International optimism over the post-pandemic restoration faces a extreme check after Russia ordered troops to enter Ukraine’s separatist areas, sparking a spherical of sanctions and better power costs, economists stated.

Even earlier than the Ukraine disaster had escalated, central banks have been sounding the alarm over the specter of a protracted interval of excessive inflation.

Now the tensions are forecast to push oil and fuel costs larger, and additional sluggish the post-Covid financial restoration, particularly in Europe, growing issues over the course of inflation and amplifying the dilemma of when to tighten financial coverage.

Most economists suppose superior economies have the resilience to emerge with out deep scars regardless of the difficulties. Daniela Ordonez at Oxford Economics famous that, though the “Russia disaster will put financial optimism to the check”, confidence was excessive after sturdy enterprise surveys.

But an escalation of tensions might rapidly bitter the temper in superior economies, warned Nathan Sheets, international chief economist at Citi.

An outbreak of battle throughout Ukraine would undermine his base case of a comparatively easy financial path forward as inflationary pressures squeezed family incomes. “Within the face of those mounting pressures, recession is now not seen as only a tail threat,” he stated.

The instant menace to the worldwide financial system from escalating sanctions will probably be restricted, economists consider. Though some sectors and commodity customers are depending on commerce with Russia, general exports have fallen again sharply since Russia annexed Crimea in 2014. Russia’s share of German exports has fallen from 3.5 per cent in 2014 to below 2 per cent and its share of US exports is lower than 0.5 per cent.

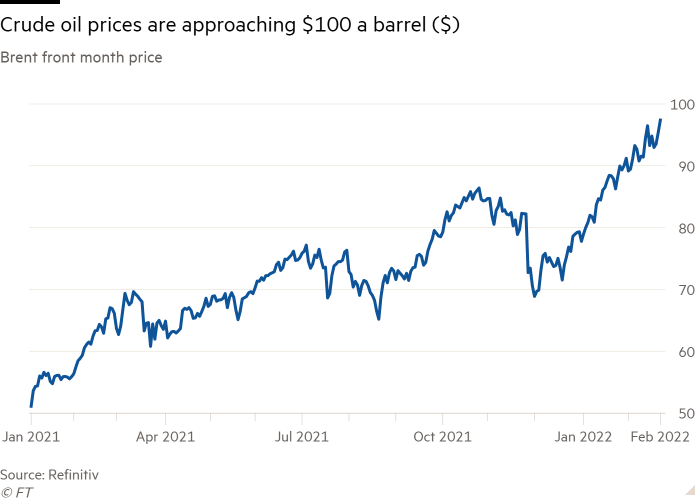

However the oblique impact of Russia’s actions on international oil and fuel costs threatens to be rather more vital. Brent crude costs rose sharply on Tuesday to ranges slightly below $100 a barrel, with wholesale fuel costs additionally up sharply.

Bethany Beckett, economist at Capital Economics, stated that “clearly, a Russia-Ukraine battle raises the danger that inflation stays larger for longer,” hitting power shoppers amongst each firms and households.

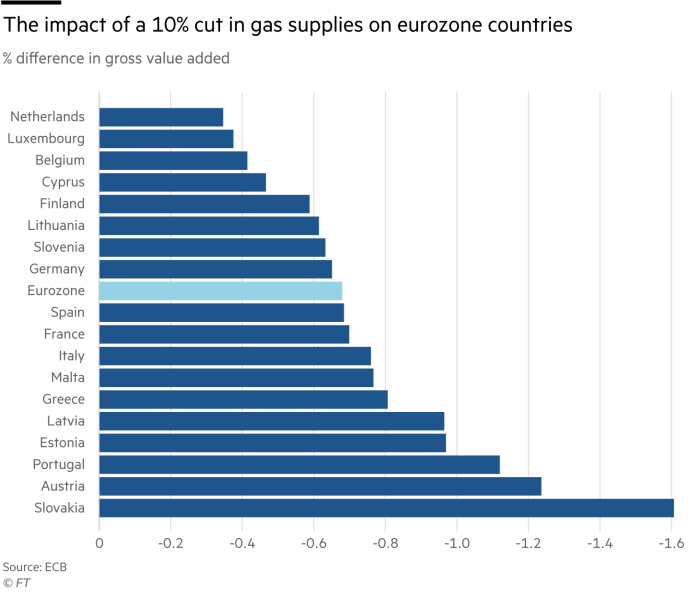

But when provides of fuel from Russia have been to be disrupted, a European Central Financial institution simulation train confirmed the consequences might be painful. It estimated a ten per cent scarcity in fuel might knock 0.7 per cent off eurozone gross home product, with the consequences most pronounced amongst nations with massive fuel and electrical energy sectors and industries most depending on fuel.

Qatar’s power ministry confused on Tuesday that neither it nor others might absolutely change Russian fuel provides to Europe in the event that they have been lower.

The ECB was a little bit extra reassuring about real-world results, nevertheless. It confused that whereas power value rises on the finish of final 12 months will in all probability scale back eurozone output by 0.2 per cent by end-2022, a “vital adverse” impact the ECB stated, this was a smaller impression than its simulation of fuel shortages.

Most economists suppose that this scale of impression wouldn’t be that severe in nations which have suffered a lot bigger contractions through the pandemic and which might adapt to lowered fuel provides from Russia.

Speedy actions resembling Germany’s determination on Tuesday to halt the approval of the Nord Stream 2 fuel pipeline would have “sturdy symbolic worth” and “restricted sensible implications”, in accordance with Elina Ribakova, deputy chief economist of the Institute of Worldwide Finance, as a result of it’s but to be operational.

Holger Schmieding, chief economist of Berenberg Financial institution, additionally urged that Russia would really feel the pinch of tit-for-tat sanctions earlier than western nations. He argued that if the disaster didn’t amplify considerably, sanctions “would weaken the Russian financial system over time with very restricted impression on the superior world”.

Monetary markets would return to regular after some time, he predicted, and after just a few months of setbacks to enterprise and shopper confidence, “financial development in Europe [would be] again on monitor for a powerful post-Omicron rebound amid easing provide shortages”.

Central banks, nevertheless, could be confronted with a extra acute dilemma if there have been additional rises in power costs and inflation. They would wish to exhibit they have been severe about controlling value rises but additionally recognise that the squeeze in incomes would even be extra highly effective in bringing inflation down than tightening financial coverage.

George Buckley, chief European economist at Nomura, stated: “Ought to meals or power costs rise additional and add to near-term inflation pressures, the ECB and Financial institution of England might want to ask looking out questions as as to if that can have a bigger upward impact on inflation expectations and pay, or a downward impact on actual incomes, confidence, spending and thereby medium-term inflation”.

Having signalled that they’re more and more eager to tighten coverage, central bankers are actually making noises suggesting they’d fear as a lot concerning the potential for decrease development as larger inflation.

Isabel Schnabel, a member of the ECB’s government board, advised the FT final week that if tensions in Ukraine escalated, “it’s in my opinion unlikely that we’d speed up coverage normalisation in such circumstances”.

Noting uncertainties over Ukraine and market expectations for a pointy rise in UK rates of interest, Sir Dave Ramsden, deputy governor of the Financial institution of England, stated “there are additionally dangers from tightening financial coverage an excessive amount of”.

Monetary market expectations of a 0.5 proportion level enhance in US charges in March have additionally been scaled again over the previous week, with most anticipating a tightening of half the dimensions.

Views are altering quickly in response to occasions on the bottom in Ukraine. Erik Nielsen, adviser to UniCredit, stated the principle factor economists knew was how little they knew. There have been now “unprecedented uncertainties throughout your entire financial and geopolitical waterfront,” he stated.