Geopolitics. This was the one issue that continued to carry the worldwide fairness markets at ransom; it continued to fracture the emotions of the markets and India was no exception. With the struggle between Russia and Ukraine displaying no indicators of slowing down, the fairness markets, each international and home, continued to commerce on a tentative word. The NIFTY witnessed hole downs in the course of the week, oscillated in a large 682-point vary earlier than ending the week on a adverse word. Few essential technical ranges have been violated by the markets; the headline index ended with a internet lack of 413.05 factors (-2.48%) on a weekly foundation.

From the technical perspective, NIFTY had defended the 50-Week MA stage which presently stands at 16564. Nevertheless, this week, it has violated and slipped beneath this level. Making use of the essential tenet of technical evaluation, any help that’s as soon as violated turns into a resistance. On this context, the 50-Week MA might pose minor resistance to the markets when it tries to tug again. In the identical breath, over the previous periods, numerous shorts positions have been added throughout the board. This may occasionally result in a pointy short-covering led pullback on the slightest of the set off. So, extra essential will probably be to look at the pattern line help that the NIFTY has violated which falls within the area of 16750-1680 ranges. In any case, at current, the markets stay extremely unsure and on tenterhooks.

The volatility arrested its spike. INDIAVIX rose by simply 4.55% to 27.96 although it stays at its multi-month excessive level. The approaching week is prone to see the buying and selling vary remaining wider than ordinary. The degrees of 16400 and 16550 will act as possible resistance factors; the seemingly helps will are available at 16150 and 15900 ranges.

The weekly RSI stands at 40.81; it has marked a 14-period low which is bearish. It continues to stay impartial and doesn’t present any divergence towards the worth. The weekly MACD is bearish and beneath its sign line. A black physique emerged on the candles. This mirrored the bearish directional bias of the market contributors; aside from this, no different formations have been seen on the charts.

The sample evaluation exhibits that the NIFTY has violated the sample help in type of a pattern line that begins from 15400 ranges and joins the next excessive factors. Aside from violating this sample help, NIFTY has additionally breached and closed beneath the 50-Week MA which presently stands at 16564. This makes the zone of 16600-16850 a powerful resistance zone for the NIFTY over the approaching days.

From a broader standpoint, the technical construction of the markets stays weak. On the identical time, no matter how fluid the geopolitical tensions may be, it is very important word that the markets have added quite a lot of contemporary shorts within the system over the previous periods. After all, such markets supply quite a lot of shorting alternatives however the safer technique to cope with such setups can be to deal with the badly crushed sectors that present extra possibilities of a pointy technical pullback. Over the approaching days, we’ll see some badly crushed auto, monetary, and pharma shares may even see a pullback. PSE and Oil and Gasoline area will proceed to do effectively. It’s endorsed to proceed staying gentle on exposures. Whereas holding total publicity at modest ranges, vigilant safety income on both facet are suggested for the approaching week.

Sector Evaluation for the approaching week

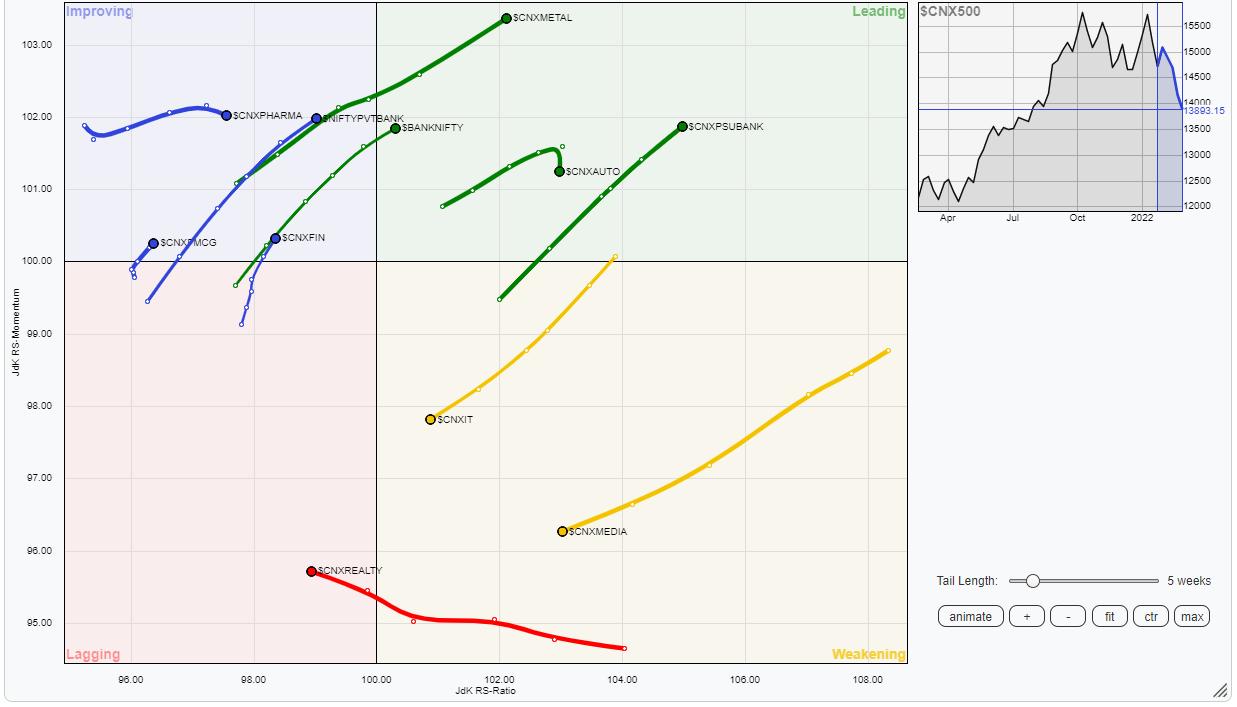

In our have a look at Relative Rotation Graphs®, we in contrast varied sectors towards CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

The evaluation of Relative Rotation Graphs (RRG) exhibits that NIFTY Commodities, Vitality, Metallic, PSE, and PSU Financial institution Index are firmly positioned contained in the main quadrant. NIFTY Auto is contained in the main quadrant as effectively however seems to have faltered on its relative momentum entrance. Aside from this, the NIFTY Financial institution index has rolled contained in the main quadrant; all these teams are prone to contribute to the relative outperformance towards the broader markets.

NIFTY Media and the IT indices keep within the weakening quadrant.

The NIFTY MidCap100 index has rolled contained in the lagging quadrant and should comparatively underperform the broader markets together with the Consumption and the Realty Index.

NIFTY Pharma, FMCG, and the Monetary Companies Index keep within the enhancing quadrant; they’re prone to put up a comparatively resilient present towards the broader NIFTY 500 index.

Vital Notice: RRG™ charts present the relative energy and momentum for a gaggle of shares. Within the above Chart, they present relative efficiency towards NIFTY500 Index (Broader Markets) and shouldn’t be used instantly as purchase or promote alerts.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a professional Unbiased Technical Analysis Analyst at his Analysis Agency, Gemstone Fairness Analysis & Advisory Companies in Vadodara, India. As a Consulting Technical Analysis Analyst and along with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Unbiased Technical Analysis to the Shoppers. He presently contributes every day to ET Markets and The Financial Occasions of India. He additionally authors one of many India’s most correct “Day by day / Weekly Market Outlook” — A Day by day / Weekly E-newsletter, at present in its fifteenth 12 months of publication.

Milan’s main duties embody consulting in Portfolio/Funds Administration and Advisory Companies. His work additionally entails advising these Shoppers with dynamic Funding and Buying and selling Methods throughout a number of asset-classes whereas holding their actions aligned with the given mandate.

Study Extra