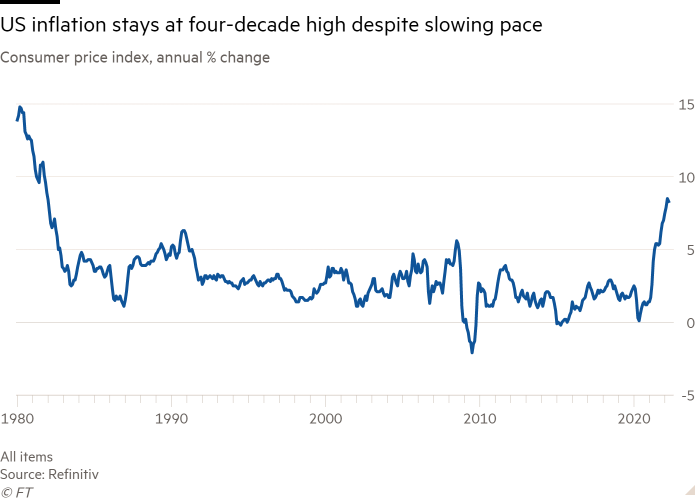

US client costs rose at an annual tempo of 8.3 per cent final month, greater than economists’ expectations and near a four-decade excessive, underscoring the urgency of the Federal Reserve’s push to stamp out inflation.

Though the buyer value index moderated for the primary time in eight months — it was a step down from the 8.5 per cent improve recorded in March — it was barely above economists’ expectations of an 8.1 per cent rise. An underlying gauge of inflation additionally rose greater than anticipated, highlighting stresses on American households and the problem for the Biden administration.

The information jolted the $22tn marketplace for US authorities bonds, sending yields hovering. The 2-year Treasury yield, which is most delicate to the outlook for financial coverage, jumped at one level roughly 0.12 share factors to 2.73 per cent, earlier than dropping again right down to 2.67 per cent. The benchmark 10-year observe settled round 3 per cent after rising quickly as properly. US shares turned adverse after the report.

“This isn’t the shock both the bond market or the Fed needed,” mentioned Emily Roland, co-chief funding strategist at John Hancock Funding Administration.

Along with the leap in costs from final 12 months, client costs climbed one other 0.3 per cent from the earlier month. That was slower than the 1.2 per cent rise recorded in March, which was fuelled by hovering power and meals prices tied to Russia’s invasion of Ukraine.

Stripping out unstable gadgets like meals and power, nonetheless, the month-to-month rise in core CPI elevated at a sooner tempo than the earlier month, at 0.6 per cent in contrast with 0.3 per cent in March. On an annual foundation, that amounted to a 6.2 per cent improve.

Economists homed in on a 0.7 per cent month-to-month leap in underlying companies inflation, which excludes power companies. Since December, that price has steadily elevated and 12 months over 12 months is up practically 5 per cent.

The newest uptick solidified issues that value pressures are now not a phenomenon unique to sectors most affected by pandemic-related disruptions — however slightly a broad-based pattern affecting all sectors.

Nonetheless, the info, printed by the Bureau of Labor Statistics, could characterize the start of a peak within the coronavirus pandemic-era inflation surge brought on by red-hot client demand coupled with extreme provide chain bottlenecks.

Economists broadly anticipate the tempo of client value development to reasonable farther from these ranges because the instant results of the battle in Ukraine abate. The headline annual inflation studying also needs to begin to fall within the coming months because it begins being in contrast with the very elevated ranges logged final 12 months.

Regardless of this projection, upward strain on inflation is unlikely to ebb considerably. In keeping with the BLS, will increase in shelter, meals and airline fares powered most of April’s improve. Vitality costs provided some reduction after rocketing final month, with the gasoline index down 6.1 per cent over the month. That offset will increase in the price of pure fuel and electrical energy, the BLS mentioned.

US president Joe Biden on Tuesday harassed that combating inflation was his administration’s “prime financial problem” as he voiced help for the Fed’s efforts to tame inflation.

The Fed has ratcheted up its efforts to comprise value pressures, implementing its first half-point price rise in additional than twenty years this month. Additional such will increase are anticipated in June and July, and doubtlessly even September, with the federal funds price anticipated to succeed in 2.7 per cent by the top of the 12 months.

The Fed’s discount of its $9tn steadiness sheet may also start in June, the second of two levers the Fed is utilizing to chill the economic system.

The principle query for buyers is whether or not the US central financial institution can deliver down inflation with out inflicting a recession. John Williams, the president of the New York Fed, mentioned this week the problem of engineering a delicate touchdown can be tough however “not insurmountable”.

The newest inflation figures “actually exacerbate a job that was already fairly tough by way of the Fed’s skill to engineer a delicate touchdown,” mentioned Roland. “If inflation stays elevated, it’s going to turn out to be a lot more durable.”