Over 20 analysts minimize their targets after the inventory plunged 17 per cent in Toronto on Wednesday, its greatest drop ever

Article content material

Canadian e-commerce firm Shopify Inc. had the typical worth goal on its shares slashed to the bottom stage since January 2021 after it signalled slower gross sales progress.

Article content material

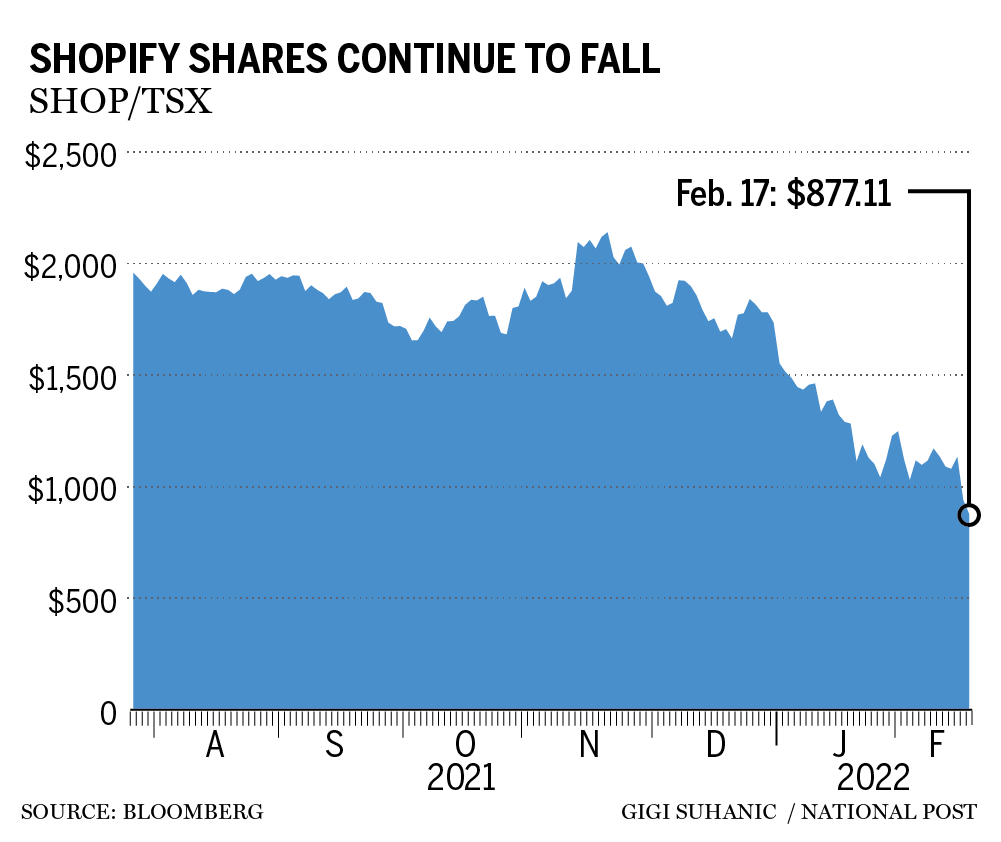

Greater than 20 analysts minimize their targets after the inventory plunged 17 per cent in Toronto on Wednesday, its greatest drop ever, following an organization assertion that full-year income progress can be decrease than the 57 per cent improve in 2021. Shares prolonged their stoop Thursday.

Shopify’s enterprise surged throughout the pandemic, with gross sales leaping 86 per cent in 2020 as consumers moved on-line. It turned Canada’s most precious firm by market capitalization, overtaking Royal Financial institution of Canada. It surrendered that place in December amid a broader tech selloff, and as consumers returned to brick-and-mortar shops.

Article content material

Final month, Shopify mentioned it had canceled warehouse and fulfilment-centre contracts, pushing shares to a 16-month low. The corporate has tumbled virtually 50 per cent this yr, shedding about $100 billion in market worth.

“The fact is that the above ‘in-line’ outcomes mixed with no agency outlook steerage was not sufficient,” Nationwide Financial institution analyst Richard Tse mentioned in a be aware to shoppers. “If the above wasn’t sufficient to trigger pause, an extra notable fly within the ointment was a shift within the firm’s SFN (fulfilment) technique to personal or run extra of the main fulfilment hubs.”

Whilst targets have been gutted, analysts are largely optimistic on the inventory: Shopify has just one promote score, with 27 buys and 19 holds.