SPX Monitoring Functions: Lengthy SPX on 3/25/22 at 4543.06.

Monitoring Functions GOLD: Lengthy GDX on 10/9/20 at 40.78.

Lengthy-Time period SPX Monitor Functions: Impartial.

Subsequent week is choices expiration week and, throughout the week earlier than (a.okay.a. this week), whipsaws are frequent. Certainly, the “Whipsaw” could also be in progress now. Final Thursday, we had a 2-day TRIN that averaged 2.02. Flip your consideration to the second window up from the underside, which is the 2-day TRIN. Two-day averages of two.00 and better (famous with purple vertical strains) all have produced backside that went on to make new quick time period highs. There might be checks of the 2-day TRIN lows and back-and-filling, however market reversals again to the upside is the norm. This time might be totally different, however April must be an up month. As we speak, the TICK closed at -604; normally, the following day is up when TICK closes beneath -300.

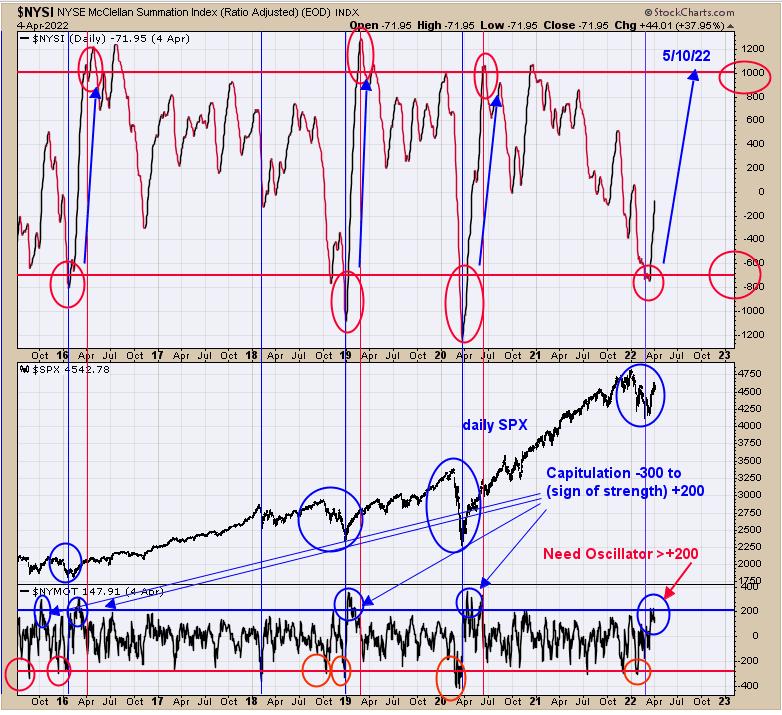

We up to date this chart, which was posted in a latest report. The highest window is the NYSE McClellan Summation index. Climatic bottoms happen when the Summation index falls beneath -700, which a reasonably uncommon prevalence and occurred solely 3 times going again to 2016. When an oversold situation beneath -700 happens, a rebound is anticipated, which usually takes the Summation again to above +1000, normally taking round two months. If the present scenario performs out like prior to now (gong again to 2016), then the Summation index might attain +1000 round Might 10. We did have a “Signal of Power” within the NYSE McClellan Oscillator, which traveled from -300 (climatic) to +200 (signal of energy) on the latest backside. We identified the earlier occasions that occurred when the Summation index fell beneath -700. The market seems to have sufficient energy to push increased into Might.

The second window down from the highest is the Inflation/Deflation ratio. When this ratio is rising, it is a bullish signal for gold and gold shares; when declining, it’s a bearish signal. Proper now, this ratio is testing Might 2020 and never backing away from that top, suggesting this ratio is “consuming via” provide and, as soon as provide is exhausted, ought to transfer increased, taking gold and gold shares with it. The following window down is the XAU (which is dwelling to extra of the high-tier main gold inventory) and it, too, is at its earlier excessive and never backing away, constructing “Trigger” (power) to push via resistance. Discover that GDX is just not at its earlier excessive (which is dwelling to lesser-tier shares), displaying that the higher-tier shares are main the best way increased. This occurs early within the bull section of the rally. When the lesser-tier shares are main the best way (that means hypothesis), its getting late within the bull section. The sideways consolidation in GDX and XAU has been happening for almost a month; time is about up for the consolidation to finish and the Impulse wave to start out. A clue that the impulse wave has began shall be when the ratio breaks to new highs.

Tim Ord,

Editor

www.ord-oracle.com. New Ebook launch “The Secret Science of Worth and Quantity” by Timothy Ord, purchase at www.Amazon.com.

Alerts are offered as common info solely and will not be funding suggestions. You’re answerable for your individual funding choices. Previous efficiency doesn’t assure future efficiency. Opinions are primarily based on historic analysis and knowledge believed dependable, there isn’t a assure outcomes shall be worthwhile. Not answerable for errors or omissions. I could put money into the automobiles talked about above.