Whereas persevering with to commerce exactly on the anticipated strains, the NIFTY continued to wrestle to maintain its head above the important thing ranges because it closed the week on a flat observe with a unfavourable bias. All of the 5 days of the week stood very shaky for the markets; NIFTY both opened with a spot up or with a spot down on nearly all the times. It did not maintain its head above the essential 200-DMA on the each day chart; the Index additionally continued resisting the 20-Week MA. The NIFTY oscillated over 488-points over the previous 5 days and ended with a web lack of 69.40 factors (-0.40%) on a weekly observe.

From a technical perspective, NIFTY is positioned at a really essential juncture. On one hand, it has did not maintain its head above the 200-DMA which stands at 17225. On the opposite facet, it has continued to take assist on a sample assist development line and the 50-Week MA. The 50-Week MA stands at 16983. The sample evaluation of the chart in addition to the derivatives knowledge proceed to indicate the zone of 16850-17500; this 150-point zone is a robust assist space for the NIFTY. In addition to this, the index has additionally seen the addition of recent brief positions on Friday as evident from the derivatives knowledge.

In any case, the markets basically and NIFTY specifically stay in a no-trade zone. As long as the NIFTY is above 16850 and beneath 17500, it’s completely unlikely that it’ll have any sustainable directional bias on both facet. The approaching week is prone to see the degrees of 17280 and 17495 appearing as possible resistance factors. The helps are available at 16950 and 16800 ranges. The buying and selling vary is prone to stay a bit wider than standard over the approaching week.

The weekly RSI is 49.09; it stays impartial and doesn’t present any divergence towards the worth. The weekly MACD is bearish and beneath the sign line. The prevalence of the spinning high on the candles continues to level in the direction of the indecisive and tentative conduct of the market contributors.

Whereas the markets stayed largely flat on a week-on-week foundation, volatility elevated. INDIAVIX rose by 5.79% to 19.42 on a weekly foundation. The worldwide, in addition to Indian markets, are additionally set to react to the FOMC determination slated to return in the midst of the approaching week. Markets seem to have largely discounted the speed hike of fifty bps.

No matter any exterior issue that will have an effect on the markets and the development, it might be prudent to stay to the technically derived ranges and keep away from getting carried away by the gaps on both facet. From a technical standpoint, the NIFTY has fashioned a congestion zone; all gaps occurring inside this space sample could have little or no significance until there’s a breakdown beneath 16850 or a breakout above 17500 ranges.

All in all, the markets stay within the talked about outlined zone; from a weekly perspective, it might be essential for the NIFTY to defend the degrees of 50-DMA; this level is at 16983 at current and is predicted to behave as essential assist on a closing foundation. Except any sustainable directional development is established, it’s strongly really helpful to keep away from shorts. Any downsides have to be used to make choose purchases. On the identical time, all income have to be vigilantly protected at greater ranges as long as the NIFTY is beneath 17500. A selective and cautious method to the markets is suggested.

Sector Evaluation for the approaching week

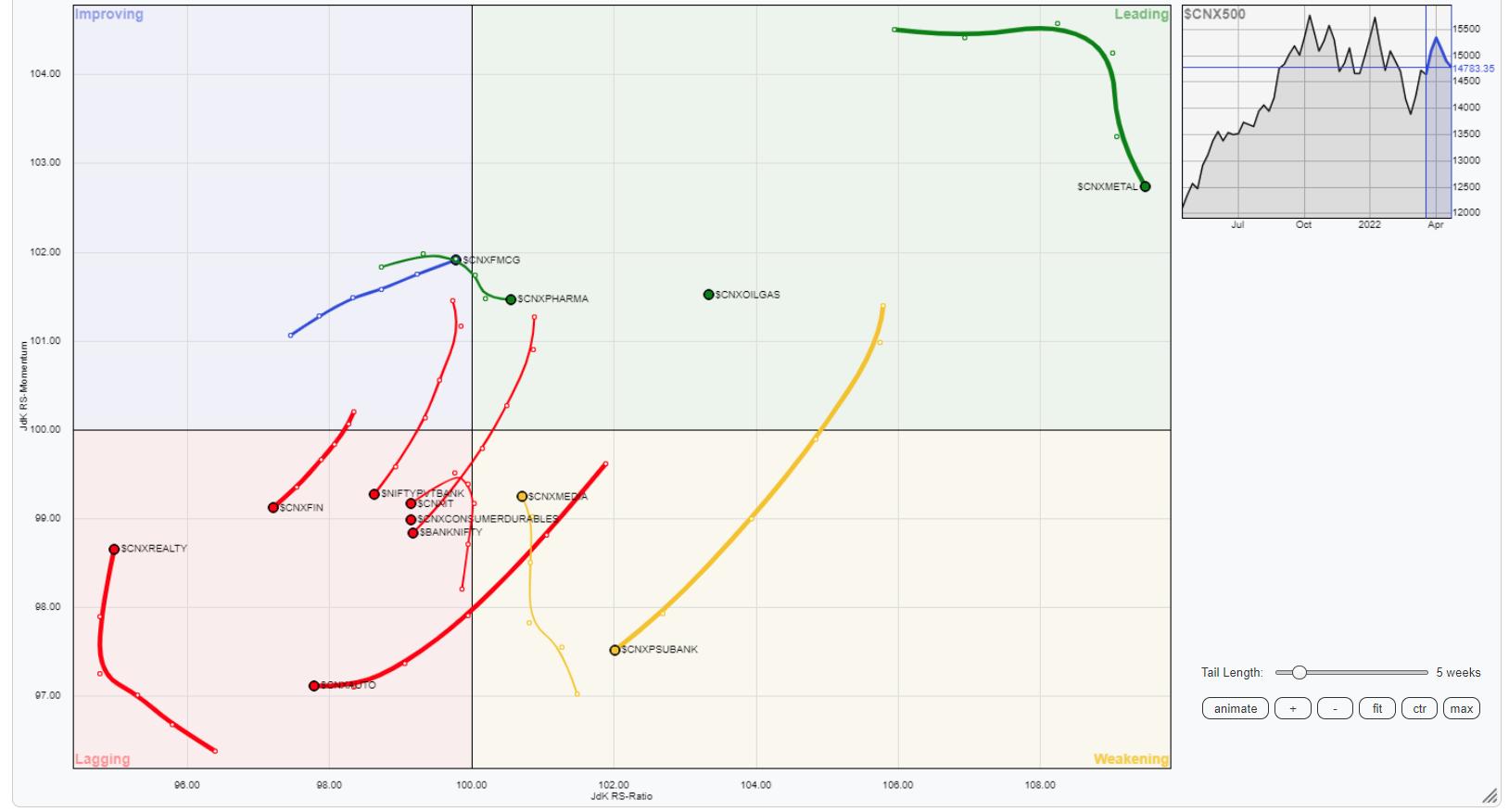

In our take a look at Relative Rotation Graphs®, we in contrast varied sectors towards CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

The evaluation of Relative Rotation Graphs (RRG) reveals that the broader markets are set to comparatively outperform once more because the NIFTY MIDCAP 100 index has rolled contained in the enhancing quadrant.

The Power, Commodities, Pharma, NIFTY PSE, Steel, and the Infrastructure indexes are contained in the main quadrant. These teams are set to proceed comparatively outperforming the broader markets. The NIFTY Media index is contained in the weakening quadrant. However it’s seen enhancing on its relative momentum Then again, the PSU Financial institution index can also be contained in the weakening quadrant however it’s seen paring its relative momentum which can negatively have an effect on its relative efficiency.

NIFTY Financial institution, Providers Sector Index, IT, Auto, and the Monetary Providers index languish contained in the weakening quadrant. These teams could comparatively underperform the benchmark. Then again, the NIFTY Realty index can also be contained in the weakening quadrant, however it’s seen strongly enhancing on its relative momentum towards the broader NIFTY 500 index.

In addition to NIFTY Midcap 100 Index, the Consumption and FMCG indexes are additionally contained in the enhancing quadrant. They’re prone to carry out higher towards the broader markets whereas sustaining their relative momentum.

Vital Word: RRG™ charts present the relative power and momentum for a bunch of shares. Within the above Chart, they present relative efficiency towards NIFTY500 Index (Broader Markets) and shouldn’t be used instantly as purchase or promote indicators.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Milan Vaishnav, CMT, MSTA is a professional Unbiased Technical Analysis Analyst at his Analysis Agency, Gemstone Fairness Analysis & Advisory Providers in Vadodara, India. As a Consulting Technical Analysis Analyst and along with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Unbiased Technical Analysis to the Purchasers. He presently contributes every day to ET Markets and The Financial Instances of India. He additionally authors one of many India’s most correct “Every day / Weekly Market Outlook” — A Every day / Weekly E-newsletter, presently in its fifteenth yr of publication.

Milan’s main tasks embody consulting in Portfolio/Funds Administration and Advisory Providers. His work additionally entails advising these Purchasers with dynamic Funding and Buying and selling Methods throughout a number of asset-classes whereas protecting their actions aligned with the given mandate.

Study Extra