Within the earlier weekly be aware, we talked about that the markets have fashioned a powerful base for themselves; probably the most logical transfer that the markets could make is to maneuver in the direction of their 50-Week MA, which was then positioned at 17073. The start of the earlier week was a bit jittery, because the NIFTY had a quick corrective consolidation to begin the week with; nevertheless, the final three periods remained very sturdy. The markets had somewhat bit larger of a buying and selling vary; it moved in a 737-point window and closed the week on a really sturdy be aware. The final three periods had gap-up openings; the headline index closed with a powerful weekly acquire of 438.80 factors (+2.62%). The markets additionally closed the month on a sturdy be aware, with NIFTY gaining 1378 factors (+8.73%) for July.

Throughout the week, the worldwide fairness markets digested the already-discounted 75 bps price hike that got here from FOMC. The fairness markets surged; India was no exception. The foundations for a powerful reversal had been set weeks in the past when practically all the important thing world markets had proven a powerful bullish divergence of the lead indicators on the charts. The NIFTY has halted on the 50-Week MA, which is presently positioned at 17086. There’s a risk that the markets could consolidate at present ranges; the consolidation could occur in type of ranged oscillations, however the downsides could keep restricted. The choices knowledge additionally recommend that the markets could have opened up some extra room for upside; nevertheless, for this to occur, retaining the top above 17000 will likely be extraordinarily essential for the markets.

The approaching week might even see a steady begin to the week; the degrees of 17350 and 17500 are anticipated to behave as potential resistance factors. The helps are available on the 17000 and 16620 ranges. The buying and selling vary for the approaching week can also be more likely to keep wider than standard.

The weekly RSI has marked a recent 14-period excessive, which is bullish; nevertheless, it stays impartial and doesn’t present any divergence in opposition to the value. The weekly MACD has proven a optimistic crossover; it’s now bullish and trades above the sign line.

A powerful white-bodied candle appeared on the charts, this mirrored the directional consensus of the market contributors.

The sample evaluation of the weekly chart means that NIFTY has efficiently marked a base for itself at the newest lows; now, except violated, that turns into a powerful intermediate help for the markets. On the upper aspect, NIFTY now trades above all of the three Weekly Transferring Averages; it has opened up some upsides. Nonetheless, to increase the up transfer, it might be essential for the Index to maintain its head above the 50-Week MA, which is presently positioned at 17086.

The volatility remained largely unchanged; INDIAVIX misplaced simply 0.60% on a weekly foundation. General, within the coming week, NIFTY’s value motion vis-à-vis the degrees of 17000 will likely be essential to observe. The index could prolong its up transfer if it stays above 17000; any slip under this may make the markets endure some consolidation as soon as once more. We’re not more likely to see any specific sector dominating the panorama, however we’re more likely to see some extremely stock-specific strikes over the approaching week. It’s anticipated that, whereas historically defensive pockets like IT and Pharma could do properly, some stock-specific strikes from the Metals, Financials and Autos can’t be dominated out as properly. It’s endorsed to proceed staying stock-specific; keep away from chasing the prolonged up strikes and defend earnings at every increased degree.

Sector Evaluation for the Coming Week

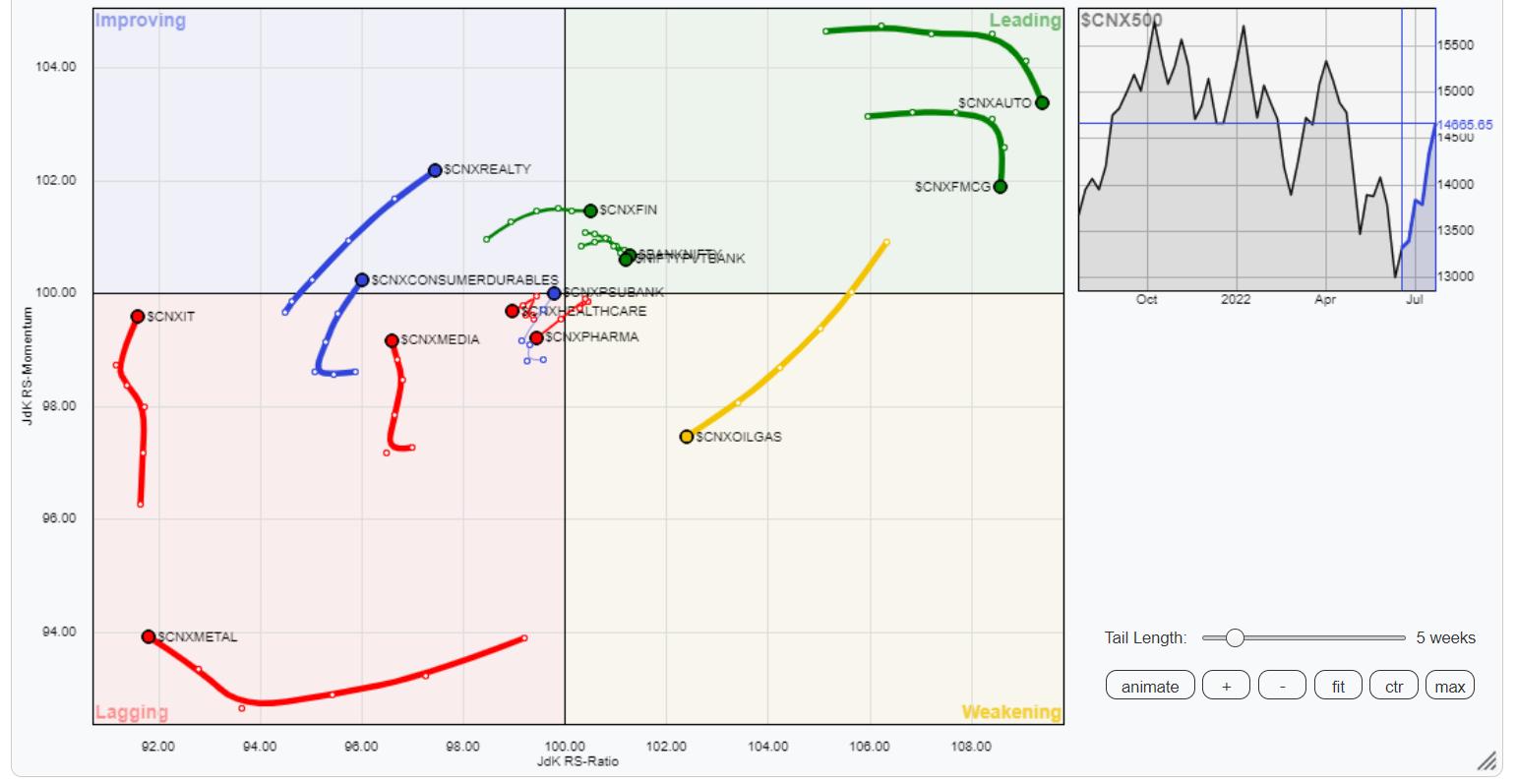

In our take a look at Relative Rotation Graphs®, we in contrast varied sectors in opposition to CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

Our evaluation of Relative Rotation Graphs (RRG) doesn’t present any main modifications within the sector setup that was there over the earlier week. BankNifty, Consumption, FMCG, Auto and the Monetary Companies Index are contained in the main quadrant; they’re more likely to proceed to comparatively outperform the broader NIFTY500 Index.

NIFTY Vitality, PSE, and Infrastructure indexes proceed to remain contained in the weakening quadrant; some remoted stock-specific reveals could occur, however, on relative phrases, they could proceed exhibiting decelerating momentum.

The NIFTY Metallic and Commodities index seems to have began its course of to finish its transfer, although it continues to languish contained in the lagging quadrant. The NIFTY Media and IT index are seen sharply enhancing their relative momentum in opposition to the broader markets.

The NIFTY Pharma, Companies Sector, and PSU financial institution indexes are seen sharply enhancing their relative momentum. These teams are more likely to submit resilient showings on relative phrases over the approaching week.

Necessary Notice: RRG™ charts present the relative power and momentum for a gaggle of shares. Within the above Chart, they present relative efficiency in opposition to NIFTY500 Index (Broader Markets) and shouldn’t be used immediately as purchase or promote indicators.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Milan Vaishnav, CMT, MSTA is a professional Impartial Technical Analysis Analyst at his Analysis Agency, Gemstone Fairness Analysis & Advisory Companies in Vadodara, India. As a Consulting Technical Analysis Analyst and together with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Impartial Technical Analysis to the Shoppers. He presently contributes each day to ET Markets and The Financial Occasions of India. He additionally authors one of many India’s most correct “Day by day / Weekly Market Outlook” — A Day by day / Weekly E-newsletter, at the moment in its fifteenth 12 months of publication.

Milan’s main tasks embody consulting in Portfolio/Funds Administration and Advisory Companies. His work additionally entails advising these Shoppers with dynamic Funding and Buying and selling Methods throughout a number of asset-classes whereas retaining their actions aligned with the given mandate.

Study Extra