In 2020, 55% of all funds have been made by credit score or debit card, in keeping with the Federal Reserve. Throughout that very same interval, money funds fell from 26% right down to solely 19%. Which implies if your online business isn’t accepting card funds, you’re leaving cash on the desk.

So does that imply you might want to make investments tons of of {dollars} in a card processing system and negotiate countless charges? Not essentially.

We’ll check out tips on how to settle for bank card funds, what it prices, and what to contemplate. Then we’ll present you 5 of the perfect methods for small companies to just accept playing cards.

Settle for Credit score Card Funds

To start out accepting bank cards you solely want two issues: a bank card processing service and a approach to accumulate your buyer’s bank card data. Inside every of those, you’ll have some decisions to make – which might get just a little overwhelming. To maintain it simple, we’ll break down every one so to concentrate on the way it matches the wants of your small enterprise.

For a processing service, you’ll want to decide on between a service provider account or a third-party cost processor (assume PayPal or Sq.).

To gather card knowledge, you’ll want to contemplate if you happen to’ll be accepting funds on-line, in particular person, or by cellphone.

Let’s check out your decisions just a little extra intently.

Service provider Account vs Cost Processor

The standard approach to settle for bank cards is to open a service provider account with a financial institution or different monetary establishment. A service provider account is a particular kind of checking account that lets you settle for funds.

With a service provider account, you’ll possible have to purchase your individual {hardware} and negotiate your charges. These charges will differ based mostly on the bank card community, card issuer, and even the strategy of card entry.

A sooner and simpler approach to get began is to make use of a third-party cost processor – like PayPal, Stripe, or Sq.. You might also see them referred to as “cost service suppliers” or PSPs. These service suppliers deal with the service provider account for you and typically embrace a card reader totally free. Their charges are usually barely increased than a service provider account, however they don’t change based mostly on the bank card community or bank card. This makes it just a little simpler to grasp what you’ll be paying every month.

So, how have you learnt which is best for you? You probably have a excessive quantity of bank card gross sales, negotiating your charges with a service provider account may prevent cash in the long term. In any other case, most small companies choose the simplicity and predictability of a PSP.

Settle for Credit score Card Funds On-line

To simply accept bank cards on-line you’ll want one thing referred to as a cost gateway. A cost gateway is software program that permits your prospects to securely share their bank card data along with your cost processor.

While you see a PayPal button on a web site, that’s a cost gateway. While you checkout from a Shopify purchasing cart, that’s additionally a cost gateway.

Most cost service suppliers embrace some form of cost gateway as a part of their service. This will likely hook up with your web site or hyperlink out to an off-site account portal.

Professional Tip: Many cost processors combine with HubSpot funds. This enables your prospects to make funds immediately out of your web site. It’s also possible to create shareable cost hyperlinks that may be despatched by e-mail or textual content, and even embedded in an bill.

Settle for Credit score Card Funds in Particular person

After getting your service provider account or cost service supplier (PSP), you’ll want a approach to bodily accumulate your prospects’ card data. This can look completely different relying on the kind of enterprise you personal. Listed below are some choices you would possibly think about:

- Level-of-Sale (POS) System – This software program can observe your merchandise, stock, and gross sales historical past. It could embrace a card reader or permit you to manually enter bank card data. A POS system is an effective selection for eating places or retailers with a number of merchandise.

- Card Reader or Terminal – This enables your prospects to swipe or insert their card. It could additionally enable them to make contactless funds.

- Cellular Card Reader – This small gadget turns your smartphone or pill right into a bank card terminal. These are a wonderful selection for meals vehicles, farmers markets, and different touring companies.

- QR Code – You show a customized QR code on your prospects to make use of. Scanning it brings them to a cost app, to allow them to enter their bank card particulars on their very own smartphone.

Many cost service suppliers will embrace some form of cost entry at no additional value.

Professional Tip: Many PSPs combine with Gross sales Hub, immediately connecting your prospects’ buy historical past to your information and experiences.

Settle for Credit score Card Funds by Cellphone

If you wish to settle for bank cards by a cellphone name, you’ll want a point-of-sale system that lets you manually enter card particulars. Your buyer will learn off the cardboard data when you enter it. That is referred to as a card-not-present transaction and is frequent for companies like eating places and florists.

Remember that card-not-present transactions will incur a better payment due to the upper danger of fraud.

Settle for Credit score Card Funds On My Cellphone

To simply accept bank cards in your smartphone, you’ll want a cellular card reader. These hook up with your cellphone by plugin or Bluetooth. Cellular readers can be found in magnetic swipe (magstripe), EMV chip, or contactless. They’re supplied by cost processors like Sq. or PayPal.

How a lot does it value to just accept a bank card cost?

Often, when speaking about the price of accepting bank cards, individuals imply transaction charges. These are a proportion of the sale worth that you just pay for every transaction. Transaction charges will be complicated as a result of they might change relying on sure elements.

With a standard service provider account, your transaction charges might change based mostly on:

- Bank card community (Visa, Mastercard, and many others.)

- Bank card kind (enterprise, rewards, and many others.)

- Technique of cost (on-line, in-person, by cellphone, and many others.)

In response to Reuters, business analysts put the common processing payment between 1.5 to three.5%.

A bonus of utilizing a PSP over a service provider account is that they usually cost a flat fee. For instance, with HubSpot funds, you pay 2.9% it doesn’t matter what kind of bank card your buyer makes use of.

Along with transaction charges, there might also be setup charges, {hardware} prices, and month-to-month subscriptions. These added prices are extra frequent with a standard service provider account. Most PSPs don’t embrace these prices or will waive them as a part of promotional presents.

Greatest Methods to Settle for Credit score Playing cards for Small Companies

- HubSpot Funds

- Stripe

- Sq.

- PayPal

- Shopify

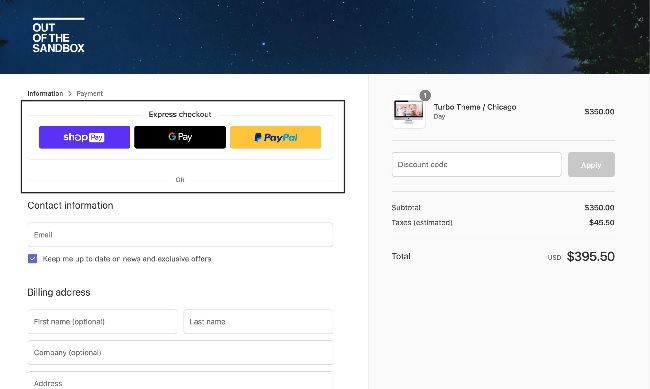

1. HubSpot Funds: Greatest Total

HubSpot funds is a frictionless cost instrument that lives inside your CRM. It lets you settle for all main debit or bank cards, ACH funds, and even recurring funds. It additionally permits you to settle for funds straight out of your web site, or create shareable cost hyperlinks that you may embed in emails, textual content messages, and even invoices.

However the perfect half is that the mixing with Gross sales Hub permits you to immediately mix your gross sales knowledge along with your buyer information and reporting.

HubSpot funds is offered to U.S.-based Gross sales Hub customers with a starter account or above. There are not any added setup charges or month-to-month prices, and the transaction charges are a easy 2.9% flat fee.

Charges: Flat 2.9% of transaction quantity

Different Prices: None

Why We Like It

- Settle for bank cards straight out of your web site

- Ship safe, shareable cost hyperlinks by e-mail or textual content

- Embed cost hyperlinks in quotes or invoices

- Immediately join your prospects’ buy historical past along with your information or reporting

- Allow recurring funds and subscriptions

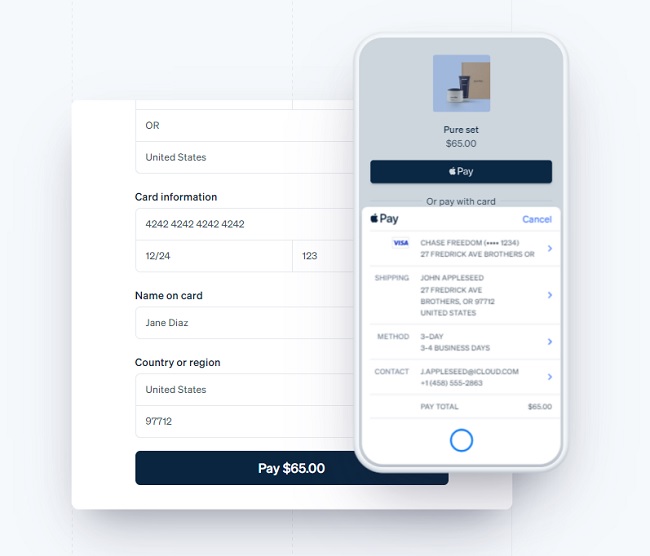

2. Stripe: Greatest for On-line Funds

Stripe permits you to provide flexibility with a Bluetooth card reader that handles swipe, EMV chip, and contactless card cost. It even works with Google Pay and Apple pay.

However the place Stripe actually excels is with on-line funds. Use certainly one of its pre-built cost pages or embed its checkout cart straight into your present web site. Or, when you have a developer helpful, you’ll be able to customise a private checkout cart.

Charges:

- On-line: 2.9% + $0.30 per transaction

- In-Particular person: 2.7% + $0.05 per transaction

Different Prices: One-time payment of $59 for primary card reader

Why We Like It

- Settle for swipe, chip, or contactless funds from the identical card reader

- Provides a pre-built cost web page for companies who simply desire a quick and straightforward on-line expertise

- On-line expertise consists of 1-click cost, handle auto-complete, and cost methodology reuse

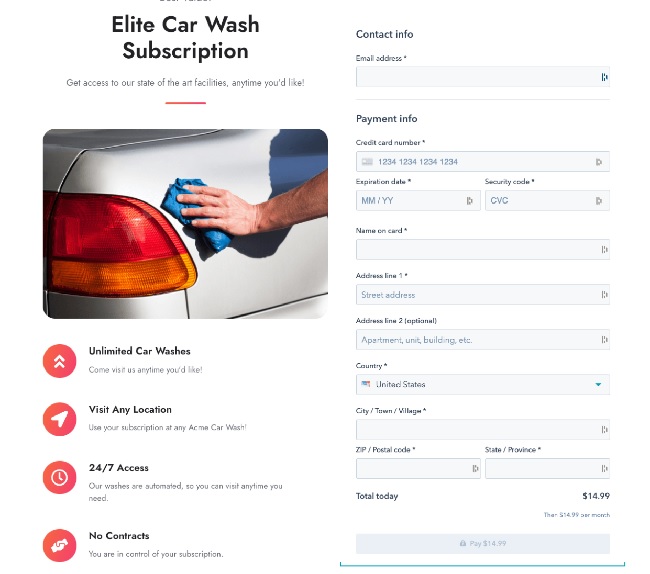

3. Sq.: Greatest for Cellular Funds

Sq. provided the unique cellular card reader and it’s nonetheless probably the most well-liked. Plug it into your cellphone, obtain the app, and also you’re able to go. Plus, your first magstripe card reader is free. It’s also possible to improve your card reader to just accept chip playing cards, contactless cost, Apple Pay, or Google Pay.

However Sq. isn’t restricted to cellular cost. It additionally presents POS software program, retail registers, and handbook entry choices. Sq. even presents invoicing and appointment scheduling software program. Want an internet choice? Sq. permits you to add a cost portal, or construct a free on-line retailer with their retailer builder.

Charges:

- On-line: 2.9% + $0.30 per transaction

- In-Particular person: 2.6% + $0.10 per transaction

- Card-not-present: 3.5% + $0.15 per transaction

Different Prices: Improve your card reader for one-time $49

Why We Like It

- Free magstripe card reader that connects to your smartphone or pill

- Settle for funds offline whenever you’re with out web

- POS, card reader, register, or on-line choices for almost any enterprise mannequin

- Free on-line retailer builder

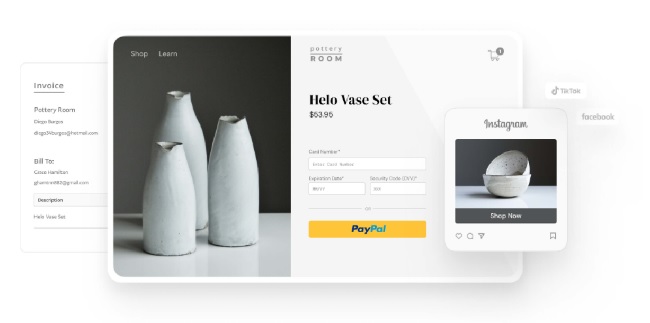

4. PayPal: Greatest All-In-One

You’ve undoubtedly heard of PayPal, and so have your prospects. So, whether or not you’re including a PayPal button to your website, or utilizing its card reader in your retailer, your prospects know they will belief it.

However other than identify recognition, PayPal’s greatest energy is that it presents a variety of cost options. Use PayPal in your web site and you’ll settle for bank cards, peer-to-peer funds, and even Venmo. Give your in-person prospects decisions with swipe, chip, contactless, or QR code cost. Observe your gross sales historical past, stock, and workers hours within the POS. It doesn’t matter what form of enterprise you run, PayPal has one thing for you.

Charges:

- On-line: 2.9% + $0.30 per transaction

- In-Particular person: 2.29% + $0.09 per transaction

- Card-not-present: 3.49% + $0.09 per transaction

Different Prices: One-time payment of $29 for card reader

Why We Like It

- Model identify recognition creates belief

- Settle for peer-to-peer funds by PayPal or Venmo

- POS software program permits you to observe stock, gross sales, and even workers hours

- Leverage QR codes for quick, contactless funds

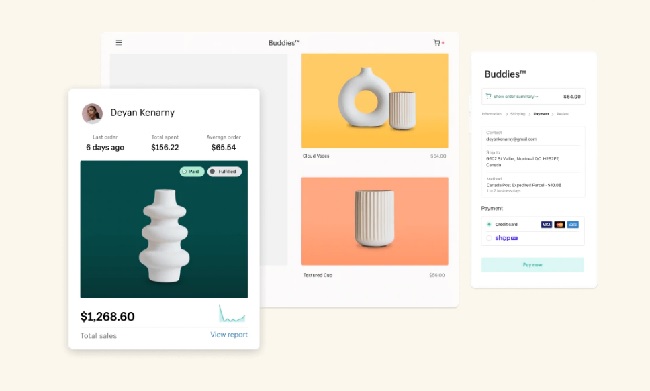

5. Shopify: Greatest for Ecommerce

Whereas Shopify presents in-person and on-line cost options, its finest recognized for its ecommerce platform. In the event you want a web site, Shopify presents a drag-and-drop retailer builder with its built-in checkout cart. Or, if you might want to monetize your present web site, Shopify permits you to simply add product playing cards and a purchase now button.

However what when you have a web site and a retail retailer? Shopify’s POS system permits you to join each. This allows you to streamline your gross sales course of on your prospects and your online business. It additionally permits you to provide helpful choices like in-store pickup from on-line purchases.

Charges:

- On-line: 2.9% + $0.30 per transaction

- In-Particular person: 2.4% of transaction quantity

- Card-not-present: 2.9% + $0.30 per transaction

Different Prices: Begins at $29/mo.

Why We Like It

- Join your in-store and on-line enterprise

- Drag-and-drop retailer builder

- Card-not-present charges are the identical as on-line cost charges

Continuously Requested Questions About Credit score Card Funds

Can I settle for bank card funds as a person?

People can use a cost processor like PayPal, Stripe, or Sq. to just accept bank cards even when they don’t have a registered enterprise.

Can I take advantage of PayPal to just accept bank card funds?

Along with peer-to-peer funds, PayPal lets you settle for bank cards on-line, in particular person, or by cellular app. PayPal works with all main bank card manufacturers, together with Mastercard, Visa, and American Specific.

Can I settle for bank cards by Venmo?

Venmo can’t be used to just accept bank cards as a cost processor. You need to use a bank card to make a peer-to-peer cost on Venmo, however it would incur a 3% processing payment and additional money advance charges.

What’s the most cost-effective approach to take card funds?

For many small companies, the most affordable approach to take card funds is to make use of a third-party cost processor. Whereas the transaction charges could also be barely increased, you’ll skip the month-to-month prices, {hardware} prices, and setup charges.

For companies which have a excessive quantity of bank card gross sales every month, it might be cheaper to barter your transaction charges with a service provider account.

How can I settle for bank card funds totally free?

There’s no approach to settle for bank cards with out transaction charges, however you’ll be able to keep away from month-to-month prices and {hardware} charges. You might also be capable to use software program to settle for on-line funds totally free.

Can I settle for bank card funds and not using a service provider account?

A cost processor like Sq. or PayPal lets you settle for bank cards and not using a service provider account. These third-party providers deal with the service provider account and processing for you.

Get Began With Credit score Card Funds

Clients are utilizing credit score and debit playing cards an increasing number of. By accepting bank cards you make it simpler for them to make use of the cost methodology they like. Irrespective of which cost processor you select, you’ll cease leaving cash on the desk, and begin placing it in your pocket.