Transferring averages are a few of the easiest technical indicators that merchants can use. It’s principally simply a median of historic costs plotted on the worth chart.

Nonetheless, regardless of its simplicity transferring averages are probably the most broadly used technical indicators. Nearly all merchants would use a transferring common or any of its variations on their value chart. It is because transferring averages are very efficient for figuring out development instructions and buying and selling with the development.

Probably the most underrated approach merchants can use the transferring common is as a dynamic space of help or resistance. In a trending market situation, merchants would usually need to commerce with the development. Nonetheless, the development would by no means transfer consistently in a single course. It might nonetheless oscillate up and down, but it’ll observe the overall course of the development. Worth would transfer with the development, retrace for a bit, then resume the course of the development, and repeat the identical course of time and again.

It’s in one of the best curiosity of a dealer to commerce with the development but search for entries throughout pullbacks or retracements. The query is, the place ought to they anticipate a pullback? Transferring averages or the realm between two transferring averages are an effective way to search for one. Worth would normally retrace again to the mathematical common of value earlier than resuming the course of the development. This causes value to bounce from the realm of the transferring common strains, which makes it a dynamic space of help or resistance.

Triple Exponential Momentum Foreign exchange Buying and selling Technique is a method that’s based mostly on this idea. Nonetheless, as an alternative of buying and selling in a longtime trending market, this technique makes an attempt to commerce on the primary retracement of the brand new development.

TEMA Customized

TEMA Customized is a modified transferring common indicator based mostly on the Exponential Transferring Common (EMA). TEMA merely means Triple Exponential Transferring Common.

TEMA Customized was developed with the intention to present merchants with a customized transferring common line that’s smoothened with the intention to reduce its susceptibility to market noise. It does this by averaging out a number of EMA strains and reducing the lag out of those transferring common strains.

The result’s a transferring common line that’s smoother and fewer inclined to market noise false alerts, but on the identical time may be very responsive to cost motion, which is an inherent attribute of the Exponential Transferring Common.

Superior Oscillator

The Superior Oscillator (AO) is a development following technical indicator which helps merchants determine the overall course of the development.

The AO is principally an oscillator based mostly on the distinction between modified transferring averages. Actually, the AO merely the distinction between the 5-period Easy Transferring Common (SMA) and the 34-period Easy Transferring Common (SMA). Nonetheless, as an alternative of utilizing the shut of the interval as a foundation for the SMA strains, AO makes use of the midpoint of every bar as the idea for the SMA strains. In a approach, the AO is an oscillator model of the basic transferring common crossover.

The AO can be utilized to determine development course bias and development momentum. Constructive histogram bars point out a bullish development bias whereas unfavourable bars point out a bearish development bias.

The colour of the bars additionally modifications relying on the energy of the development. Constructive inexperienced bars point out a strengthening bullish development, whereas optimistic purple bars point out weakening bullish development. Then again, unfavourable purple bars point out a strengthening bearish development, whereas unfavourable inexperienced bars point out a weakening bearish development.

Merchants can use the AO as a development course filter. This implies merchants can use it to keep away from taking trades that aren’t aligned with the present development course.

It may also be used as a development reversal or momentum entry set off. Merchants can both use the shifting of the bars from optimistic to unfavourable as a commerce sign, or they’ll additionally enter trades as the colour of the bars change indicating the course of the development.

Buying and selling Technique

This buying and selling technique is a development reversal technique that trades on the crossover of the TEMA Customized line and the 14-period Exponential Transferring Common (EMA) line. Nonetheless, as an alternative of buying and selling on the precise crossover of the 2 strains, merchants ought to anticipate value to retrace in direction of the realm between the 2 strains and reject the realm. This is able to affirm that value motion is respecting the transferring common strains as a dynamic space of help or resistance for the newly established development.

The Superior Oscillator is used to substantiate the brand new development and the course of the momentum. Merchants ought to solely take purchase commerce setups each time there’s a optimistic inexperienced bar on the AO and promote commerce setups solely when the AO has a unfavourable purple bar.

Indicators:

- Tema_custom

- Exponential Transferring Common

- Superior

Most popular Time Frames: 30-minute, 1-hour and 4-hour charts

Foreign money Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York periods

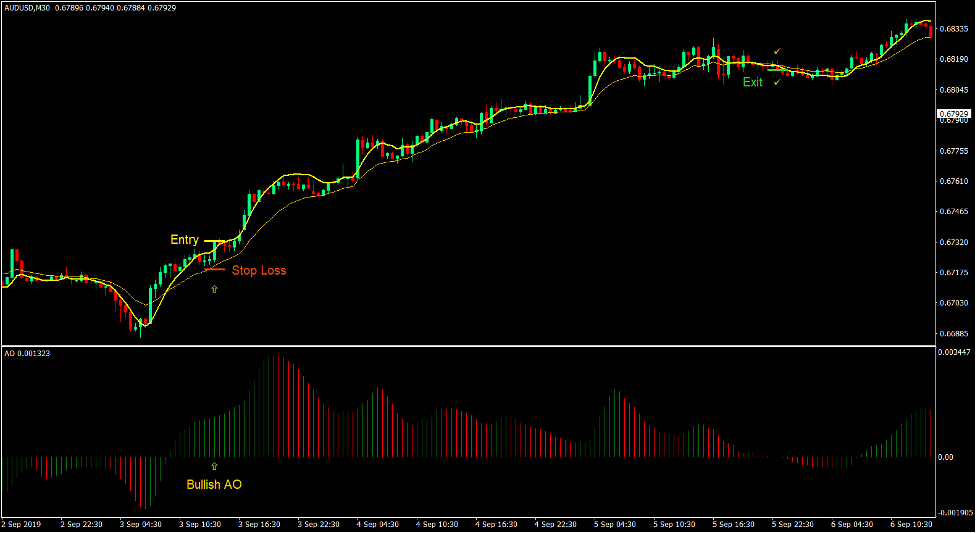

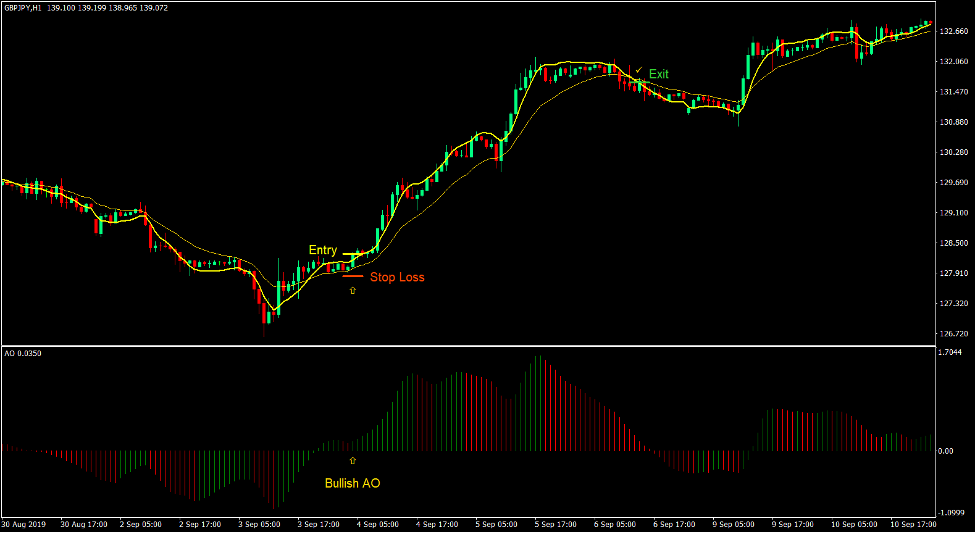

Purchase Commerce Setup

Entry

- The TEMA Customized line ought to cross above the 14 EMA line.

- Worth ought to retrace and reject the realm between the TEMA Customized and 14 EMA strains.

- The AO bar ought to be optimistic inexperienced.

- Enter a purchase order on the affirmation of those situations.

Cease Loss

- Set the cease loss on the help under the entry candle.

Exit

- Shut the commerce as quickly because the TEMA line crosses under the 14 EMA line.

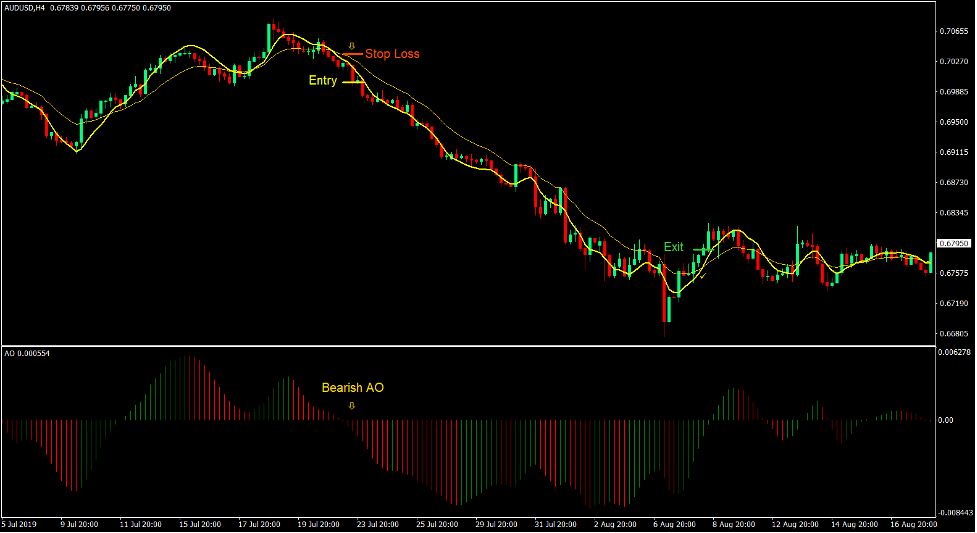

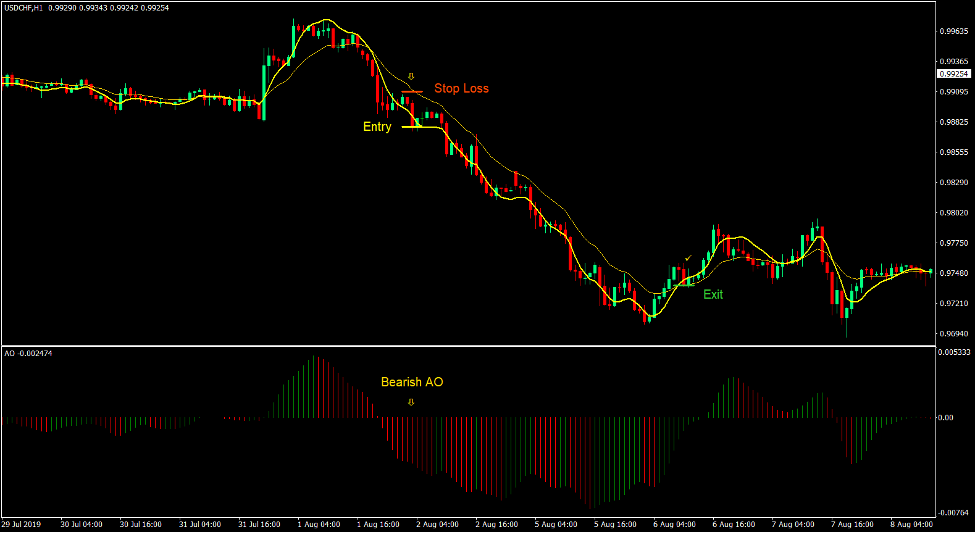

Promote Commerce Setup

Entry

- The TEMA Customized line ought to cross under the 14 EMA line.

- Worth ought to retrace and reject the realm between the TEMA Customized and 14 EMA strains.

- The AO bar ought to be unfavourable purple.

- Enter a promote order on the affirmation of those situations.

Cease Loss

- Set the cease loss on the resistance above the entry candle.

Exit

- Shut the commerce as quickly because the TEMA line crosses above the 14 EMA line.

Conclusion

This buying and selling technique works very properly as a result of it trades on the retracement and rejection on the TEMA Customized and 14 EMA strains. This serves as a affirmation of the dynamic space of help and resistance in addition to a affirmation of value motion based mostly on the swing factors.

The essential talent that merchants ought to develop when buying and selling this technique is in figuring out believable pullbacks or retracements in addition to the rejection of the realm between the 2 strains based mostly on value motion. Merchants who can grasp this talent can revenue from the foreign exchange market utilizing this technique.

Foreign exchange Buying and selling Methods Set up Directions

Triple Exponential Momentum Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the collected historical past knowledge and buying and selling alerts.

Triple Exponential Momentum Foreign exchange Buying and selling Technique supplies a chance to detect numerous peculiarities and patterns in value dynamics that are invisible to the bare eye.

Based mostly on this info, merchants can assume additional value motion and modify this technique accordingly.

Really helpful Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

set up Triple Exponential Momentum Foreign exchange Buying and selling Technique?

- Obtain Triple Exponential Momentum Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 information to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you need to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Triple Exponential Momentum Foreign exchange Buying and selling Technique

- You will notice Triple Exponential Momentum Foreign exchange Buying and selling Technique is on the market in your Chart

*Notice: Not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain: