Some within the local weather activist group — possibly many — abhor the investments and a spotlight flowing into carbon seize and storage applied sciences, arguing that they detract from focus and funds wanted for vitality and transportation options that wean the worldwide economic system off fossil fuels. Some recommend that it even perpetuates our dependancy to them.

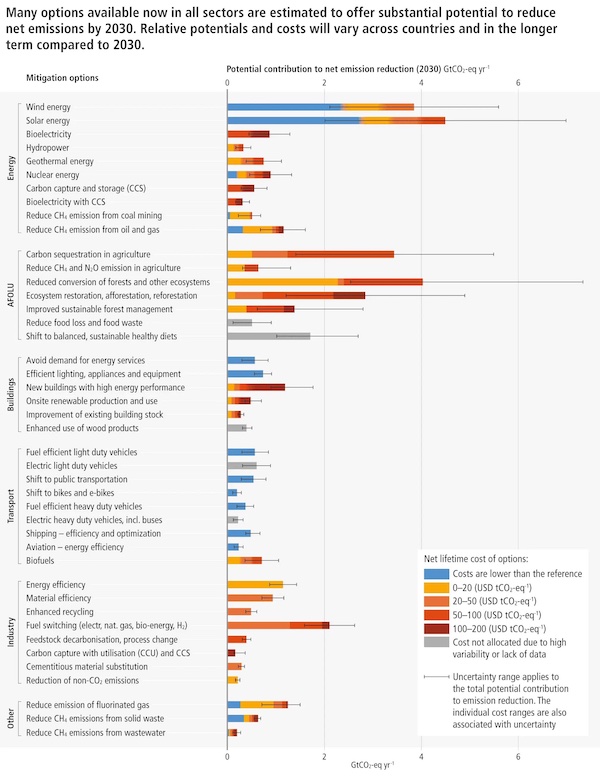

The unhappy reality, one underscored final week by the scientists who authored the newest Intergovernmental Panel on Local weather Change report, is that creating methods of eradicating residual carbon dioxide can be important to the transition — if we’ve got any hope of retaining world temperature will increase beneath 1.5 levels Celsius. In reality, we want just about each choice talked about in “that” chart they revealed outlining the assorted pathways to 1.5 levels C (beneath and linked right here), which is making the rounds among the many local weather tech group. Anybody have it in poster measurement but?

That’s one cause I consider the efforts of firms together with Microsoft, Shopify, Stripe and Swiss Re to prioritize carbon removing and storage approaches — fairly than avoidance initiatives — are noteworthy. You could possibly argue, validly, that their rigorously curated carbon removing contracts are simply an evolution of company offset buying methods. And everyone knows that purchasing offsets isn’t any substitute for practices that scale back emissions over the long run. However you possibly can additionally argue, validly, that scaling each method at our disposal is a clever transfer.

That’s the motivation behind the substantial new Frontier Fund, a $925 million “advance market dedication” (AMC) arrange by software program agency Stripe to spend money on carbon removing offsets — together with funding from Alphabet, Shopify, Meta and McKinsey, to begin.

The fund is basically a much bigger model of the initiatives that Stripe and Shopify have been managing individually for the previous couple of years. Each of these funds have centered on evaluating early-stage startups which can be truly engaged in carbon removing, and each have realized lots over these months that they’re desperate to share with different company consumers.

The going-rate for these contracts is usually greater than what an organization would pay for a lot of avoidance credit in the marketplace right now. When it made its first purchases in 2020, for instance, Stripe paid about $100 per metric ton for initiatives being developed by CarbonCure (the CO2-sequestering concrete firm) and $600 per metric ton for work being finished by geological storage concern Allure Industrial.

The main target of Frontier Fund is to assist scale the provision of options that value lower than $100 per metric ton. It’s going to consider potential removing offsets primarily based on these standards (amongst others): permanence (how lengthy will the CO2 keep out of the ambiance, it seeks greater than 1,000 years); how massive of a footprint a specific expertise requires (some direct air seize choices might be awfully space-hungry); how a lot capability the answer truly gives; whether or not it actually ends in a internet unfavorable end result and might be verified as such; and the environmental justice influence.

Stripe likens the trouble to mechanisms set as much as speed up vaccine improvement: “The idea of an AMC is borrowed from vaccine improvement and was piloted a decade in the past. The primary AMC accelerated the improvement of pneumococcal vaccines for low-income international locations, saving an estimated 700,000 lives. Whereas the market dynamics of carbon removing and vaccines aren’t similar, they face related challenges: uncertainty about long-term demand and unproven applied sciences. AMCs have the ability to ship a robust and quick demand sign with out choosing successful applied sciences firstly.”

Ultimately, the fund plans to open to extra consumers.

Frontier is one among a number of carbon removing procurement developments I’ve been contemplating this week. One other massive announcement got here Tuesday within the type of a giant “carbon credit score buy settlement” that includes CarbonCure Applied sciences, which has developed a approach of injecting captured CO2 into concrete the place it’s mineralized and “completely” saved.

The Canadian firm, which final 12 months cut up the prime prize within the Carbon XPrize, has disclosed a $30 million cope with two firms which have begun investing in carbon credit as a part of a brand new partnership, investor Invert and blockchain/crypto tech agency Ripple. CarbonCure’s carbon removing methodology has been permitted by the Verra crediting program, which lets consumers hint the main points.

Invert plans to make credit from the portfolio out there to people and different companies. The contract covers “lots of of 1000’s of quick, everlasting and verifiable carbon credit to be delivered over a 10-year interval.”

CarbonCure’s company mission is to take away 500 million metric tons of CO2 yearly by 2030, which it describes as the identical as taking 100 million automobiles off the highway yearly.

The opposite firm in my highlight on this second is San Francisco-based Heirloom, which final month raised one of many largest Sequence A rounds for a direct air seize firm thus far — $58 million led by Carbon Direct Capital Administration, Ahren Innovation Capital and Breakthrough Vitality Ventures, together with the Microsoft Local weather Innovation Fund.

Heirloom can be one of many startups that has signed contracts with each Shopify and Stripe, each of that are receiving credit for serving to increase the expertise in its early levels. Different early prospects embrace software program firms Klarna and Sourceful and nonprofit Milkwire. The corporate has raised a complete of $58 million up to now, together with grants from ARPA-E and the Nationwide Science Basis, in response to Max Scholten, head of commercialization for Heirloom.

Heirloom makes use of renewable vitality to speed up a pure course of that makes use of minerals that “thirst” for carbon dioxide and encourages them to soak it up like sponges, turning them into stone. It touts a value that’s sub-$100 per metric ton, considerably decrease than different direct air seize programs. The Heirloom method is modular, and can rely on the geologic storage capability of a given location, Scholten advised me. “We are able to match the size of our system to the constraining issue,” he stated. Its intention: take away 1 billion metric tons of CO2 by 2035.

Once I spoke with Scholten in regards to the method, he stated Heirloom plans to personal and function installations on behalf of consumers. Amongst different issues, the brand new financing will assist fund the corporate’s first business deployment, the placement of which has not been disclosed. “The objective must be as low-cost and everlasting as shortly as doable,” he stated.

It’s clear that we want extra company help for the CarbonCures and Heirlooms of this world — in a lot the identical approach that company procurement of renewable vitality initiatives helped speed up photo voltaic and wind installations. The Frontier Fund is one other massive step towards that. The problem, after all, is how one can apply what are basically a unique kind of carbon offset to carbon accounting fashions. Let’s all hope we will get the mathematics so as to add up sooner fairly than later.