Being a finance skilled is stimulating and rewarding, nevertheless it comes with a set of distinctive challenges. The accuracy and timeliness of data is crucial, but for many organizations, the quantity and complexity of economic data is rising constantly. Merely working tougher doesn’t appear to unravel the issue; finance professionals should work smarter, making use of the proper instruments to get the job finished shortly, effectively, and precisely.

This text explores the three largest challenges related to monetary reporting. You’ll learn the way main finance groups apply know-how to the duty of manufacturing quick, correct reviews, eliminating tedious guide effort, giving managers visibility to real-time organizational metrics, and instilling confidence in stakeholders all through the corporate.

Problem 1. ERP Complexity

Enterprise Useful resource Planning (ERP) software program performs a central function within the finance perform. Years in the past, ERP methods at many firms centered totally on core accounting features comparable to Basic Ledger, Accounts Payable, and Accounts Receivable. As computing know-how grew to become ubiquitous, an array of latest accounting and ERP merchandise emerged, and the useful complexity of such methods grew. Stock administration, MRP, challenge administration, and buyer relationship administration (CRM) are actually commonplace, extending or integrating with present ERP software program.

That brings super advantages for small and midsize companies, nevertheless it additionally results in elevated challenges arising from the inherent complexity of the underlying knowledge. Furthermore, this development continues apace, as extra firms than ever join their ERP methods with standalone e-commerce platforms, cell purposes, and cloud-based providers.

Even if you restrict reporting to an remoted ERP system, complexity generally is a formidable problem. Because the performance of the software program will increase, it’s essential to retailer increasingly more data within the underlying database. Many of those methods have grown to comprise a whole bunch and even hundreds of tables, typically with arcane naming conventions and fields that comprise cryptic data. Deciphering all of that data, consolidating it, after which making it helpful and significant to a common viewers is not any straightforward activity.

Database designs will not be usually intuitive to end-users. But these exact same enterprise customers need entry to the essential data that’s locked up of their ERP database. Luckily, there’s a resolution to this downside. The perfect purpose-built reporting instruments can translate arcane database tables and fields into a well-recognized and significant format for typical enterprise customers. This serves as a form of translation layer, making it attainable to navigate advanced ERP data shortly and simply and produce advert hoc reviews just about on demand.

Problem 2. Gradual, Guide Processes

The second key problem arises from the truth that many ERP methods lack a sturdy built-in reporting mechanism. The off-the-shelf reporting instruments that include most enterprise software program are considerably rigid, very troublesome to grasp, or each. In consequence, many finance groups flip to a cumbersome workaround; they export knowledge from their ERP software program, then import it right into a spreadsheet program the place they’ll manipulate, filter, and format it to go well with their wants.

Sadly, manually exporting, formatting, and making ready knowledge in spreadsheets is an inefficient use of sources. Merely transferring knowledge from one place to a different consumes useful employees time — time spent performing an exercise that doesn’t add worth.

Such guide processes additionally are inclined to introduce errors into the info. If you copy and paste data into an present spreadsheet, for instance, the addition of 1 further row could render present formulation inaccurate. When you don’t uncover the error till later, this might lead to dangerous data being disseminated to stakeholders in your group. That undermines confidence within the finance crew’s skill to supply correct reviews, and it may possibly in the end result in dangerous enterprise selections.

There’s yet one more downside with guide processes: the ensuing reviews solely mirror a snapshot in time. As quickly as you export knowledge out of your ERP software program or different enterprise methods, it’s out of date. New transactions won’t be mirrored in your report except you undergo the whole means of exporting, copying, and pasting data yet again.

The answer to this problem is purpose-built reporting software program that robotically accesses the supply knowledge in your ERP system, ideally in actual time. Your finance crew can entry correct, up-to-date reviews anytime, with out performing any guide processes. That saves time and frees up the members of your crew to give attention to higher-value actions.

Problem 3. Dependency on Costly Consultants or the IT Division

Finance professionals have a particular expertise for understanding and decoding the numbers, however they shouldn’t need to develop the form of specialised IT abilities required to develop and keep reviews utilizing advanced instruments. In most organizations, finance depends upon the IT division to try this, or they pay costly outdoors consultants to get the job finished. Sadly, each of these approaches include distinct disadvantages.

In most firms, IT has restricted bandwidth. A request for a brand new report is usually merely added to the queue. It might take days, and even weeks, to see the outcomes. If something within the request will get misplaced in translation, finance may have to attend but once more till IT has time for an additional revision.

Exterior consulting companies can typically be extra responsive, however with that comes a really excessive value. Within the case of extremely specialised reporting instruments, it might be troublesome to seek out certified specialists, which drives prices up even additional.

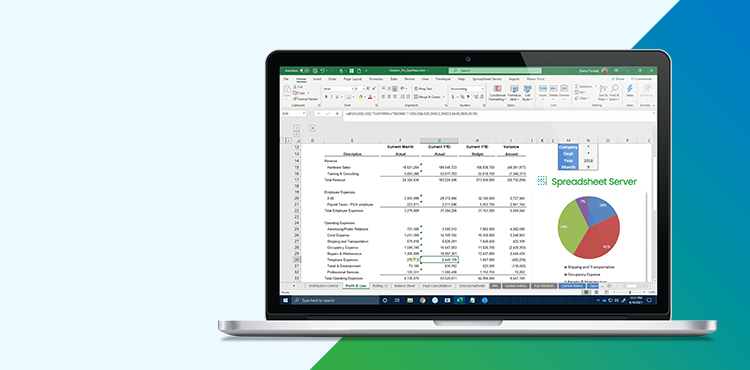

Clear up Monetary Reporting Challenges with Spreadsheet Server

With the proper instruments, finance groups can overcome all three of those challenges, reaching better velocity and agility whereas releasing up their useful time to allow them to give attention to what issues most. Spreadsheet Server from insightsoftware empowers finance professionals to construct advert hoc reviews, accessing real-time data from over 140 completely different ERP methods, with out relying on IT to get the job finished. Spreadsheet Server presents an intuitive option to entry and analyze vital enterprise data immediately inside Microsoft Excel, eliminating guide processes and making your crew extra productive.