“Select your battles correctly. Battles not fought are usually not misplaced, merely battles not value preventing for.” This quote may appear to be a superb life lesson, but it surely additionally applies in buying and selling.

The foreign exchange market is stuffed with alternatives, but it’s also filled with potential risks. Merchants can shortly flip their fortunes round buying and selling the foreign exchange market, but folks might additionally unfastened their fortune in the event that they make fallacious choices.

Due to the various alternatives that the foreign exchange market presents inside a buying and selling interval or a buying and selling day, many merchants are tempted to commerce each alternative that’s offered by the market. Nevertheless, not all commerce setups are value buying and selling. Some are simpler to commerce with a better win likelihood, whereas others have decrease potential rewards and decrease chances.

Pattern following methods are among the best commerce setups to commerce. It often has larger win charges as a result of merchants are buying and selling with the development. On the similar time, merchants even have the chance acquire greater earnings as a result of developments can generally last more than standard.

Nevertheless, many development following merchants are responsible of buying and selling their development following methods even in markets that aren’t trending. This causes them to lose extra typically than they want, regardless that they’re buying and selling methods which are purported to have larger win chances.

Usoho Ichi Excessive Low Foreign exchange Buying and selling Technique is a development following technique which helps merchants filter out non-trending market alternatives. This helps merchants keep away from trades which have decrease chances and take solely trades with higher probabilities of leading to a win.

Usoho Ichi Common

Usoho Ichi Common is a customized shifting common which relies on the Ichimoku Kinko Hyo indicator. Just like the Ichimoku Kinko Hyo indicator, the Usoho Ichi Common presents a whole commerce setup utilizing a single indicator. It signifies short-term, mid-term and long-term developments, in addition to worth motion, utilizing shifting averages.

The distinction between the Ichimoku Kinko Hyo indicator and the Usoho Ichi Common is with how the shifting averages are plotted. The Ichimoku Kinko Hyo traces are based mostly on the median of costs whereas the Usoho Ichi Common relies on modified shifting averages.

The Usoho Ichi Common consists of 5 traces. The lime line represents worth motion and is moved a number of durations again, identical to the Chikou Span of the Ichimoku Kinko Hyo. The crimson line is the MA Tenkan, which represents the short-term development, whereas the blue line is the MA Kijun which represents the mid-term development. The MA Senkou consists of two traces which represents the long-term development. The MA Senkou is sandy brown when the development is bullish and thistle when the development is bearish.

Pattern reversal indicators are generated every time the MA Tenkan and MA Kijun traces crossover. Nevertheless, the indicators generated ought to be filtered based mostly on the route of the MA Senkou development. Other than this, merchants also needs to observe if the lime line is crossing worth motion which causes the chart to look messy. This means that the market isn’t trending robust sufficient to warrant a sound development following entry.

Gann HiLo Activator Bars

The Gann HiLo Activator Bars is a customized momentum indicator which helps merchants determine the route of the fast momentum or short-term development.

The Gann HiLo Activator Bars point out the route of the momentum by overlaying bars on the value chart. These bars change colour relying on the typical motion of worth motion. The bars are blue every time it detects a bullish momentum, and crimson every time it detects a bearish momentum.

Merchants can use the altering of the colour of the bars as an entry sign based mostly on the short-term development or momentum.

Buying and selling Technique

This buying and selling technique is a development following technique which makes use of the world between the MA Tenkan and MA Kijun traces as an space of dynamic assist or resistance. Trades are taken every time worth retraces and bounces off this space.

To commerce this technique, the MA Tenka, MA Kijun and MA Senkou traces ought to be stacked so as, indicating that the market is trending. Other than this, the lime line which represents worth motion which is moved again a number of durations shouldn’t be crossing worth motion or any of the traces. This may point out that the development is shifting robust sufficient.

The Gann HiLo Activator Bars can be used because the precise commerce entry set off after the retracement in direction of the MA Tenkan and MA Kijun traces.

Indicators:

- uSoho_Ichi_Average

- Gann HiLo activator bars

Most popular Time Frames: 1-hour and 4-hour charts

Foreign money Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York classes

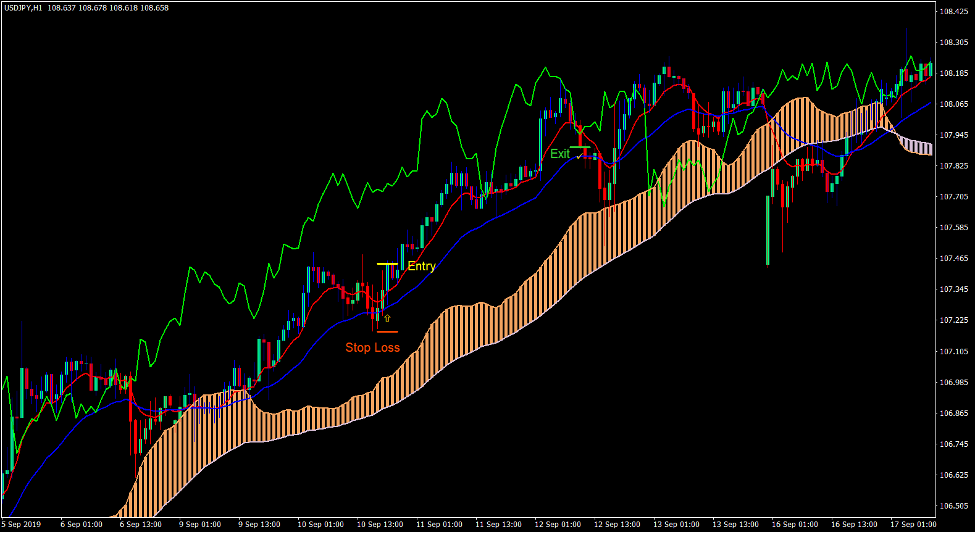

Purchase Commerce Setup

Entry

- The MA Senkou space ought to be sandy brown.

- The MA Kijun ought to be above the MA Senkou.

- The MA Tenkan ought to be above the MA Kijun.

- The lime line mustn’t contact worth motion or the opposite traces.

- Worth ought to retrace in direction of the MA Tenkan and MA Kijun traces inflicting the Gann HiLo Activator Bars to quickly change to crimson.

- Enter a purchase order as quickly because the Gann HiLo Activator Bars adjustments to blue.

Cease Loss

- Set the cease loss on the assist beneath the entry candle.

Exit

- Shut the commerce as quickly because the Gann HiLo Activator Bars change to crimson.

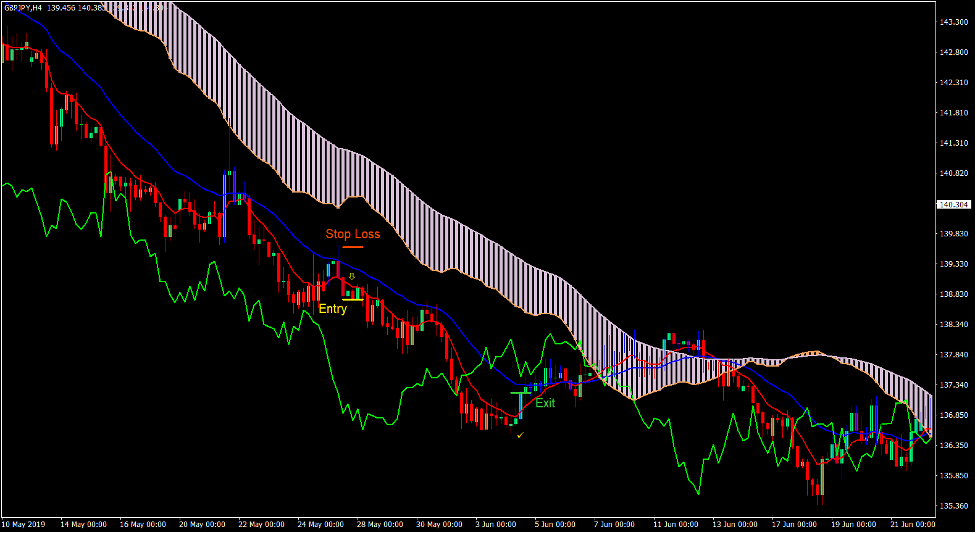

Promote Commerce Setup

Entry

- The MA Senkou space ought to be thistle.

- The MA Kijun ought to be beneath the MA Senkou.

- The MA Tenkan ought to be beneath the MA Kijun.

- The lime line mustn’t contact worth motion or the opposite traces.

- Worth ought to retrace in direction of the MA Tenkan and MA Kijun traces inflicting the Gann HiLo Activator Bars to quickly change to blue.

- Enter a promote order as quickly because the Gann HiLo Activator Bars adjustments to crimson.

Cease Loss

- Set the cease loss on the resistance above the entry candle.

Exit

- Shut the commerce as quickly because the Gann HiLo Activator Bars change to blue.

Conclusion

This buying and selling technique is a working buying and selling technique which might produce excessive likelihood commerce setups with the potential to provide large beneficial properties. Similar to the Ichimoku Kinko Hyo indicator, if used correctly within the right market situation this indicator will help merchants develop into persistently worthwhile buying and selling the foreign exchange markets.

Though it’s potential to commerce based mostly on worth motion exhibiting indications of rejecting the world between the MA Tenkan and MA Kijun, commerce indicators coming from the Gann HiLo Activator Bars systematically supplies the commerce entry triggers.

The important thing to buying and selling this technique profitably is in isolating trending market circumstances as the one market situation that we must always commerce in.

Foreign exchange Buying and selling Methods Set up Directions

Usoho Ichi Excessive Low Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the collected historical past knowledge and buying and selling indicators.

Usoho Ichi Excessive Low Foreign exchange Buying and selling Technique supplies a possibility to detect varied peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Based mostly on this info, merchants can assume additional worth motion and modify this technique accordingly.

Advisable Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

Find out how to set up Usoho Ichi Excessive Low Foreign exchange Buying and selling Technique?

- Obtain Usoho Ichi Excessive Low Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 information to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you wish to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick Usoho Ichi Excessive Low Foreign exchange Buying and selling Technique

- You will note Usoho Ichi Excessive Low Foreign exchange Buying and selling Technique is offered in your Chart

*Observe: Not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain: