Federal Reserve officers opted to not increase rates of interest in June to evaluate the affect of earlier hikes, and think about what’s subsequent. In the meantime, unemployment claims fall nationwide.

Homebase knowledge reveals a summer season upswing for small companies, as employment exercise grows, wages rise, and staff log extra constant hours.

In financial circumstances the place forecasts and expectations can change seemingly each day, real-time knowledge on exercise throughout North American companies reveals that hotter climate is bringing consumers and diners out and about. Homebase seeks to know how the broader financial setting is affecting small companies and their staff throughout the starting of Q2 by analyzing behavioral knowledge from greater than two million staff working at multiple hundred thousand SMBs.

Abstract of findings: Most important Avenue job development sees seasonal growth with out of doors exercise in full swing, as longer days translate to extra hours for small enterprise staff.

- Employment exercise is up on Most important Avenue, however trailing behind historic developments. Staff are working longer shifts to satisfy demand.

- Employment development varies throughout industries. Leisure noticed a large improve from Could to June (22.3%), in-line with prior years. Hospitality noticed a leap (8.8%) that lagged earlier years’ large spikes.

- Summer season climate is in full impact on small companies. Northern cities see robust job development with heat days, whereas June heatwaves hamper job numbers within the south.

- Wages for hourly staff are on the rise once more, pushed by service industries, after a dip in Could.

Longer summer season days result in longer shifts at SMBs

Small companies are seeing a giant pick-up in exercise, although not fairly on the identical ranges as prior years. Homeowners are counting on present staff working extra to satisfy demand.

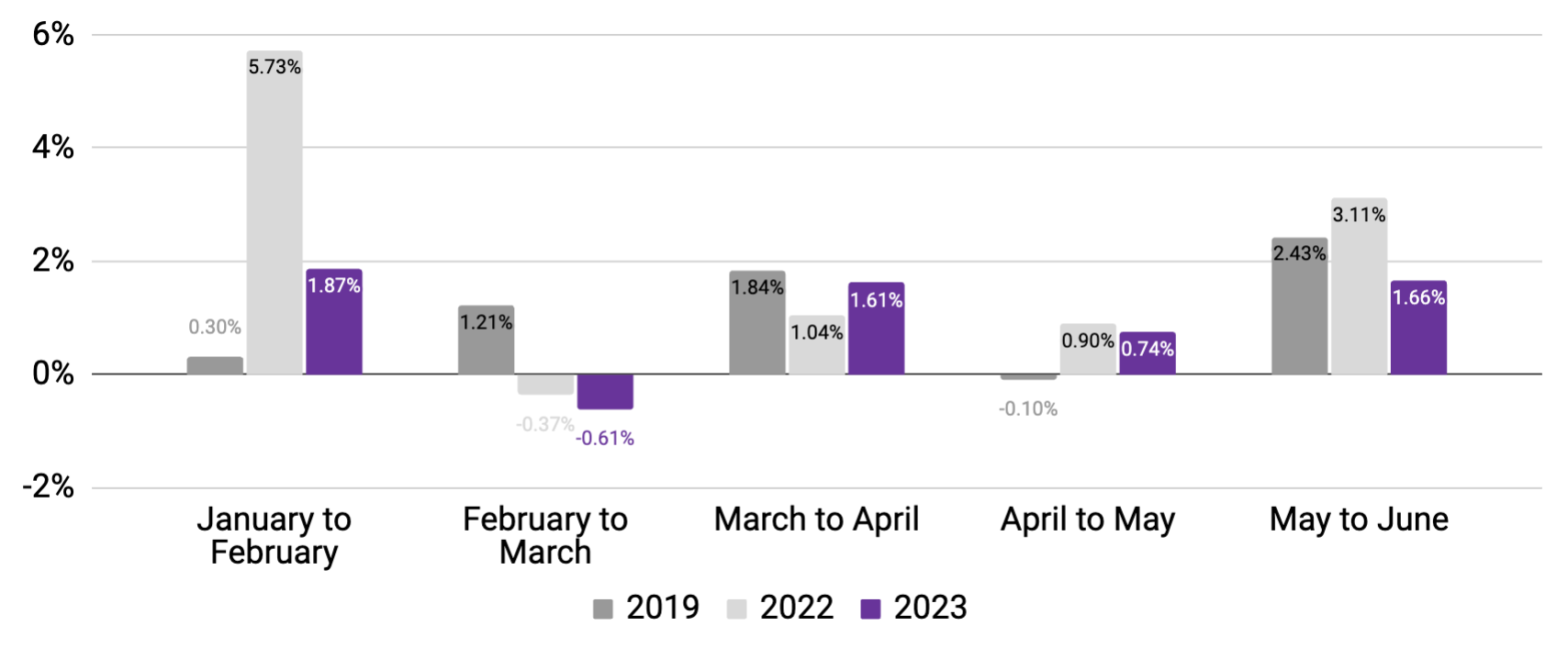

Staff working

(Month-to-month change in 7-day common, relative to January of reported yr)

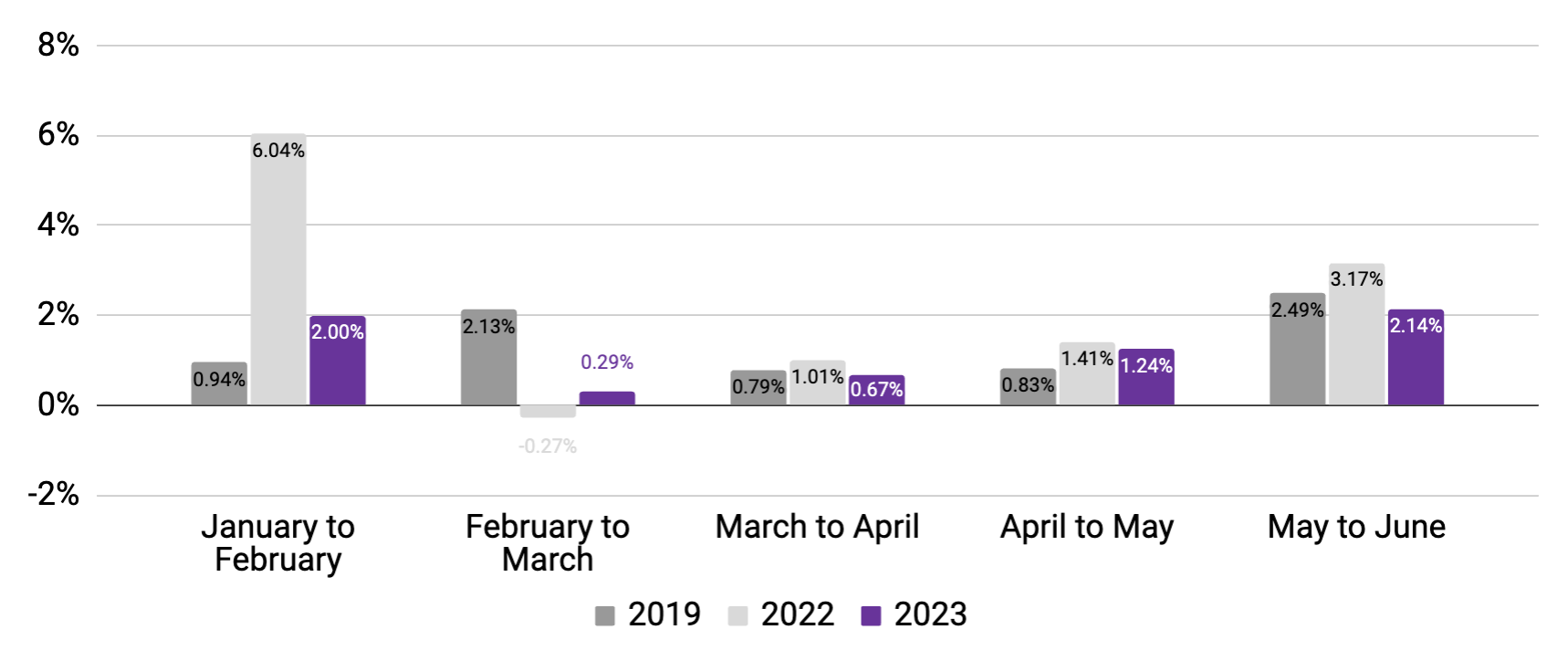

Hours labored

(Month-to-month change in 7-day common, relative to January of reported yr)

Knowledge typically compares rolling 7-day averages for weeks encompassing the twelfth of every month; April 2023 knowledge encompasses subsequent week to account for Easter vacation. Supply: Homebase knowledge.

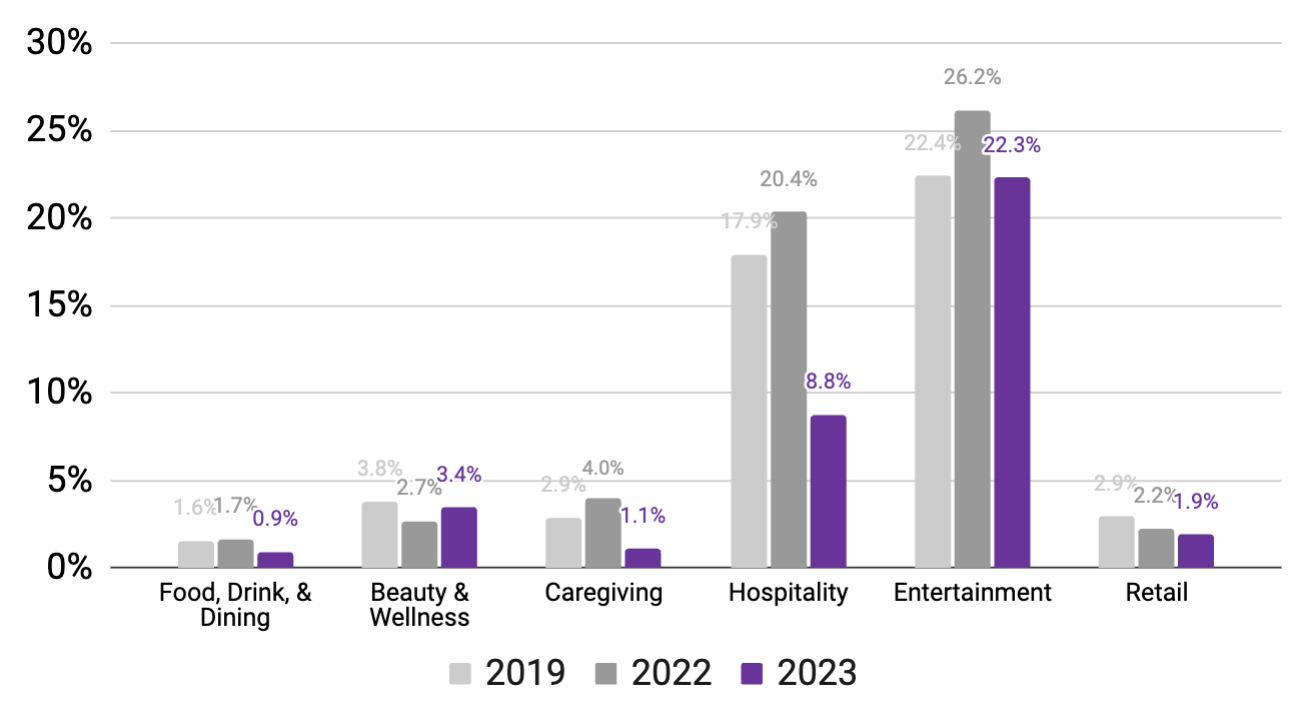

Leisure is booming for small enterprise

As faculties set free, households have been turning to out of doors leisure to fill their time.As faculties set free, households have been turning to out of doors leisure to fill their time.

Leisure¹ noticed a large improve from Could to June (22.3%), in-line with prior years, whereas Hospitality noticed a leap (8.8%) that lagged earlier years’ large spikes.

Meals & eating and retail (0.9% and 1.9%, respectively) additionally noticed will increase, however confirmed extra seasonal consistency – Most important Avenue purchasing and eating has been a month-to-month mainstay.

P.c change in staff working

(Mid-June vs. mid-Could, utilizing Jan. ‘19 and Jan. ‘23 baselines)²

1. Leisure contains occasions/festivals, sports activities/recreation, parks, film theaters, and different classes.

2. June 9-15 vs. Could 12-18 (2019); June 12-18 vs. Could 8-14 (2022); June 11-17 vs. Could 7-13 (2023). Supply: Homebase knowledge.

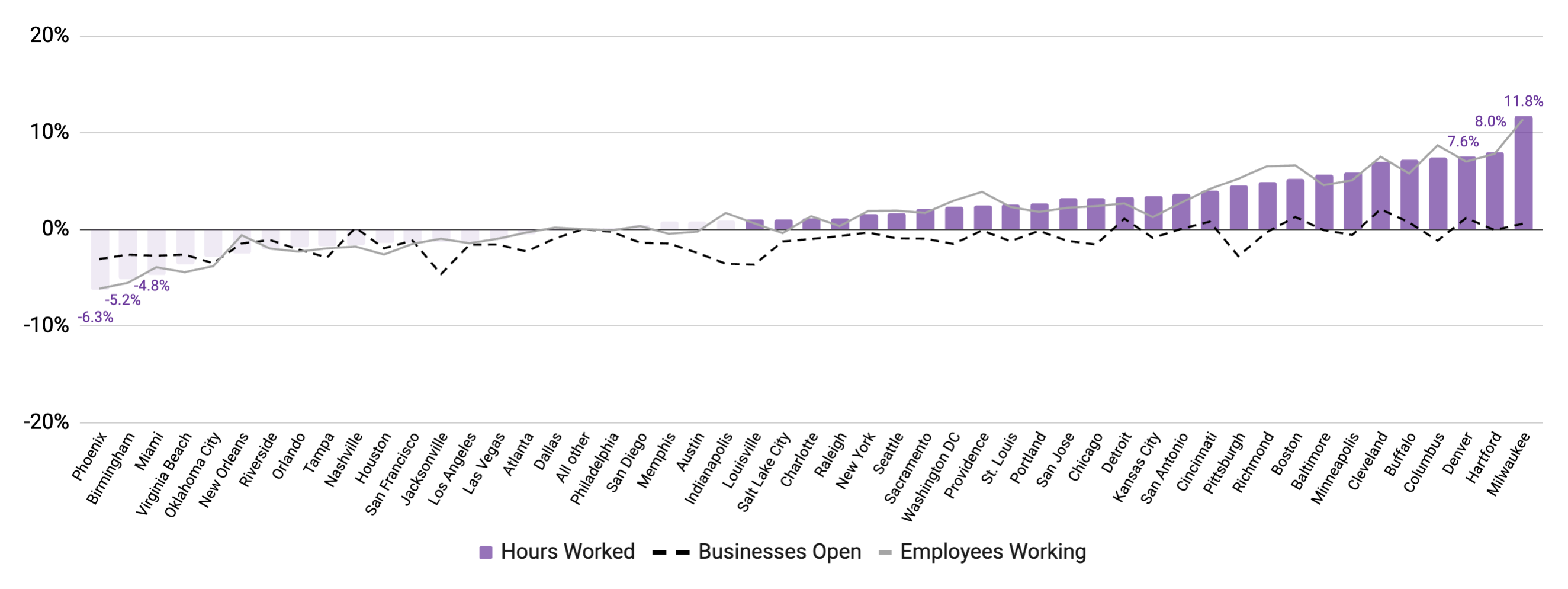

Northern cities noticed a weather-driven increase in SMB exercise

Unseasonable warmth within the south on each coasts led to dampened spending at small companies.

Word: June 11-17 vs. Could 7-13. Supply: Homebase knowledge

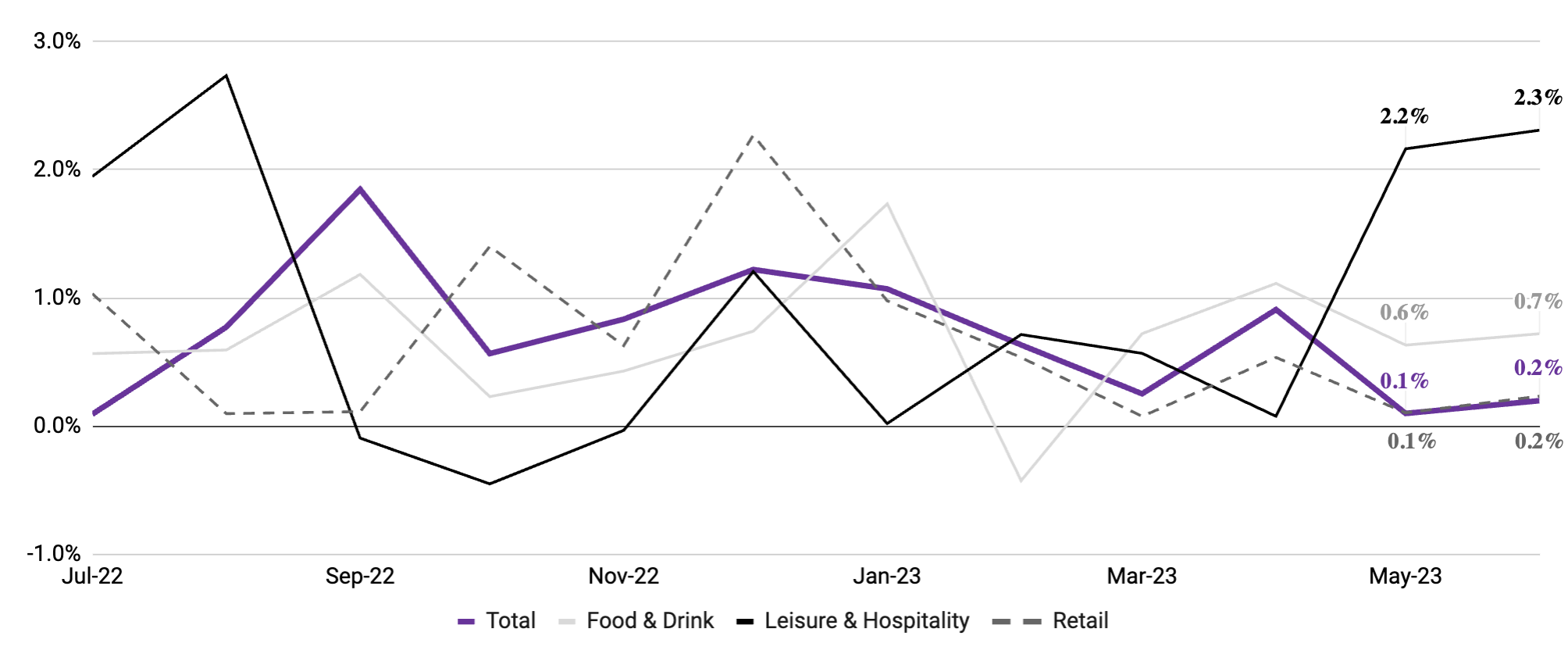

After a down month, greater wages in service industries pushed earnings up for hourly staff

Wage inflation

Month-over-month change in common hourly wages

Word: Knowledge measures common hourly wages for areas that utilized Homebase to pay staff in each June 2022 and June 2023. Supply: Homebase Payroll knowledge.

Hourly Worker Pulse Test

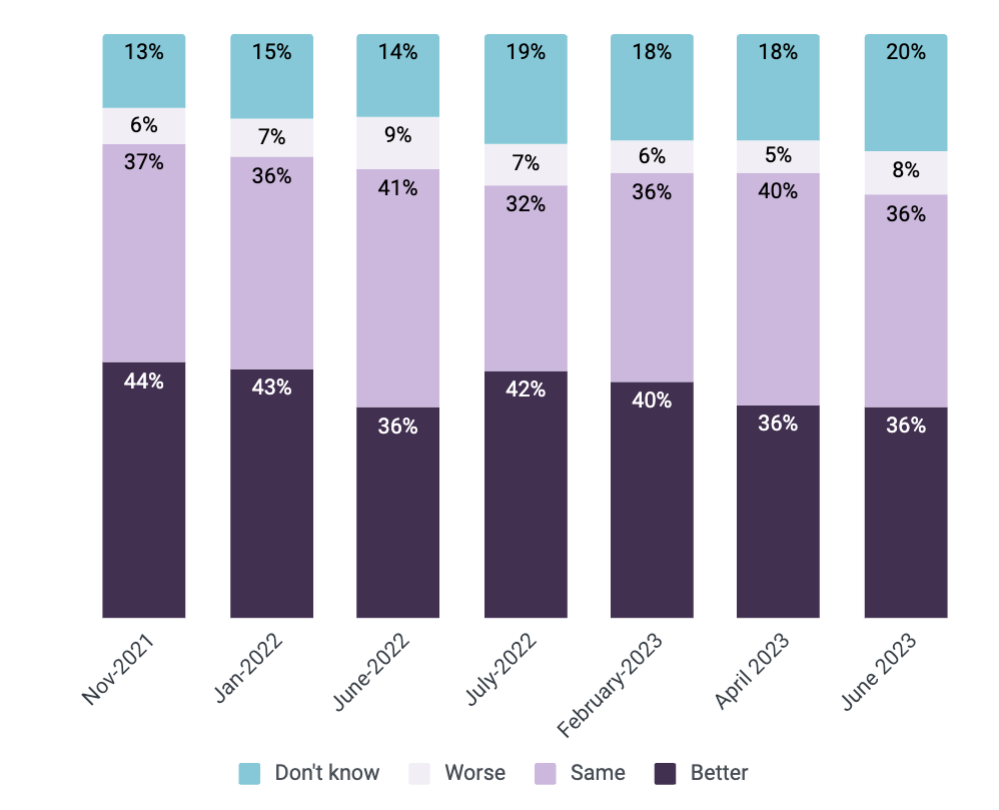

A June pulse verify of over 600 hourly staff reveals lowering optimism in the direction of job prospects.

Longer hours and decrease expectations for staff

A majority of staff surveyed nonetheless see their job prospects remaining the identical or enhancing (each 36% and 36%, respectively) in a yr, although 28% are actually both not sure or foresee worse prospects (up from 23% in April). The uptick in respondents reporting pessimism (8%) and uncertainty (20%) reveals increasingly more hourly staff are questioning if the grass actually is greener for future prospects.

Small enterprise staff are typically working extra this summer season than in prior months. Whereas extra dependable shifts reduce anxiousness about getting sufficient hours, additionally they put a damper on optimism for what jobs is perhaps on the market subsequent yr.

Survey query: Do you suppose your job choices shall be higher, about the identical, or worse in 12 months in comparison with as we speak?

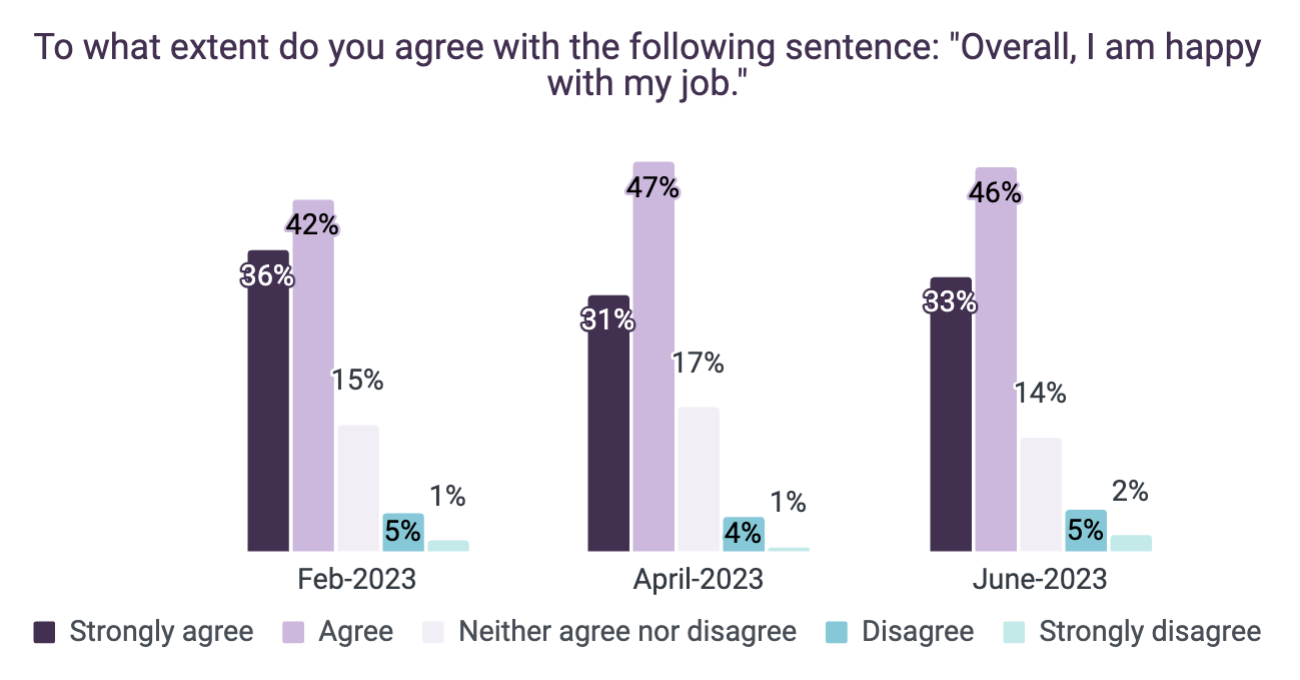

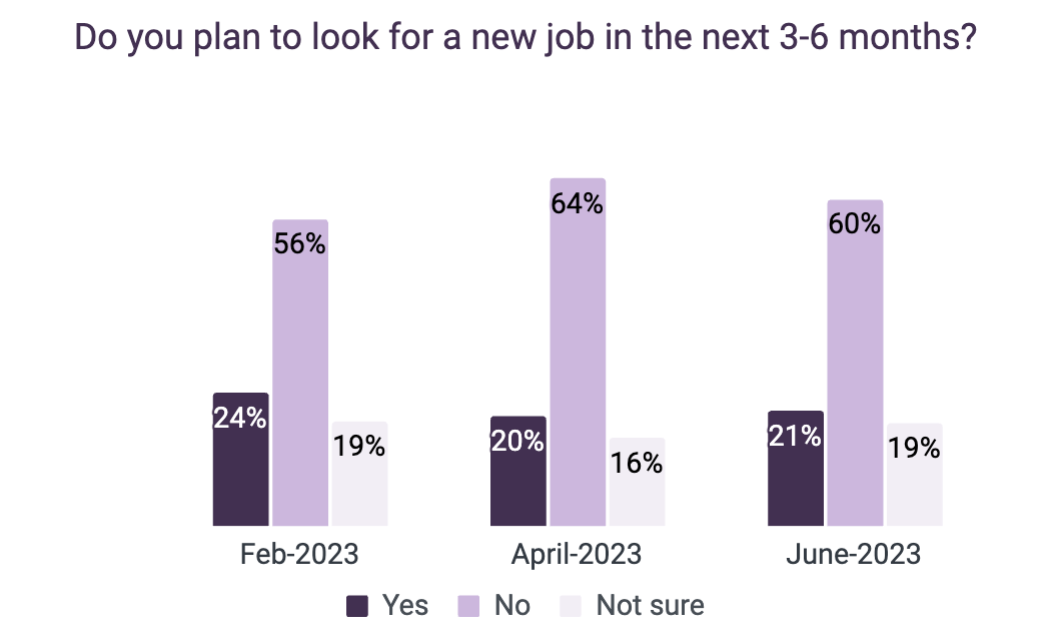

Extra hours is sweet information, however not for all

Staff proceed to report widespread satisfaction with their jobs (79% in June); nevertheless, in comparison with our April survey, we noticed 7% on respondents being sad versus 4% in April, displaying that there stays dissatisfaction amongst choose teams. One in 5 staff have plans to search for a job within the close to future (21%), versus 4 in 5, who both mentioned no or aren’t positive (79%).

Getting constant hours at work is a key consideration driving worker satisfaction, however different components are nonetheless on the minds of hourly staff. Workforce relationships, flexibility, wages and work setting are simply a number of the different methods homeowners can win the hearts of Most important Avenue staff.

Supply: Homebase Worker Pulse Survey. N = 873 (Feb. ‘23); N = 666 (Apr. ‘23); N = 611 (Jun. ‘23)

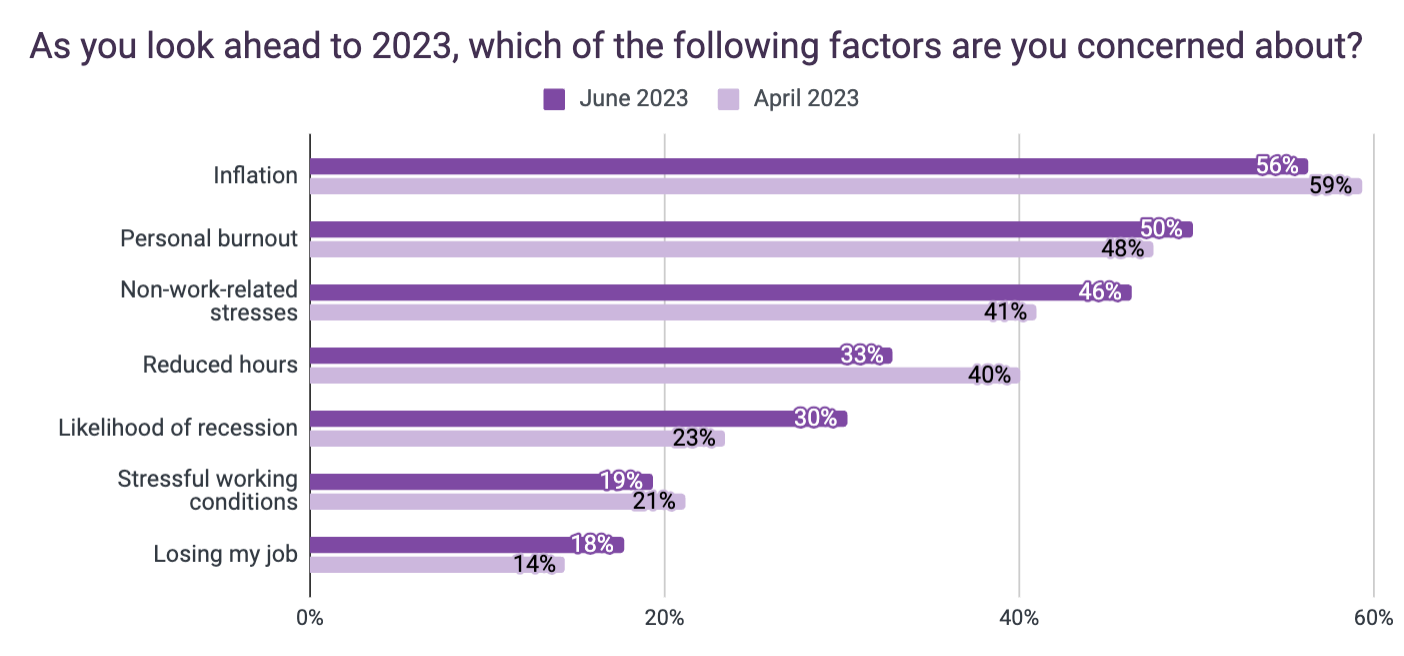

Staff nonetheless involved about inflation however much less so on hours

Inflation (56%), burnout (50%) and non-work stresses (46%) stay high issues for workers. Of be aware, June confirmed a steep drop in issues about lowered hours in comparison with April (33%, down from 40%), revealing hourly staff are extra happy with the elevated hours on their schedules.

Supply: Homebase Worker Pulse Survey. N = 666 (Apr. ‘23); N = 611 (Jun. ‘23)

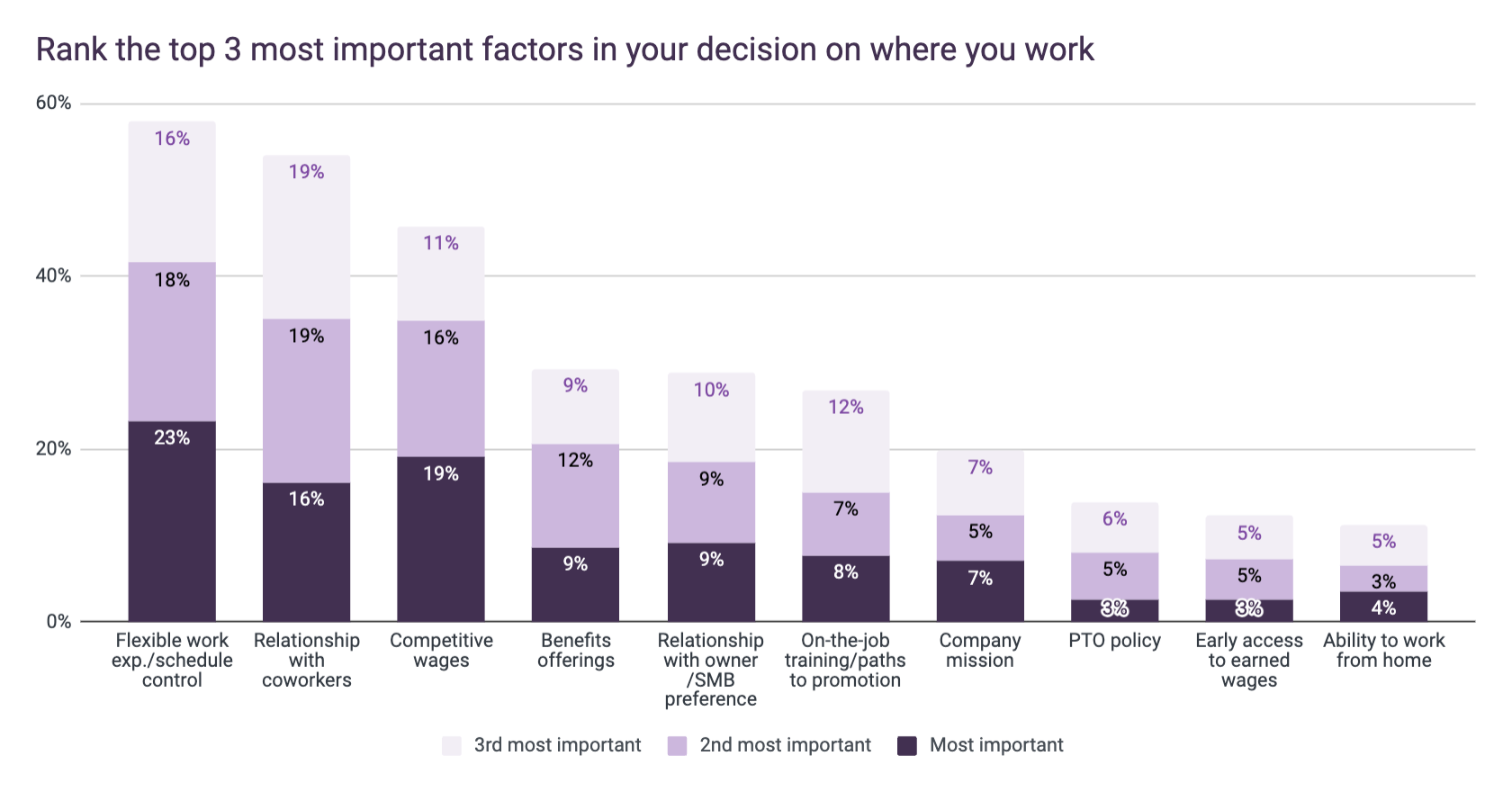

Wages take again seat to different non-pay advantages for staff

It’s not all in regards to the cash. Whereas wages stay a compelling consider staff’ resolution on the place they work (46% of cited it as a high 3 standards), June noticed non-pay advantages, together with schedule management (57%) and coworker relationships (54%), take first and second place.

Supply: Homebase Worker Pulse Survey. N = 666 (Apr. ‘23); N = 611 (Jun. ‘23)

Hyperlink to PDF of: June 2023 Homebase Most important Avenue Well being Report If you happen to select to make use of this knowledge for analysis or reporting functions, please cite Homebase.