Haulage corporations that spent final 12 months battling to rent drivers now have a brand new drawback: a scarcity of vehicles.

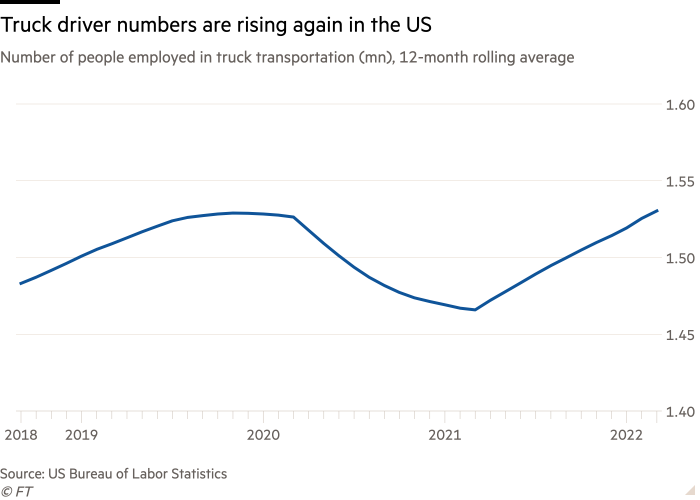

On each side of the Atlantic, rising wages have helped lure employees again on the highway after a scarcity of drivers strained the trade to breaking level, leaving delivery containers stranded at ports on the US west coast and petrol pumps working dry on British forecourts.

However a longstanding shortfall of apparatus — due initially to coronavirus restrictions and chip shortages — is turning into extra extreme as Russia’s invasion of Ukraine shuts down the provision of key elements and Chinese language lockdowns threaten additional turmoil in world provide chains.

“The driving force has been the largest constraint of the final two years . . . The larger provide constraint now’s the truck, and to some extent the trailer,” stated Tim Denoyer, analyst at Indiana-based ACT Analysis.

Rico Luman, an economist at ING, stated some European truckmakers had been taking no extra orders as a result of their backlogs had been already lengthy, whereas others couldn’t quote a worth as a result of they had been not sure of the price of uncooked supplies for autos that could be delivered “far into” subsequent 12 months.

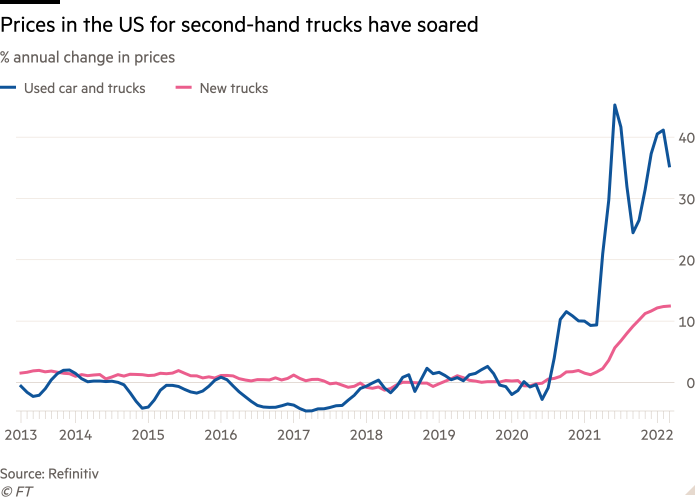

“Vans one to two-years-old are virtually the identical worth as new ones for the time being: there isn’t a possibility B to get spare capability,” Luman stated.

“We’re struggling to maintain the UK fleet on the highway,” stated Kieran Smith, chief government of the recruitment company Driver Require, who stated automobile availability on the operators with which he works had dropped noticeably due to a scarcity of spare elements.

Greater pay — wages throughout the trade rose about 25-30 per cent over the previous 12 months, in keeping with Denoyer — and the easing of the Omicron coronavirus wave has alleviated employee shortages within the US.

The wave of latest employees, in the meantime, has helped cap prices for corporations transporting their items by truck. US dry-van spot charges, excluding gas, fell abruptly in March and are down greater than a 3rd because the begin of the 12 months.

The image is comparable within the UK, the place trade associations say driver shortages have eased as pay has improved, testing for HGV licences resumed and large-scale government-backed coaching schemes received underneath means.

“A 12 months in the past we had been bleeding drivers throughout because of Covid,” stated Rod McKenzie, head of coverage on the Street Haulage Affiliation. “Now issues are actually easing.” McKenzie estimated a shortfall of 100,000 drivers had dropped to about 65,000.

Luis Gomez, president of XPO Logistics Europe, stated vacancies within the firm’s UK enterprise had fallen and wages had stabilised throughout the trade, with job candidates giving precedence to shift patterns that supplied a greater work-life steadiness over giant pay packets.

Paul Day, chief government of Turners Soham, a Cambridgeshire based mostly trucking and warehousing firm, stated the UK market was “near equilibrium” between the variety of drivers and the quantity of labor, with wages in his personal enterprise up about 15-20 per cent 12 months on 12 months.

However he and others imagine the haulage trade is ready to cope mainly as a result of rising costs for items, mixed with bottlenecks in manufacturing, have taken the sting off demand.

“We’ve averted the worst as a result of sarcastically the financial system slowed down,” stated Day, who stated the amount of products moved by supermarkets had tailed off, though demand in building was nonetheless stable.

Ken Hoexter, an analyst at Financial institution of America, stated shippers within the US had been additionally reporting weaker demand as gas costs soared and producers had much less work to do on rebuilding their inventories, which dropped to low ranges through the pandemic.

Nonetheless, the trade stays fragile. Though hauliers typically move on modifications in gas costs, they face price pressures for different uncooked supplies. The worth of Advert Blue, an anti-pollutant utilized in diesel engines, has quadrupled as a result of its key ingredient is sourced from Russia, stated Day. Small operators caught in drawn-out negotiations with clients may swiftly run into money movement difficulties.

Although the motive force scarcity is much less acute, the trade has not solved endemic issues with recruitment and retention of an ageing workforce.

“We’re within the slower a part of [the] 12 months . . . and we’re working near the sting,” Smith stated, including that situations may worsen as demand picked up through the historically busier summer time months. “It will likely be actually tight . . . We’re not distant from one other scarcity.”