Each quarter I attempt to do an replace of the Sector Rotation Mannequin. We’ve the framework as described by Sam Stovall right here on the positioning.

The picture above reveals my interpretation of the varied elements that have an effect on this mannequin.

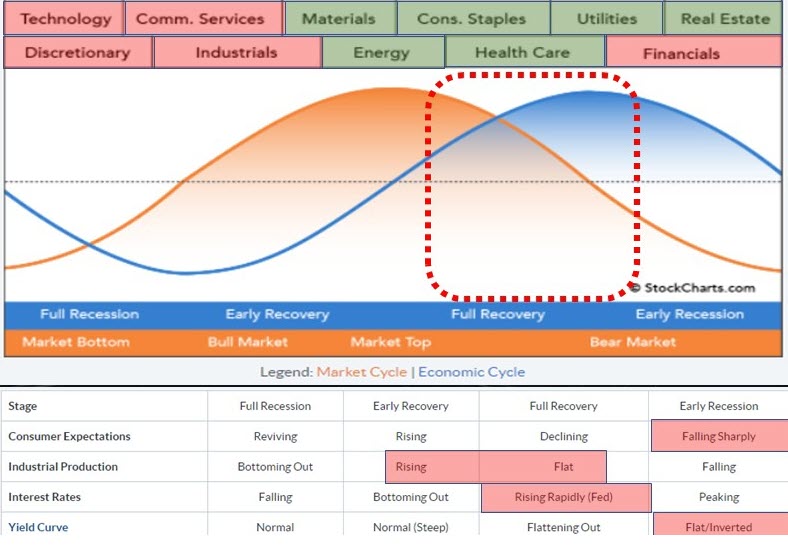

Throughout the highest, you will see that the eleven sectors. The orange sine-wave represents the (inventory) market cycle and the blue line represents “the financial system” as they transfer by way of the varied phases.

Beneath the graph is a desk that reveals 4 macroeconomic metrics that affect the financial system and the market and the way they normally behave in every section.

Sectors

The sectors on the high of the framework point out which sectors normally do nicely throughout which section of the financial system. I’m taking the reverse method. I’m which sectors are doing nicely in the mean time and attempting to detect by which section we’re from there.

With a view to do this, I’ve shaded the sectors throughout the highest of the framework based mostly on (my interpretation of) their present rotations. And in the mean time the image couldn’t be extra clear. Fairly often the colours fluctuate and are a bit blended however in the mean time. It is vitally clear how the purple and inexperienced shaded sectors are aligned.

Protection guidelines!

Macro-Financial Elements

An essential, typically missed, a part of the sector rotation mannequin is the interpretation of the macro-economic elements which can be used as gauges for the financial system.

I’ve a set of 4 charts in a public chartlist that I replace sometimes and use to shade the areas beneath the framework.

The primary issue is “Client Expectations”. Throughout the SC database we’ve $$UMCSENT, the College of Michigan Sentiment Index that I exploit as a gauge.

Within the textual content block on the chart I’ve listed the 4 phases and the everyday conduct of that indicator belonging to that section. So right here IMHO the index is falling sharply which aligns with Early Recession within the framework.

The second indicator is $$IPI, the Industrial Manufacturing Index. This index remains to be rising however not as quick it was. So my judgement is that this aligns someplace between Early Restoration and Full Restoration. It is undoubtedly not falling neither is it bottoming out.

Rates of interest are represented by the 5-year yield on authorities bonds (center of the curve). I believe this qualifies as rising quickly but it surely may nicely be near peaking as it’s nearing a heavy overhead resistance stage coming off the earlier excessive. So this places the motion in charges someplace between Full Restoration and Early Recession.

Lastly, we’ve the yield curve, 10-year minus 2-year. This metric got here down quick in the previous few months and has nearly reached zero. As you already know, ranges beneath zero imply that the yield curve is inverted. That has not occurred but however at 0.19 I really feel comfy labeling this as flat (and really near an inversion).

This aligns with the early recession section.

The readings taken from these 4 charts are shaded within the desk beneath the framework as displayed on the high of this text.

Conclusion

Placing all this info collectively. The sectors which can be outperforming in the mean time, together with the readings from the 4 macro-economic elements result in the conclusion that the financial system is transferring from a full restoration extra in direction of the early recession section. On the identical time, that signifies that the (inventory) market is now past its high and in, or heading in direction of, a bear market.

There isn’t any approach to inform how lengthy and deep that recession might be and the way robust that bear market might be. However I imagine there may be sufficient motive to stay very cautious with regard to the broader inventory market.

#StaySafe, –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels below the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can not promise to answer every message, however I’ll actually learn them and, the place fairly potential, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive methodology to visualise relative power inside a universe of securities was first launched on Bloomberg skilled providers terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Army Academy, Julius served within the Dutch Air Drive in a number of officer ranks. He retired from the army as a captain in 1990 to enter the monetary business as a portfolio supervisor for Fairness & Regulation (now a part of AXA Funding Managers).

Be taught Extra