SPX Monitoring Functions: Offered Lengthy 3/3/22 at 4363.49 =3.27% acquire; Lengthy SPX on 2/23/22 at 4225.50.

Monitoring Functions GOLD: Lengthy GDX on 10/9/20 at 40.78.

Lengthy Time period SPX Monitor Functions: Impartial.

SPY was been up 5 of the final six days and the one down day was minimal, which is a Bullish signal. For the very quick time period, the market is prolonged. The second window down from the highest is the VVIX/VIX ratio and the highest window is the RSI for this ratio. When the RSI of this ratio reaches >70 (present studying is 72.80), the market is often due for a relaxation. The crimson vertical traces present the instances when the RSI reached above +70. Ideally, we wish to see the TRIN and TICK attain panic ranges to arrange the subsequent bullish sign.

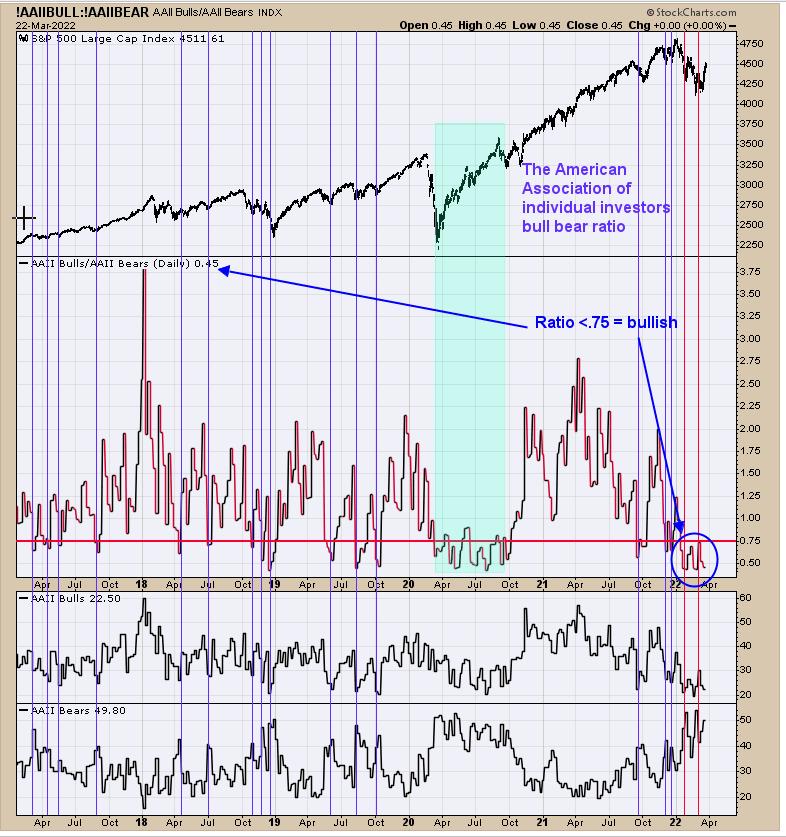

Above is The American Affiliation of Particular person Traders Bull/Bear Ratio. Intermediate-term lows have fashioned when this ratio closed under .75 (present studying is .45). Although the market has rallied over every week from the low, the ratio stays all-time low, suggesting traders are usually not believing the rally, which, in flip, is a bullish signal.

Yesterday, we posted a long-term view of the month-to-month XAU/Gold ratio (which was bullish). In the present day, we’re exhibiting one other long-term view of the Gold market, which is the month-to-month Inflation/Deflation ratio. Bullish uptrends happen within the XAU when the month-to-month Inflation/Deflation ratio RSI is above 50. The highest window is the RSI for this ratio and the blue half exhibits the instances when RSI is above 50. The blue vertical traces present when the RSI crossed above 50; the crimson vertical traces present when RSI fell under 50. The present bullish sign got here when RSI crossed above 50 in early 2020. We even have the Bollinger Band on the Inflation/Deflation ratio; the underside window exhibits that the Bollinger Bands on this ratio could be very slender, suggesting there might be an acceleration within the Inflation/Deflation ratio coming quickly. Its laborious to see on the chart, however the ratio has closed above its pattern line drawn on the chart, which provides to the bullish image.

Tim Ord,

Editor

www.ord-oracle.com. New E-book launch “The Secret Science of Value and Quantity” by Timothy Ord, purchase at www.Amazon.com.