/improve/”><span fashion=”coloration: #ffffff;”>Get Obtain Entry</span></a>

</span></p>