“The steadiness of change charges is vital, and their speedy modifications are undesirable”, Japan’s Deputy Finance Minister Masato Kanda stated lately, echoing statements made again in March by a authorities spokesman and finance minister.

BoJ Governor Kuroda additionally stated at the moment that the yen’s fall was “considerably speedy”, which could possibly be seen as a robust warning.

On the identical time, many economists are warning of rising recession dangers within the US resulting from a string of provide shocks, whereas the Fed raises charges to curb inflation.

The chance of a slowdown in enterprise exercise, together with dangerously excessive inflation, which reached 7.9% in February, poses a troublesome job for the Fed. The central financial institution is attempting to chill the financial system by slowing down inflation, however not permitting spending cuts and rising unemployment.

Returning to the USD/JPY pair, we will assume its additional development within the quick and medium time period. Thus far, traders nonetheless desire the greenback, whereas geopolitical tensions persist on the planet (exterior the US). Thus, final Friday the DXY greenback index up to date a 2-year excessive at 100.19, and plenty of economists agree {that a} breakdown of the psychologically important degree of 100.00 will speed up the additional development of DXY, and the greenback will proceed to strengthen.

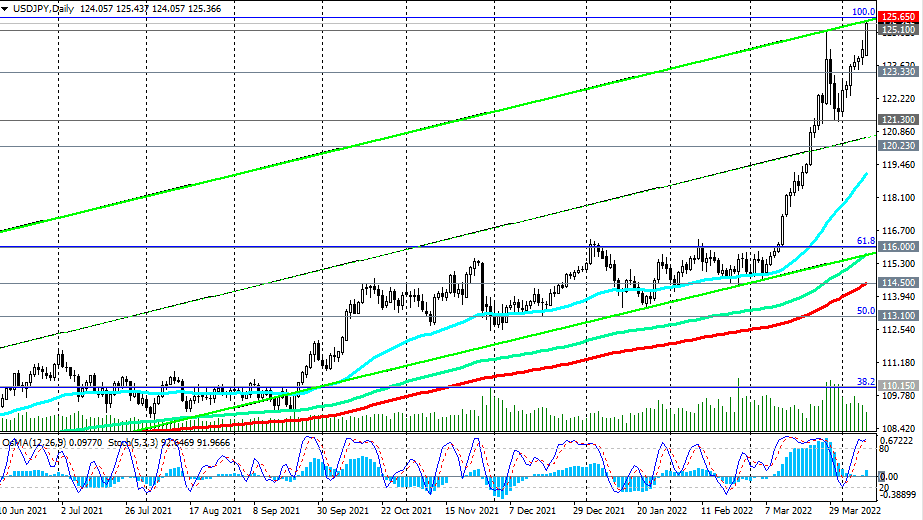

In the present day, USD/JPY is up sharply, posting a 6-week run in a row to interrupt above 125.10 (the excessive of final month and August 2015). The discrepancy between the financial coverage of the Fed and the Financial institution of Japan is more likely to enhance, creating preconditions for additional development of USD/JPY. On this case, the pair will head in direction of multi-year highs close to 135.00, reached in January 2002.

Assist ranges: 125.10, 124.40, 123.33, 121.30, 120.23, 116.00, 114.50, 113.10, 110.15

Resistance ranges: 125.65

*) see additionally “Technical evaluation and buying and selling suggestions” -> Telegram

**) Get no deposit StartUp bonus as much as 1500.00 USD

Supply: InstaForex