The S&P 500 SPDR (SPY) surged 5.77% from Tuesday to Thursday and this was the largest 3-day surge for the reason that 6.07% advance on November fifth, 2020. This early November surge led to a breakout and the advance prolonged till January 2022. The present surge additionally reveals some critical short-term power, however there are some key variations between now and November 2020. Let’s examine.

The S&P 500 SPDR (SPY) surged 5.77% from Tuesday to Thursday and this was the largest 3-day surge for the reason that 6.07% advance on November fifth, 2020. This early November surge led to a breakout and the advance prolonged till January 2022. The present surge additionally reveals some critical short-term power, however there are some key variations between now and November 2020. Let’s examine.

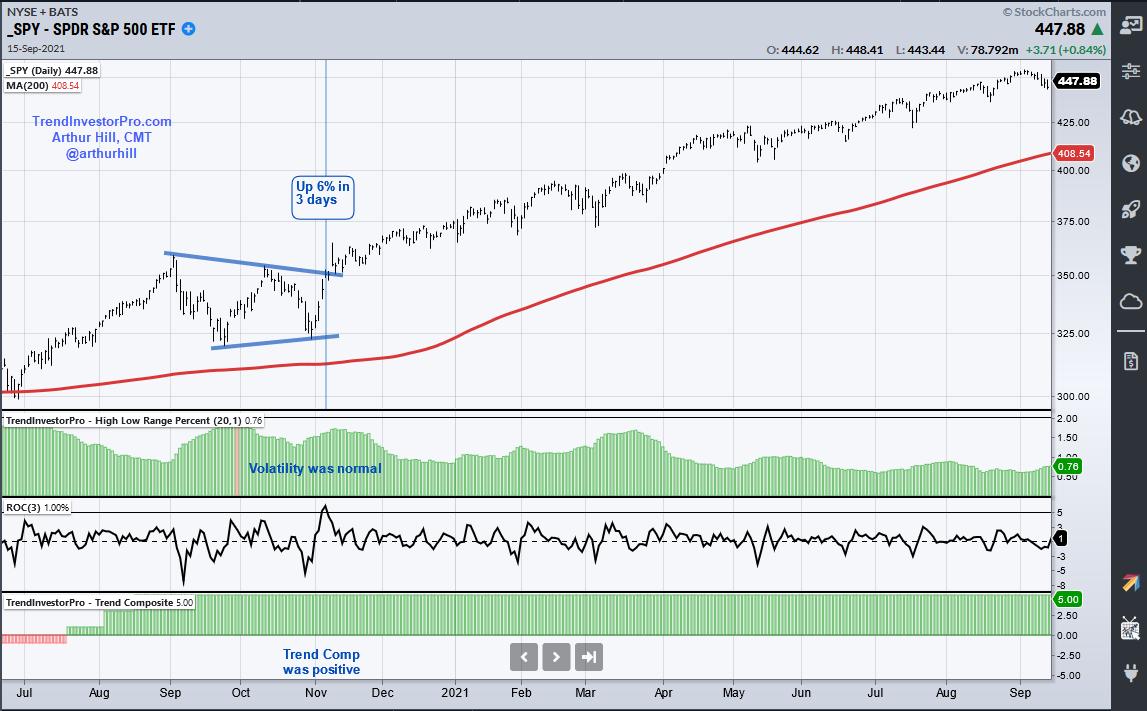

The chart under reveals SPY above its 200-day because it consolidated in September-October 2020. The Development Composite (backside) window was additionally optimistic. Thus, the long-term pattern was up. The center indicator window reveals the 3-day Fee-of-Change for reference. The highest indicator window reveals 20-day common of the Excessive-Low Vary %, which is the high-low vary as a share of the common value. This measures volatility and the indicator was under 2% on the time of the November surge (regular volatility). Thus, SPY was in an uptrend and volatility was regular because the ETF broke out of a triangle.

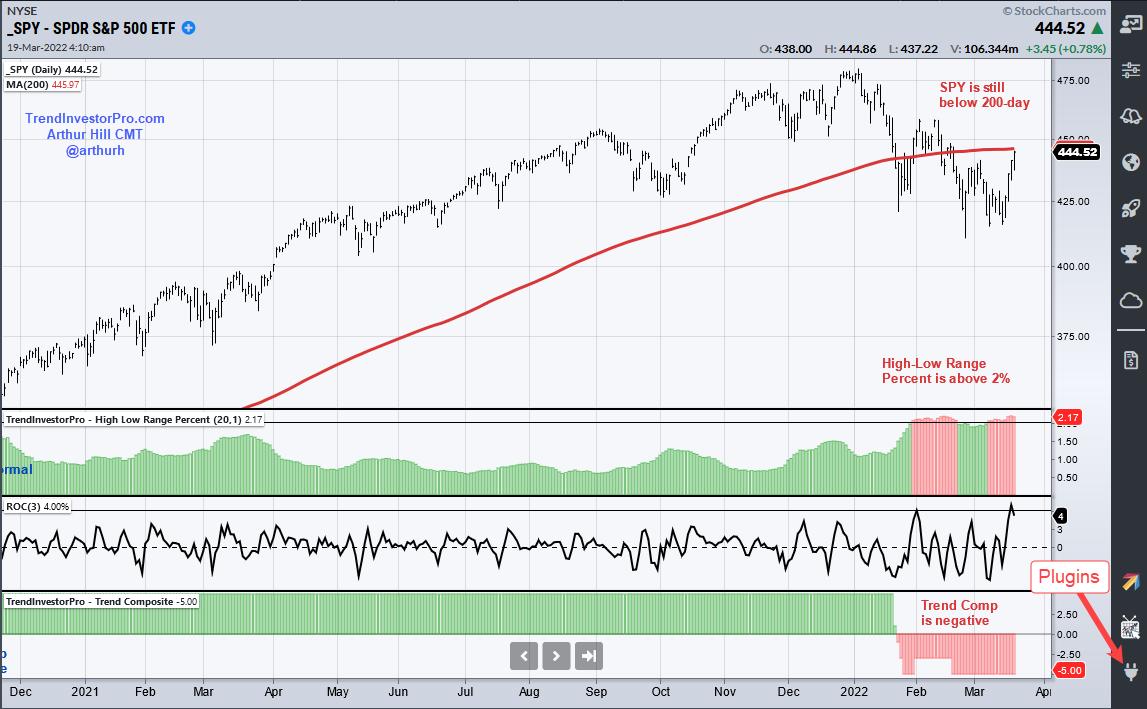

Now let’s take a look at March 2022. First, SPY is under its 200-day SMA and the Development Composite is damaging. Thus, the long-term pattern remains to be down. Second, the Excessive-Low Vary % indicator has been above 2% for 9 days (pink) and this reveals above common volatility (threat). This week’s surge is spectacular short-term, however SPY remains to be in a downtrend and volatility is above common. I want to see a significant breakout and comply with via earlier than contemplating it as greater than a bear market bounce.

This week at TrendInvestorPro I continued the Development Composite buying and selling technique sequence with half 5. This half examined a trend-momentum technique utilizing the 50 ETFs within the All Climate Listing. Click on right here for instant entry to this sequence and extra.

On this week’s Subsequent Stage Charting (video right here), I used the Excessive-Low Vary % indicator to quantify volatility within the S&P 500 SPDR (SPY), DB Power ETF (DBE) and Gold SPDR (GLD). The latter two are in uptrends and skilled short-term parabolic strikes.

The Development Composite and Excessive-Low Vary % are a part of the TIP Indicator Edge Plugin for StockCharts ACP. This plugin consists of 9 different indicators that assist merchants outline the pattern, determine tradable pullbacks and set stops. Click on right here to be taught extra.

—————————————————

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic method of figuring out pattern, discovering alerts inside the pattern, and setting key value ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise Faculty at Metropolis College in London.