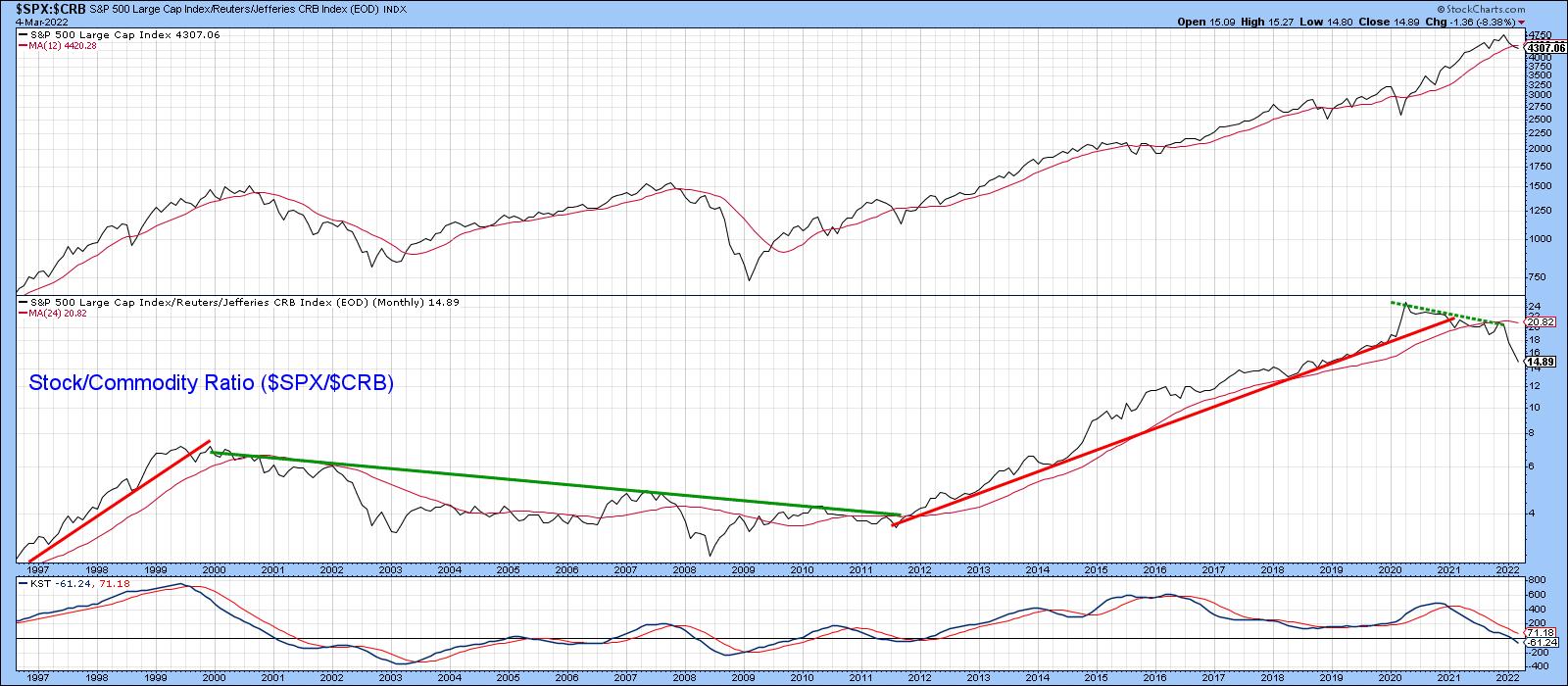

Chart 1 exhibits that, beginning in early 2020, shares started to slowly however quietly underperform commodities. Because the begin of this yr, although, this development has begun to essentially speed up on the draw back, i.e. transferring in favor of commodities. The middle window additionally exhibits that, when a prolonged trendline of this relationship has been violated, an prolonged transfer in the other way usually follows.

The purple trendline relationship from 2011 was violated in early 2021 and has already had a adverse impact on the ratio. Nonetheless, allowing for the size of the penetrated line and the truth that the KST of the ratio has solely simply crossed under zero, it appears doubtless that the development of superior commodity efficiency will prolong a lot additional. Our sign on the contrary would come up if the ratio can transfer above the dashed-green down trendline and 24-month MA. If not, what are the doubtless implications?

Chart 1

Chart 1

Risk of a Secular Bear Marketplace for Shares

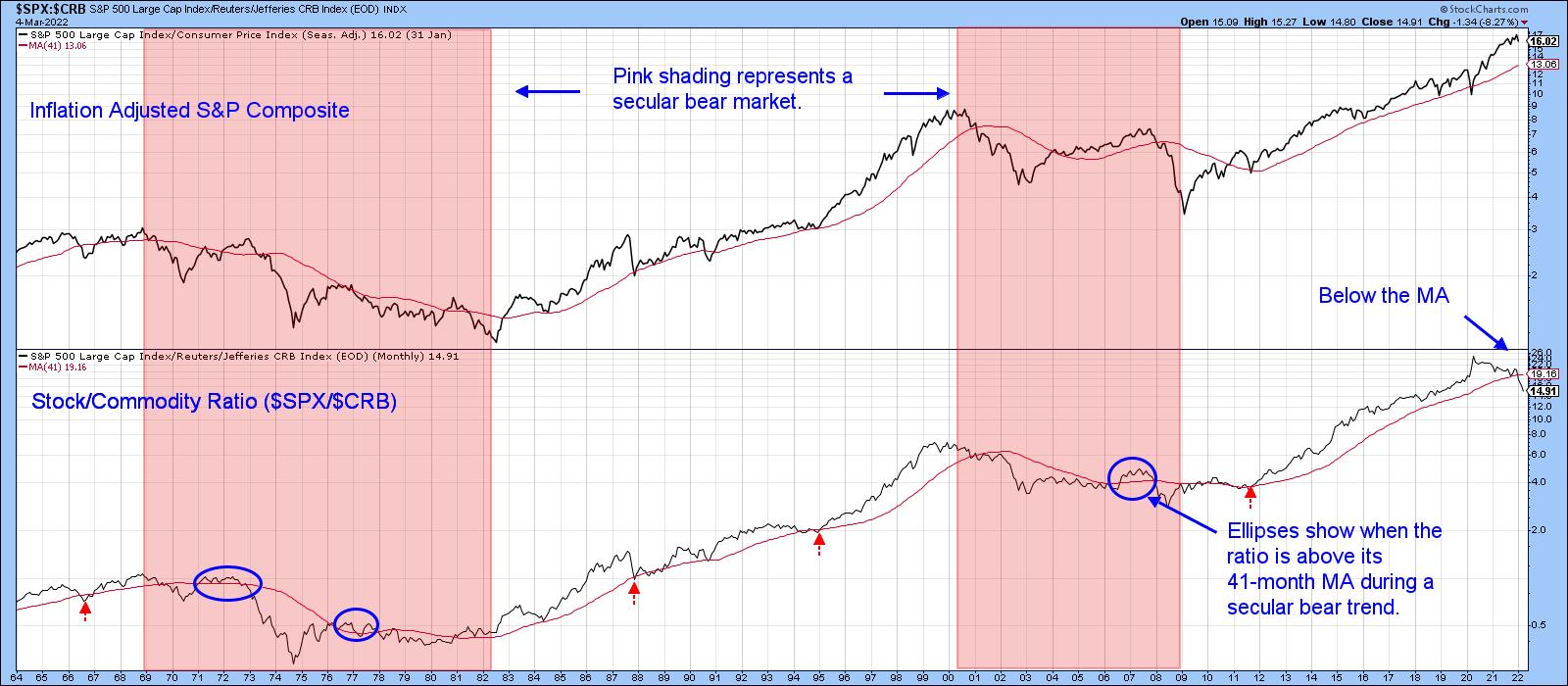

Chart 2 shows the ratio again to 1964, however, this time, compares it to the inflation-adjusted S&P Composite. When contemplating lengthy durations of time, adjusting the fairness index by shopper value inflation is smart. In any case, in case your inventory portfolio rises 10% and inflation is at, say, 12%, the portfolio is definitely shedding buying worth. To me, that is a bearish state of affairs.

Utilizing the advantage of hindsight to determine the precise peaks and troughs, the pink shadings flag the 2 secular bear markets which have developed within the final 60 years or so. Each largely occurred when the inventory/commodity ratio was buying and selling under its 41-month MA, though the ellipses point out these comparatively temporary durations when it was not. By the identical token, secular bull markets not often, if ever, noticed the ratio drop under its MA. If that occurred, it was often a one-month whipsaw. These deceptive breaks have been flagged by the small-dashed arrows. It’s also true to say that neither secular bull skilled as decisive a MA crossover because the one which has already taken place. The implication is {that a} secular bear might be underway.

That mentioned, it is essential to notice that this crossover represents simply one piece of proof. We want extra. Additionally, the ratio did cross marginally under its MA on the finish of January. Nonetheless, the most recent, extra decisive, plot is simply primarily based on 4 buying and selling days in March. With the intention to make it official, we’d like end-of-month information. I’m actually exhibiting the chart to level out that this relationship could be very near triggering a significant long-term sign, indicating the general setting could have develop into extra like 1965-1982 or 2000-2009, versus 2009-2021. For inventory market traders, inflation, as I emphasised in my 2022 outlook, will very a lot matter because the yr unfolds.

Chart 2

Chart 2

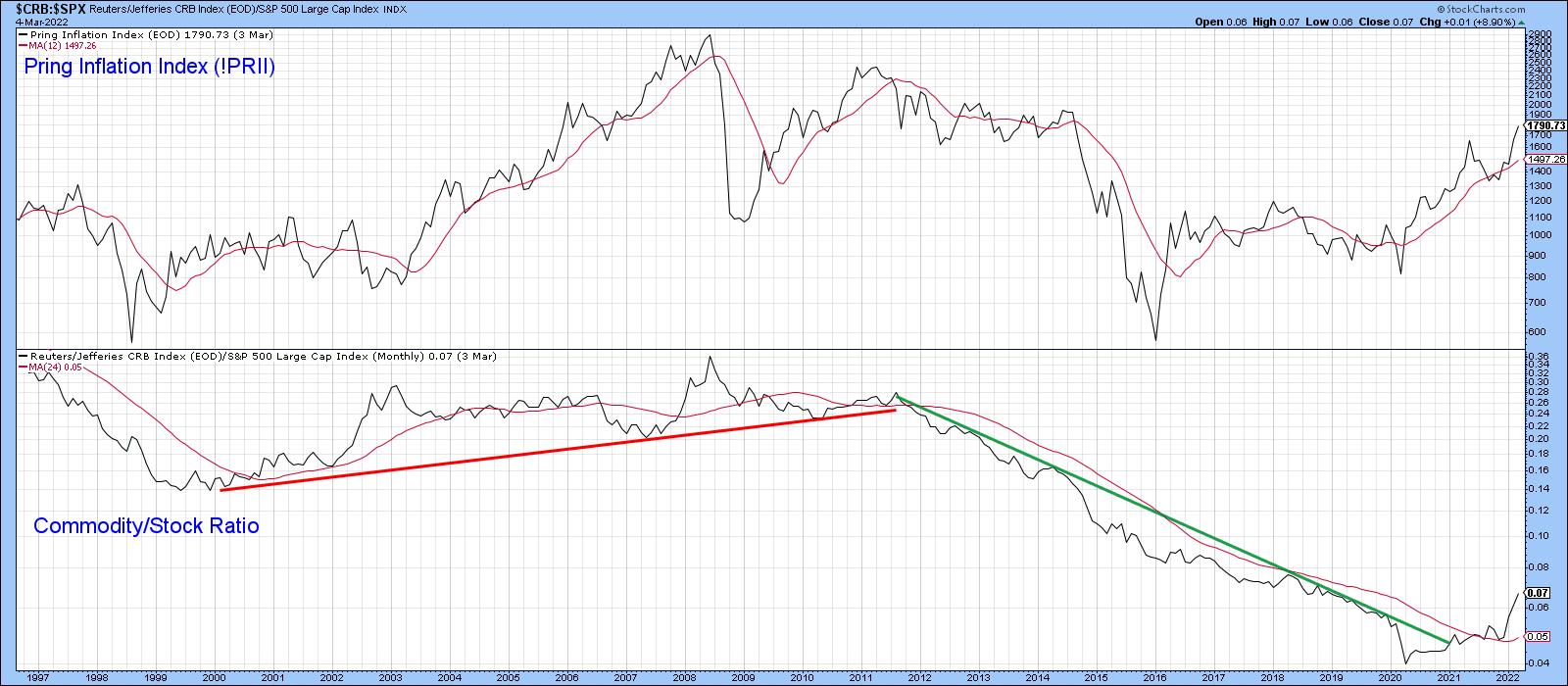

Inflation-Delicate Shares Prone to Outperform on a Lengthy-Time period Foundation

My Inflation Index, which you’ll examine right here, contains a number of S&P trade teams that reply positively to inflationary situations. For example, mining and power shares. The Index is featured in Chart 3, alongside the Commodity/Inventory ratio. Be aware that I’ve switched the elements from the 2 earlier charts to be able to mirror inflationary (up) and deflationary (down) tendencies. There’s a tough correlation between the 2 sequence, however, because the shares included within the Inflation Index are topic to swings within the inventory market, there are some occasional evident variations between them. For instance, the Index bottomed in early 2016, whereas the ratio hit its low level in early 2020.

Chart 3

Chart 3

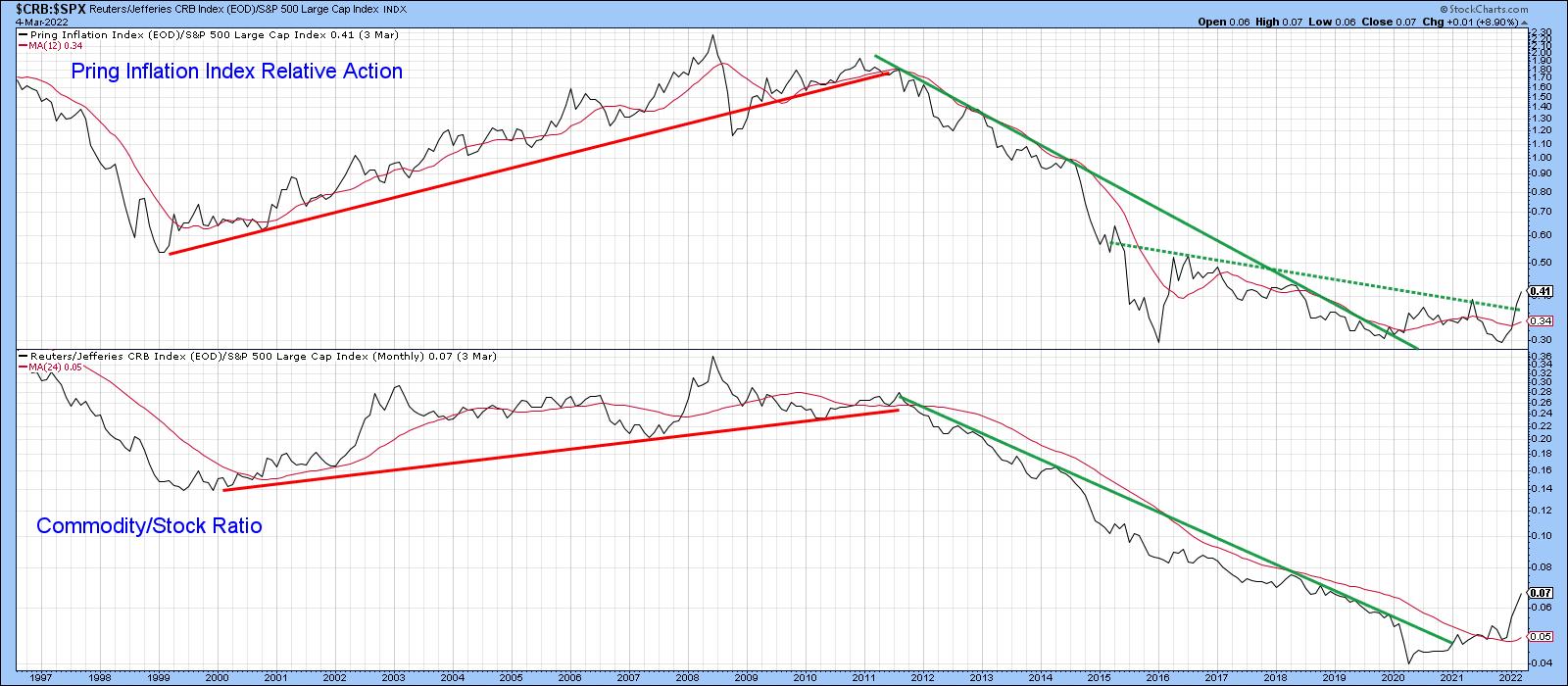

Quick ahead to Chart 4, which compares the relative motion of the Index to the S&P, and you’ll see that there’s a a lot nearer relationship. If I’m proper in regards to the change in development between the inventory/commodity or commodity/inventory relationship, then the implication could be for a long-term superior relative efficiency by these inflation-sensitive shares.

Chart 4

Chart 4

Larger Oil Costs are Doubtless Over the Lengthy Time period

There isn’t a doubt that the oil value is overstretched on a short- and intermediate-term foundation and, subsequently, topic to an sudden shakeout at any time. Nonetheless, Chart 5 exhibits that it has damaged out on each an absolute and relative foundation in opposition to the S&P.

Chart 5

Chart 5

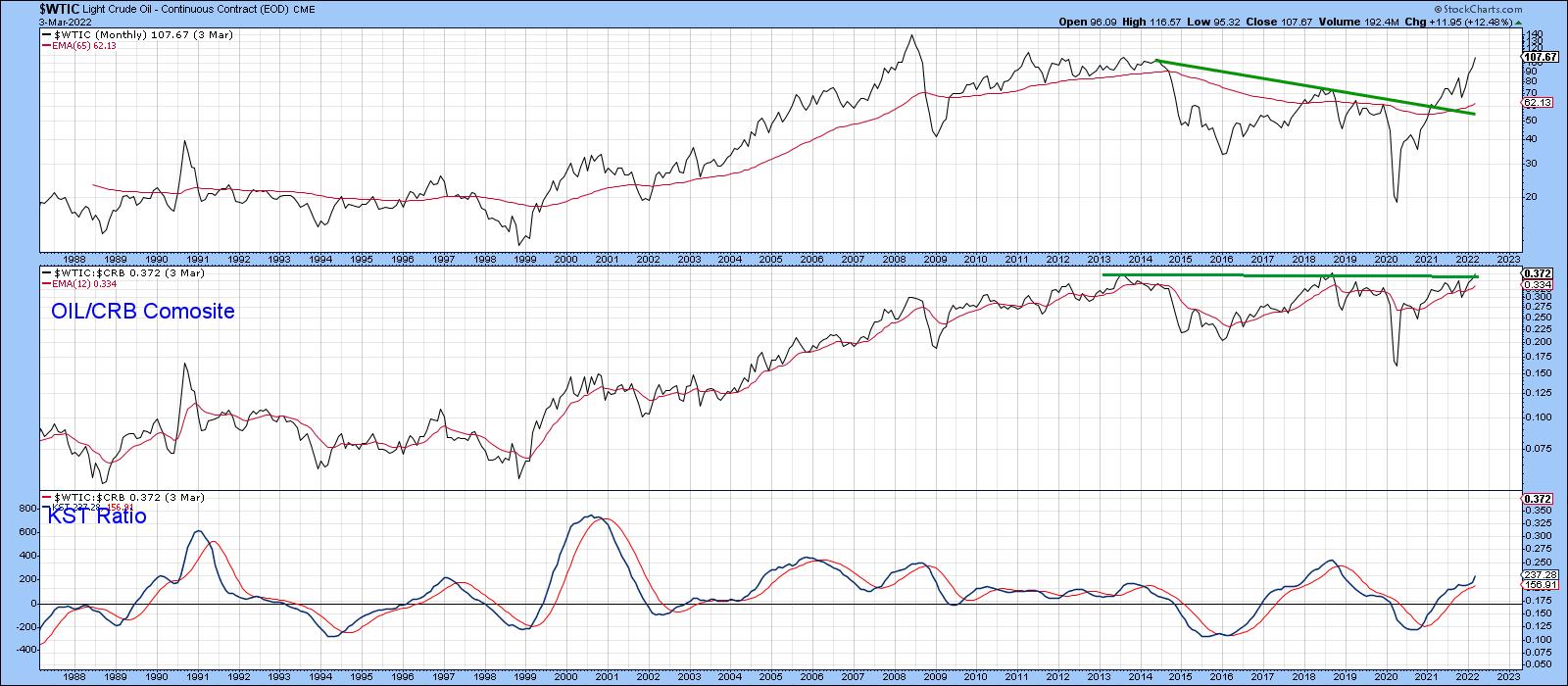

Lastly, Chart 6 tells us within the second panel that oil is on the verge of breaking out in a relative sense in opposition to the CRB Composite. It is already tentatively above the 2013-2022 resistance trendline. Once more, although, it is essential to notice that it is a month-to-month line chart; the official shut is not going to be recognized till March 31.

Chart 6

Chart 6

This text is an up to date model of an article beforehand revealed on Wednesday, March 2nd at 6:19pm ET within the member-exclusive weblog Martin Pring’s Market Roundup.

Good luck and good charting,

Martin J. Pring

The views expressed on this article are these of the writer and don’t essentially mirror the place or opinion of Pring Turner Capital Group of Walnut Creek or its associates.

Martin Pring is without doubt one of the most outstanding names within the trade. A grasp technical analyst and educator extraordinaire, he’s the award-winning writer of quite a few books on Technical Evaluation, together with Introduction to Technical Evaluation and Technical Evaluation Defined. The latter is now utilized by a number of worldwide technical societies for coaching and for a number of a long time was one of many three core books for Stage 1 CMT certification with the Market Technicians Affiliation. Translated into over 7 languages, the ebook is, as quoted by Forbes, “broadly considered the usual work for this era of chartists”.

Study Extra