by Chris Kimble

It’s been a loopy final couple of years. And that’s in all probability an understatement.

And 2022 is off to an identical begin with provide disruptions, surging inflation, and struggle abroad.

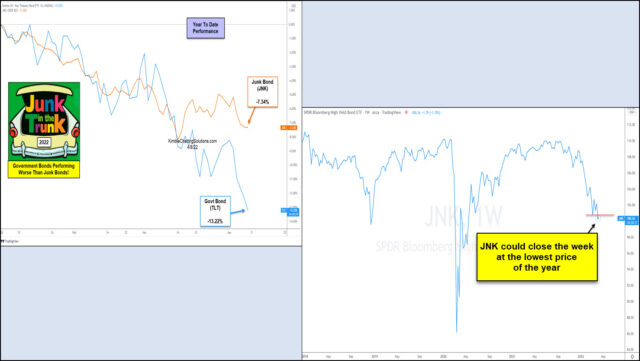

Evidently, shares are buying and selling decrease this 12 months. And, no shock, junk bonds are buying and selling decrease as effectively. However what’s shocking is that the customarily safe-haven US treasury bonds (TLT) are buying and selling down… by so much.

Right now’s chart 2-pack seems at how the junk bonds ETF (JNK) is out-performing the authorities bonds ETF (TLT). Not fairly often that you just see shares get hit and treasuries carry out worse than junk bonds.

Additionally, you’ll be able to see that junk bonds are at an necessary intersection after closing final week on the lowest value of the 12 months. Bulls higher hope for a fast restoration or we might see some imply reversion as junk bonds head decrease. Keep tuned!

This text was first written for See It Markets.com. To see the unique put up CLICK HERE.

Assist Assist Impartial Media, Please Donate or Subscribe:

Trending:

Views:

16