SPX Monitoring Functions: Lengthy SPX on 3/25/22 at 4543.06.

Monitoring Functions GOLD: Lengthy GDX on 10/9/20 at 40.78.

Lengthy Time period SPX Monitor Functions: Impartial.

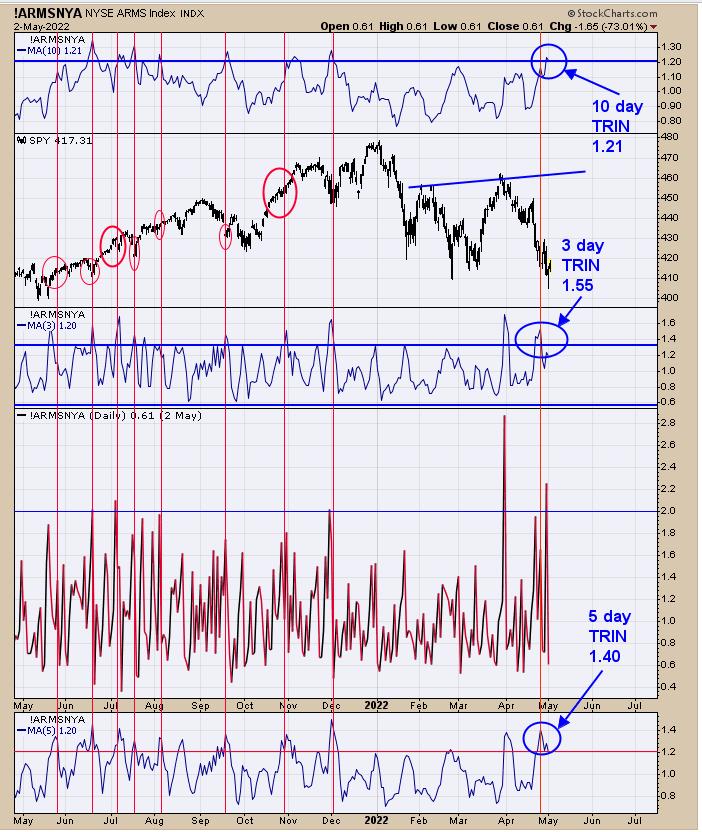

The above chart exhibits the TRIN with a 5-day common (backside window), a 3-day common (center window) and the 10-day common (high window). The pink vertical exhibits the instances when 3-, 5- and 10-day common of the TRIN reached bullish ranges. Every time, the market was both at a backside or within the means of a rally. The ten-day TRIN simply ticked to a bullish stage on Friday with a studying above 1.20. Bought panic in lots of completely different indicators beginning on April 26, and panic are what bottoms are fabricated from. Must see a “Signal of Power” of this low to maintain bigger development bullish.

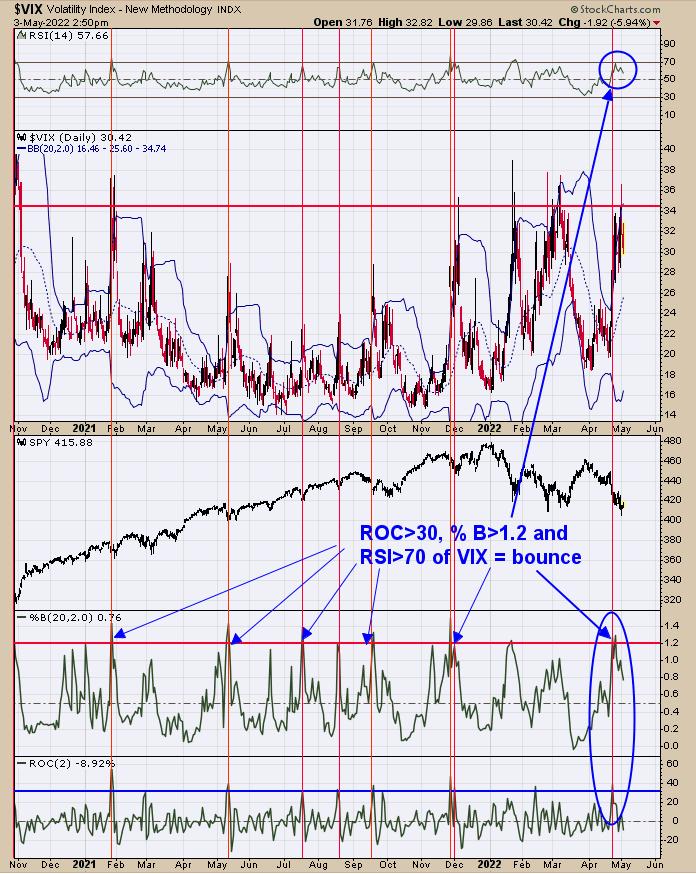

Panic types at lows out there and lots of panic began to from beginning April 26. The second window down from the highest is the day by day VIX. The highest window is the RSI for the VIX. RSI readings for the VIX >70 suggests a big acceleration of the VIX, which is a type of panic, and the RSI hit the 70 vary on 4/26. The underside window is the Charge of Change for the VIX; readings above 30 additionally exhibits an acceleration of the VIX, and the 30 vary was hit on 4/26. The subsequent window larger is the P.c Bollinger Band, which exhibits readings above 1.00 when VIX hits its higher Bollinger Band; readings above 1.20 implies VIX hast gone as much as quick and will normalize again to .5 or decrease. P.c B traded above 1.20 additionally on 4/26. Its pretty uncommon to get all three indicators to excessive ranges (occurs each 3 months or longer). The final time got here with the early December 2021 low, almost 5 months in the past.

We up to date this chart from previous stories, which is the month-to-month Inflation/Deflation ratio. We identified earlier this 12 months that the month-to-month Bollinger bands are pinching on this ratio, suggesting a big transfer is nearing. Since then, the month-to-month Bollinger Bands are simply beginning to develop, suggesting this massive transfer is starting. Discover additionally that the ratio has closed above its development line, connecting the excessive going again to 2016, which is a breakout. The highest window is the RSI for this ratio, which is above 50, exhibiting this ratio is in an uptrend. One other bullish issue is that the ratio is above its mid-monthly Bollinger Band. The month-to-month chart stays bullish and, in line with the research on this web page, the rally is within the early levels of a bullish transfer.

Tim Ord,

Editor

www.ord-oracle.com. New E book launch “The Secret Science of Worth and Quantity” by Timothy Ord, purchase at www.Amazon.com.

Indicators are supplied as normal data solely and are usually not funding suggestions. You’re answerable for your personal funding choices. Previous efficiency doesn’t assure future efficiency. Opinions are based mostly on historic analysis and knowledge believed dependable, there is no such thing as a assure outcomes shall be worthwhile. Not answerable for errors or omissions. I could spend money on the automobiles talked about above.