The dual perils of slowing progress and excessive inflation, or stagflation, will hit the worldwide financial system this 12 months as Russia’s struggle in opposition to Ukraine exacerbates a slowdown within the restoration from the coronavirus pandemic, in keeping with Monetary Occasions analysis.

Mounting worth pressures, slipping output growth and sagging confidence will all pose a drag for many international locations, in keeping with the most recent Brookings-FT monitoring index.

Consequently, policymakers will probably be left with “grim quandaries”, mentioned Eswar Prasad, senior fellow on the Brookings Establishment.

The IMF is that this week anticipated to downgrade its forecasts for many international locations as finance ministers and central bankers convene on the spring conferences of the fund and the World Financial institution to debate how to answer the darkening financial outlook.

Policymakers should work out the right way to handle quickly rising costs and the hazards of elevating rates of interest when debt ranges are already excessive.

Kristalina Georgieva, IMF managing director, on Thursday referred to as the struggle in Ukraine a “huge setback” for the worldwide financial system.

Prasad mentioned there was a threat that 2022 may turn out to be “a fraught interval of geopolitical realignments, persistent provide disruptions and monetary market volatility, all in opposition to the background of surging inflationary pressures and restricted room for coverage manoeuvre”.

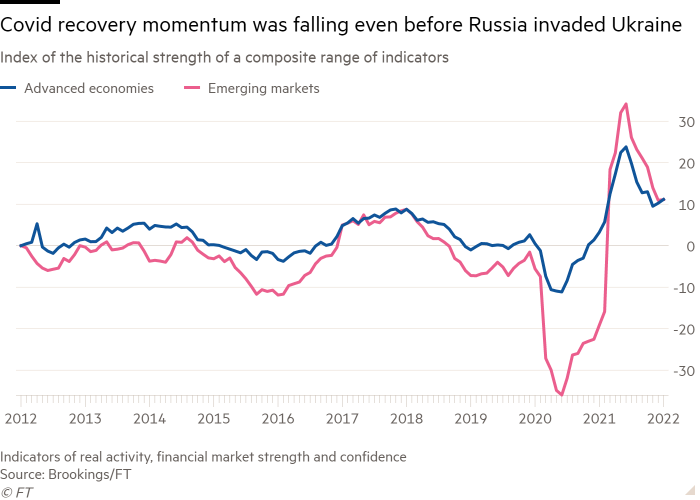

The Brookings-FT Monitoring Index for the World Financial Restoration (Tiger) compares indicators of actual exercise, monetary markets and confidence with their historic averages, each for the worldwide financial system and particular person international locations, capturing the extent to which knowledge within the present interval is healthier or worse than regular.

Within the twice-yearly collection, the composite index exhibits a marked lack of progress momentum since late 2021 in superior and rising economies, with confidence ranges additionally dropping from their peaks and monetary market efficiency taking a dip extra not too long ago.

Every of the world’s three massive financial blocs faces appreciable difficulties, Prasad mentioned. Whereas spending stays robust within the US and the labour market has returned to pre-pandemic situations, inflation poses extreme difficulties for the Federal Reserve’s mandate of worth stability. The tempo of worth progress surged to a 40-year excessive of 8.5 per cent in March.

“The Fed is at actual threat of shedding management of the inflation narrative and might be pressured to tighten much more aggressively than it has signalled, elevating the danger of a marked slowdown in progress in 2023,” Prasad mentioned.

China’s issues stem from its want to stick to its zero-Covid technique after a surge in circumstances of the extra infectious Omicron coronavirus variant. Lockdowns, such because the extreme restrictions in Shanghai, threaten client spending, funding and manufacturing, whereas the potential to ease financial coverage once more will amplify longer-term dangers to monetary stability.

China is about to report first-quarter gross home product figures on Monday and they’re extensively anticipated to point out that Beijing faces a troublesome problem in assembly its 5.5 per cent progress goal over the course of this 12 months.

For Europe, most uncovered to the Ukraine battle and struggling to cut back reliance on Russian power imports, confidence ranges have declined sharply.

Prasad mentioned there have been no simple coverage options and willingness to behave appeared in brief provide.

“Protecting the worldwide financial system on an inexpensive progress observe would require concerted actions to repair the foundation issues, together with measures to restrict pandemic-induced disruptions, steps to tamp down geopolitical tensions and focused measures resembling infrastructure spending to spice up long-term productiveness relatively than simply fortify short-term demand,” he mentioned.