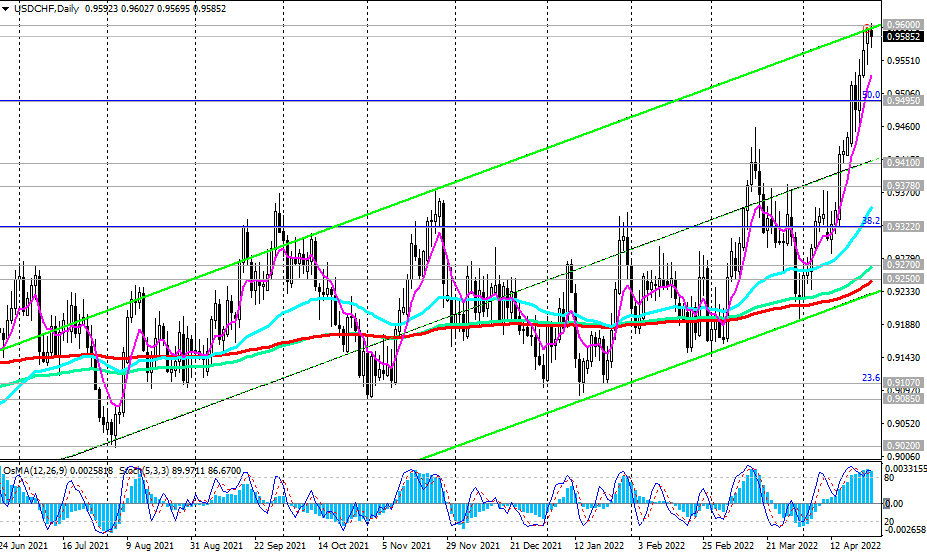

Even though the franc enjoys the standing of a defensive asset and is strengthening towards different main currencies, it continues to weaken towards the US greenback. Thus, the USD/CHF pair immediately up to date one other excessive since July 2020, exceeding 0.9600 (for extra particulars, see “USD/CHF: technical evaluation and buying and selling suggestions for 04/26/2022“).

Not in favor of the franc was additionally launched immediately’s statistics, indicating a lower within the surplus of the international commerce steadiness of Switzerland in March to 2.988 billion francs from 5.882 billion francs in February, which additionally turned out to be worse than the forecast for a decline to 4.890 billion francs.

Tomorrow (at 08:00 GMT) the ZEW Expectations Index might be printed, assessing the enterprise local weather, the scenario on the employment market and different elements that have an effect on the each day conduct of enterprise in Switzerland, and on Friday (at 07:00 GMT) – the index of main indicators KOF, which is taken into account an indicator of financial stability in Switzerland. Each indicators are unlikely to trigger the franc to strengthen, as they’re anticipated to be weak (-9.1 and 99.3 after -27.8 and 99.7, respectively, within the earlier month).

On Friday (08:00 GMT), the speech of the pinnacle of the SNB, Thomas Jordan, can be scheduled. Buyers might be ready for indicators from him relating to additional plans for the financial coverage of the SNB. The sign to open new lengthy positions would be the replace of immediately’s excessive of 0.9600.

Assist ranges: 0.9570, 0.9495, 0.9410, 0.9378, 0.9300, 0.9270, 0.9250

Resistance ranges: 0.9600, 0.9670, 0.9960, 1.0000, 1.0235, 1.0480

*) see additionally “Technical evaluation and buying and selling suggestions” -> Telegram

**) Get no deposit StartUp bonus as much as 1500.00 USD

Supply: InstaForex