SPX Monitoring Functions: Coated 1/24/22 open 4356.32=7.57%; Brief SPX 1/11/22 at 4713.07.

Monitoring Functions GOLD: Lengthy GDX on 10/9/20 at 40.78.

Lengthy Time period SPX Monitor Functions: Impartial.

Panic kinds at bottoms of markets. TRIN (together with VIX and TICKS) helps to outline when panic arrives. The market has been down an honest quantity over the past month and the 10-day TRIN, which helps to outline the larger timeframes the place panic is current. Intermediate-term lows kind when the 10-day common of the TRIN reaches above 1.20; the present studying stands at 1.00. The market could also be near a low, however, in response to the 10-day TRIN, panic has not reached ranges the place a worthwhile low has fashioned. This situation can change rapidly if TRIN rises within the subsequent few days. Being affected person for now.

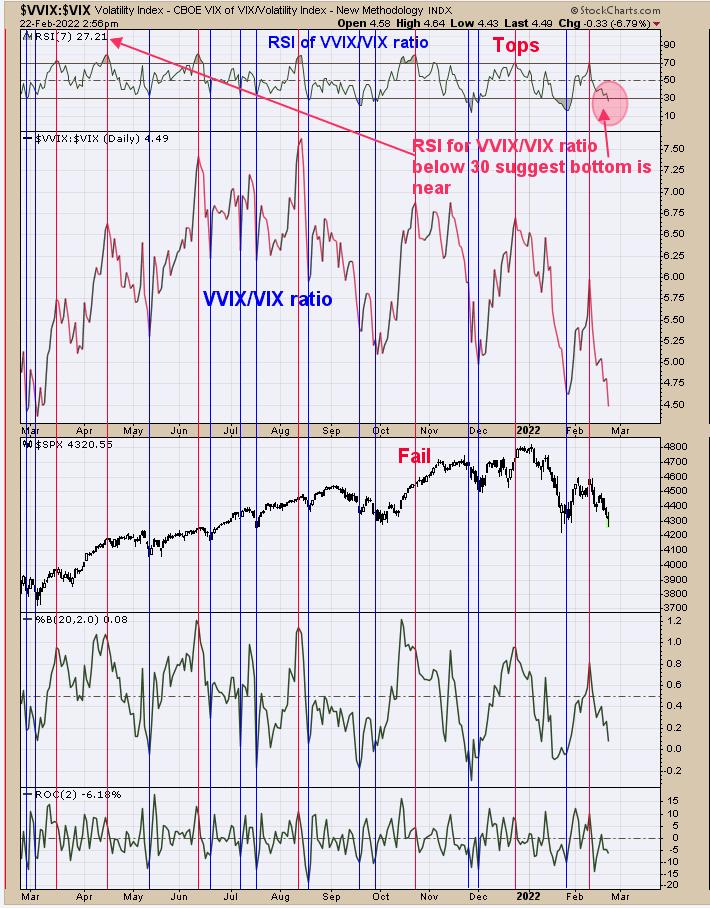

The highest window is the RSI for the VVIX/VIX ratio (which is the subsequent window down). RSI readings under 30 for this ratio recommend a backside is nearing. Proper now, the RSI is 27.21, however may fall additional under 30 earlier than the underside is in. The crimson vertical traces present the instances when the RSI of this ratio is above 70, suggesting a short-term high and the blue vertical traces exhibits the instances when RSI was under 30, suggesting a backside is close to. VVIX/VIX RSI readings is an indicator that helps to outline greed and worry.

Above is the month-to-month gold chart going again to mid-1981. We’ve proven this chart previously; it is now up to date to present knowledge. We’ve labeled the 16- and 8-year cycles on this chart. Each cycles backside in 2016. The 8-year cycle is because of backside on the finish of 2023 or early 2024, so there’s loads of time for the gold market rally. The highest window is the month-to-month RSI for gold, which is closed at 60.53. RSI readings above 50 present the gold market is in a bull section and under 50 a bear section. RSI has been above 50 since late 2018. From the low in 2001 to a excessive in 2011, gold retraced 50% of that rally going right into a low in 2016. A 50% retracement of a earlier rally marks the midway level of the transfer up, which might give a goal close to 2700 for Gold. Counting the low in 2016, the “Head” (1100 vary) and the “Left Shoulder” being 2011 consolidation and the “Proper Shoulder” ending up now would put the “Neckline” close to 2000 on gold. The distinction from the underside of “Head” to the “Neckline” is 900 factors; including that to the Neckline would give a goal close to 2900 for Gold. Must be much more enjoyable within the gold market within the coming months than it was previously 1.5 years.

Tim Ord,

Editor

www.ord-oracle.com. New E book launch “The Secret Science of Value and Quantity” by Timothy Ord, purchase at www.Amazon.com.