“Don’t chase value!” That is most likely one of the vital in style mantras of many merchants. Nonetheless, many momentum merchants are responsible of doing this many times. Actually, that is most likely ingrained of their buying and selling methods. Some momentum methods have buying and selling plans that’s prone to chasing value.

On the flip aspect, commerce setups that would probably trigger momentum merchants to lose cash may additionally imply earnings for contrarians. These are merchants who search for reversals every time they see that the market is overextended in a sure course.

Contrarians are the precise reverse of momentum merchants. Whereas momentum merchants commerce within the course of a powerful momentum, contrarians attempt to anticipate reversals coming from an overextended development or momentum.

Buying and selling in opposition to the development is counter intuitive. Actually, additionally it is thought-about equally dangerous as a result of merchants are likely to attempt to choose tops and bottoms, that are very tough to anticipate.

Nonetheless, regardless of the dangers, many merchants have additionally made big earnings buying and selling counter traits. It’s because at instances, if picked on the proper time, reversals may end in big yields coming from a single commerce.

TDI Plus Reversal Foreign exchange Buying and selling Technique is a reversal buying and selling technique that trades in opposition to an overextended development or momentum. It systematically identifies overextended costs and confirms reversals primarily based on two technical indicators.

TDI Plus

TDI Plus is a modified model of the Dealer’s Dynamic Index (TDI).

It’s a versatile technical indicator which might present plenty of info by itself. It supplies info concerning development course and development reversals, in addition to overbought or oversold market situations.

TDI Plus is an oscillator that mixes the Relative Energy Index and Bollinger Bands into one indicator. It’s composed of 5 strains which offer completely different info.

The inexperienced line is the RSI line. It’s a modified RSI line adjusted to suit the vary of the TDI Plus indicator. It’s paired with a sign line, which is the crimson line. The sign line is mainly a transferring common derived from the RSI line. Quick-term development reversals or momentum might be derived primarily based on the crossing over of the RSI line and the sign line.

TDI Plus additionally has a Bollinger Band included. The midline of the Bollinger Band, which is the yellow line, is a transferring common line derived from the RSI. The outer strains, coloured aqua, are normal deviations derived from the midline.

Having the RSI line above the yellow line signifies a bullish development bias, whereas having the RSI line bellow the yellow signifies a bearish development bias.

Development reversal alerts primarily based on the RSI line and the sign line, occurring whereas value is reversing from an overextended situation primarily based on the outer strains of the Bollinger Bands tends to have larger possibilities.

Heiken Ashi Candlesticks

Heiken Ashi in Japanese actually means “common bars”. That is mainly what Heiken Ashi Candlesticks are.

Heiken Ashi Candlesticks is a technical indicator developed to current value charting in a distinct method. It modifies the fundamental Japanese candlesticks as a way to point out the short-term development a lot clearly primarily based on the typical value.

Common Japanese candlesticks plot the excessive, low, open and shut of value as is. This provides merchants an thought concerning the conduct of the market primarily based on how the market reacted to cost actions.

Heiken Ashi Candlesticks alternatively makes use of the identical excessive and low, but it modifies the open and shut of the candle primarily based on the typical historic costs. This creates a smoothened-out chart with candles that change coloration solely when the short-term development reverses. It nonetheless retains the identical highs and lows of the candle, which could be very helpful for figuring out value motion swings.

Buying and selling Technique

This buying and selling technique is a reversal technique primarily based on the TDI Plus indicator.

To commerce this technique, we should always await value to be both overbought or oversold primarily based on the RSI line of the TDI Plus indicator going outdoors of its Bollinger Bands. We then await value to reverse which ought to trigger the RSI line and its sign line to crossover hooking again to the Bollinger Bands.

The situations above ought to coincide with the Heiken Ashi Candlesticks to alter coloration. If this confluence happens, we then place a cease entry order on the excessive or low of the Heiken Ashi Candlestick. Value breaking the excessive or low of the Heiken Ashi Candlestick ought to affirm the reversal, which must also set off our commerce entries.

Indicators:

- Heiken Ashi

- !btmm_TDI_Plus

Most well-liked Time Frames: 15-minute, 30-minute, 1-hour and 4-hour charts

Foreign money Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York periods

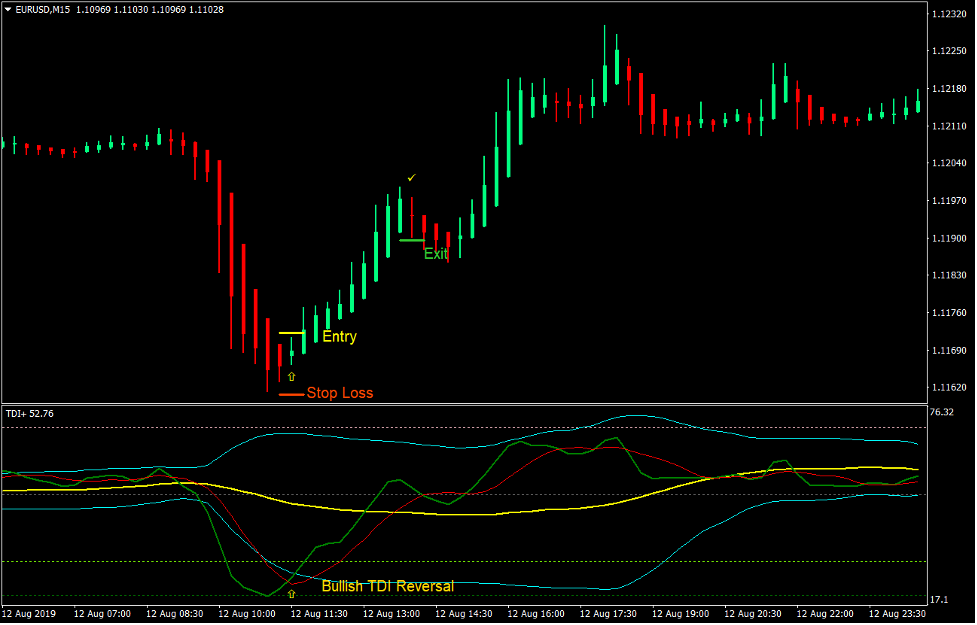

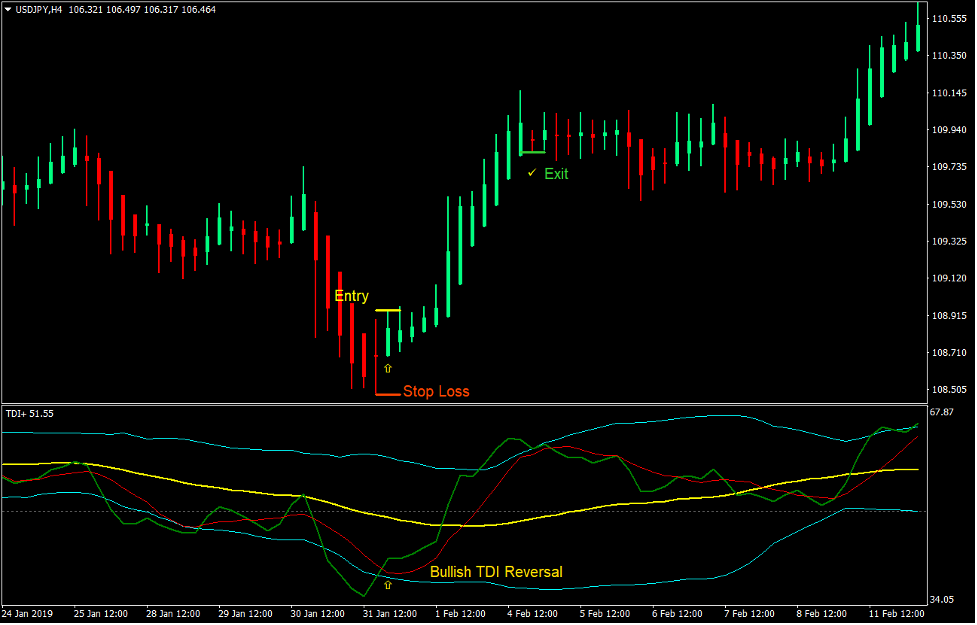

Purchase Commerce Setup

Entry

- The RSI line of the TDI Plus indicator needs to be under the decrease outer line of the Bollinger Bands.

- The RSI line ought to cross above the sign line.

- The Heiken Ashi Candlestick ought to change to spring inexperienced.

- Place a purchase cease order on the excessive of the Heiken Ashi Candlestick.

Cease Loss

- Set the cease loss on the fractal under the entry candle.

Exit

- Path the cease loss two candlesticks behind till stopped out in revenue.

- Shut the commerce as quickly because the Heiken Ashi Candlestick modifications to crimson.

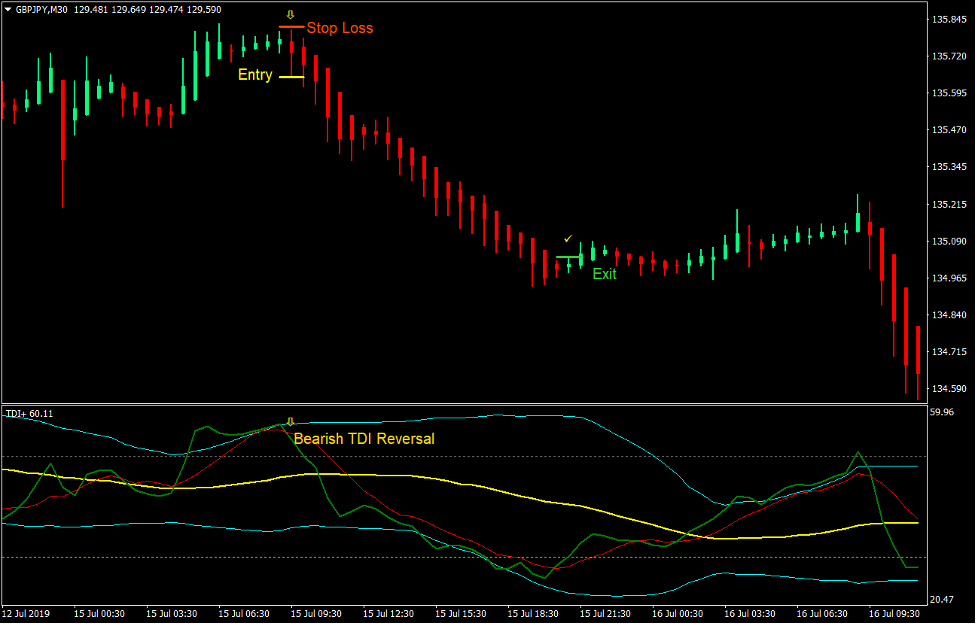

Promote Commerce Setup

Entry

- The RSI line of the TDI Plus indicator needs to be above the higher outer line of the Bollinger Bands.

- The RSI line ought to cross under the sign line.

- The Heiken Ashi Candlestick ought to change to crimson.

- Place a promote cease order on the low of the Heiken Ashi Candlestick.

Cease Loss

- Set the cease loss on the fractal above the entry candle.

Exit

- Path the cease loss two candlesticks behind till stopped out in revenue.

- Shut the commerce as quickly because the Heiken Ashi Candlestick modifications to spring inexperienced.

Conclusion

Buying and selling reversals coming from a powerful momentum is a really tough kind of buying and selling technique. Nonetheless, there are a lot of merchants who’ve efficiently traded this manner, making 1000’s of {dollars} every single day. It’s because buying and selling such reversals often imply having a excessive yield potential.

Nonetheless, additionally it is responsible of attempting to catch tops and bottoms, which is a really tough job. It takes plenty of apply buying and selling this manner and a really feel for the way the market strikes.

Foreign exchange Buying and selling Methods Set up Directions

TDI Plus Reversal Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the gathered historical past knowledge and buying and selling alerts.

TDI Plus Reversal Foreign exchange Buying and selling Technique supplies a chance to detect numerous peculiarities and patterns in value dynamics that are invisible to the bare eye.

Primarily based on this info, merchants can assume additional value motion and regulate this technique accordingly.

Beneficial Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

set up TDI Plus Reversal Foreign exchange Buying and selling Technique?

- Obtain TDI Plus Reversal Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 information to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you need to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick TDI Plus Reversal Foreign exchange Buying and selling Technique

- You will notice TDI Plus Reversal Foreign exchange Buying and selling Technique is on the market in your Chart

*Observe: Not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain: