Wish to spruce up your house? You’re not alone. Greater than one-third of People are planning to rework their properties throughout the subsequent 5 years. Should you’re like most People, your home is one among your greatest bills, and it’s necessary to maintain it updated and in good situation. However not all house enchancment tasks add important worth to your house. Preserve studying to search out out which tasks supply probably the most bang to your buck and which to keep away from in the event you plan to promote quickly. Then uncover the tasks that may enable you to lower your expenses in your taxes.

Promoting quickly?

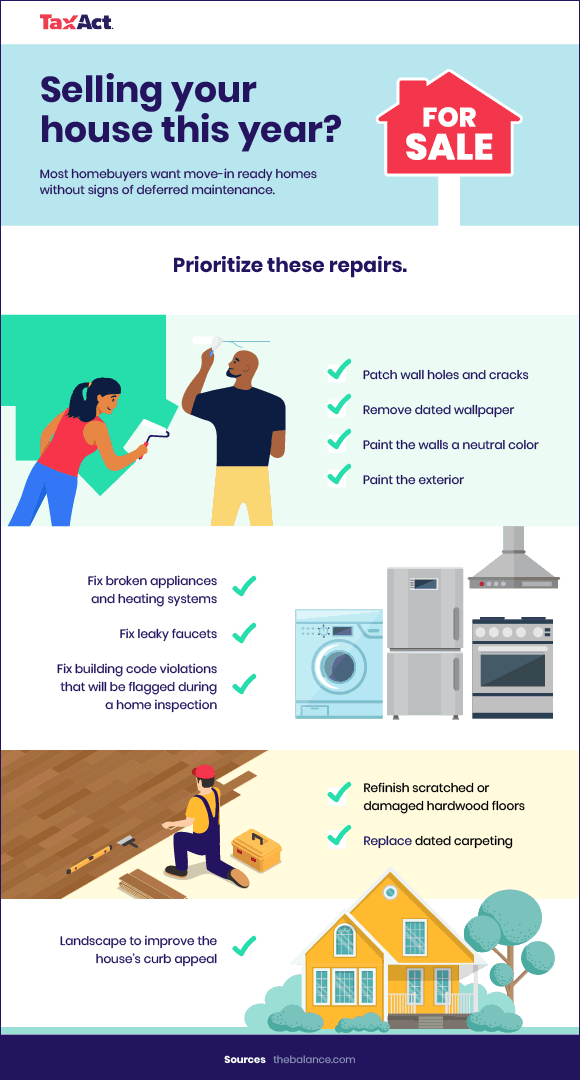

You could be weighing whether or not it’s extra advantageous to renovate your home or promote it as is. Most homebuyers need move-in-ready properties and can pay considerably much less for fixer-uppers. Furthermore, some lenders received’t mortgage cash for homes in poor situation.

It’s normally a good suggestion to do non-cosmetic repairs, akin to changing a worn-out roof, patching holes and cracks, portray the inside and exterior, fixing damaged home equipment or heating methods, repairing damaged taps or pipes, and fixing building-code violations that will probably be flagged throughout an inspection. It might even be worthwhile to take away outdated wallpaper and paneling, substitute dated carpeting, refinish broken hardwood flooring, and do fundamental landscaping to enhance the home’s curb enchantment.

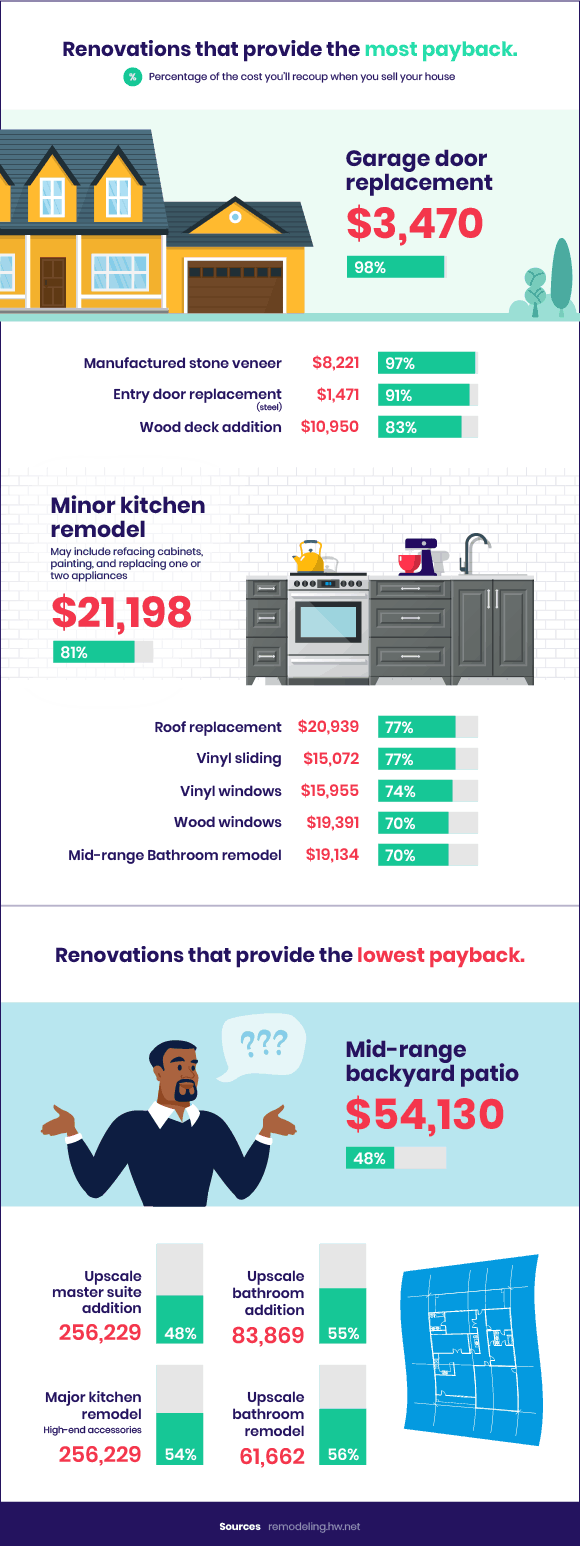

Extra in depth renovations in all probability received’t repay in the event you’re promoting quickly. Householders hardly ever get a dollar-for-dollar enhance in market worth for main enhancements. For instance, in the event you add a $123,000 main bedroom to your home, you’ll recoup solely about $70,000 on the resale worth of your house, in keeping with Reworking Journal. For a mid-range kitchen rework, you’ll recoup about 57 p.c of the fee, and for a mid-range tub rework, you’ll recoup about 70 p.c of the fee.

Discuss to an area realtor earlier than you do any renovations. She or he will help you perceive what homebuyers count on in your space. Additionally, tour related homes on the market in your neighborhood and word the situation and facilities. Should you decide your home wants enhancements earlier than you put up for sale, deal with renovations that present probably the most payback. Basically, costly, high-end enhancements repay the least.

Staying put for 5 years or longer?

It is sensible to remain in your home and renovate in the event you love your neighborhood or faculties. Whereas it’s a good suggestion to maintain your house’s resale worth in thoughts regardless of while you plan to promote, you’ll be able to put your loved ones’s high quality of life entrance and middle in the event you plan to remain for some time.

What bothers you most about your home? Damaged cupboards, outdated home equipment, a dated rest room, a cool structure? That’s what you need to enhance first. In 2021, house enchancment spending was on the rise, with householders rising their spending by 25 p.c yr over yr. The hottest remodels have been:

- Inside portray

- Rest room remodels

- Landscaping

- Good house system set up

- Flooring

Should you’re over the age of 75 or reside with an getting old relative, it might be time to enhance your home for ease of dwelling. Forty-six p.c of householders renovate their properties in anticipation of getting older.

Fashionable tasks for older householders embrace:

- Including pull-out cabinets to kitchen cupboards

- Altering doorknobs to lever handles

- Putting in sensible thermostats

- Putting in sensible blinds and drapes

- Putting in sensible lighting

- Changing decrease kitchen cupboards with drawers

Get monetary savings in your taxes

Most house enhancements aren’t tax-deductible as a result of they’re thought-about private bills. However sure renovations might enable you to lower your expenses on taxes in the event that they fall into the next classes.

1. Renovations of a house workplace

Are you self-employed and work from home? In that case, you’ll be able to deduct one hundred pc of the price of enhancements you make to your house workplace. For instance, in the event you substitute the home windows in your workplace, you’ll be able to deduct your complete value of provides and labor as an workplace expense, offered you meet the house workplace deduction necessities.

You may additionally be capable of deduct a share of whole-house repairs. To determine how a lot you’ll be able to deduct, divide the sq. footage of your home by the sq. footage of your workplace. For instance, if your home is 1,000 sq. toes and your workplace is 100 sq. toes, you might deduct 10 p.c of the price of whole-house repairs. Meaning in the event you painted your complete house at a price of $500, you might deduct $50 as an workplace expense.

As of 2022, solely self-employed employees can deduct home-office bills. Should you work for an employer and have a house workplace, you’re not eligible to deduct out-of-pocket bills for working from house.

2. Photo voltaic panels

In case your roof faces south, east, or west and will get not less than 5 hours of sunshine a day, it might be value outfitting your home with photo voltaic electrical energy — particularly as a result of the federal authorities presents a beneficiant tax incentive. For photo voltaic methods put in in 2020-2022, the IRS will provide you with a tax credit score for 26 p.c of the price of the undertaking. In 2023, the federal credit score drops to 22 p.c. Until Congress renews it, this tax credit score is ready to run out for personal residences in 2024.

Many states additionally supply their very own tax incentives. For example, Arizona presents a tax credit score of as much as $1,000.

A typical photo voltaic system prices an common of $20,498 and will probably be about $15,168 after factoring within the federal tax credit score. Don’t neglect, photo voltaic panels additionally enable you to save on electrical energy payments. How a lot you’ll save relies on how costly electrical energy is the place you reside.

3. Renewable vitality enhancements

The federal authorities additionally gives tax credit for renewable vitality installations together with gas cells, small wind generators, and geothermal warmth pumps. You may get a 26 p.c tax credit score for methods put in and positioned in service in 2020-2022. This tax credit score will drop to 22 p.c for methods positioned in service in 2023 and expire solely in 2024.

4. Medically-necessary enhancements

Do it’s good to set up ramps, modify bogs, widen doorways and hallways, add handrails, set up lifts, or make another enhancements for medical functions? These bills are deductible as itemized medical bills so long as the fee is affordable and the advance doesn’t enhance the worth of your property. You may additionally deduct the prices of working and sustaining any medically-necessary enhancements.

5. Enhancements funded by a mortgage or House Fairness Line of Credit score (HELOC)

Should you roll the price of enhancements into the acquisition value of your house and take out a mortgage to pay for them, you’ll be able to deduct the price of the mortgage’s curiosity in your taxes. The FHA 203(ok) mortgage and the Fanny Mae HomeStyle Renovation mortgage are designed to assist homebuyers pay for renovations.

Some householders can even deduct the curiosity on a House Fairness Line of Credit score (HELOC). As of 2018, HELOCs should be used to enhance a house and want to satisfy sure different necessities for the curiosity to be deductible. For example, householders can solely deduct the curiosity on house loans (mortgages and HELOCs) totaling a most of $750,000. Money-out refinancing is an alternative choice that will have tax advantages. Qualifying householders with important fairness of their properties can usually borrow as much as 80 p.c of the appraised worth of their properties and stroll away with money for renovations. Nevertheless, chances are you’ll find yourself with a better rate of interest in your new mortgage.

Conclusion

Should you plan to revamp your house quickly, get savvy about which house enhancements repay and which tasks will help you lower your expenses at tax time. By enhancing your home, you might promote it sooner or remodel it into your dream house.