We have rallied a TON off the February low, which is definitely encouraging. Whereas I consider it is nonetheless doable that we print a brand new low someday over the following 3-6 months, the numerous rally over the previous few weeks shouldn’t be ignored and will increase the percentages that our 2022 low has been set. On this article, I wish to spell out the the reason why I am not completely satisfied of that backside. I will begin off with one in all my favourite technical mates — relative energy.

Defensive Sectors Proceed to Lead in 2022

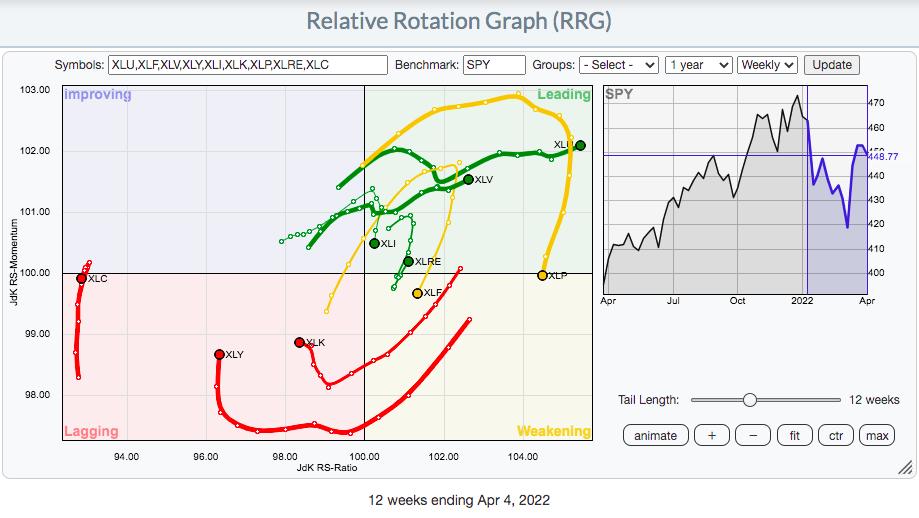

An image is value a thousand phrases, proper? So let me avoid wasting ink right here and easily present you the weekly RRG chart for 9 of our 11 sectors. I am ignoring power (XLE) and supplies (XLB) to concentrate on the connection between the offensive sectors — know-how (XLK), shopper discretionary (XLY), communication companies (XLC), industrials (XLI), financials (XLF) — and the defensive sectors — well being care (XLV), shopper staples (XLP), actual property (XLRE) and utilities (XLU). All 9 of those sectors are mirrored on this RRG chart vs. the benchmark S&P 500:

2022 has been the yr of rotation from aggressive areas of the market to defensive areas of the market. Trying on the above RRG, how will you come to some other conclusion? Whereas we do see the momentum enhancing for the three most essential sectors – XLK, XLY, and XLC – all of them are nicely left of the vertical axis, which is the axis that represents relative energy. We have seen little or no flip again to the correct, and the XLK appears prefer it’s placed on its left flip sign. So, sure the rally has been good, however Wall Avenue has but to noticeably start to maneuver into know-how and shopper discretionary, which is worrisome.

Inflation: The Worst Quantity But Arrives on Tuesday

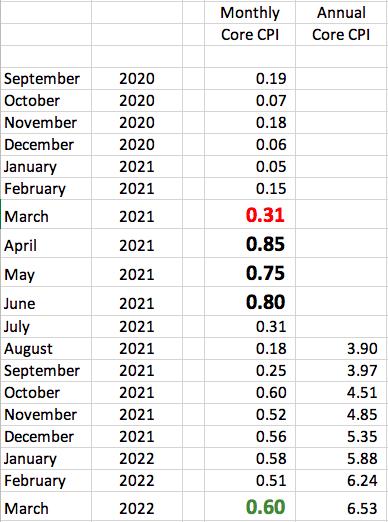

At 8:30am ET on Tuesday, April twelfth, put together your self. The annual core fee of inflation on the shopper stage (Core CPI) goes to leap. The maths is very easy to forecast; you have a look at the final 12 readings on the Core CPI and add them up. That is your annual fee. When a brand new month-to-month Core CPI quantity is launched, you add it to the final annual studying, then subtract the one from a yr earlier. Listed here are the final 18 Core CPI readings, plus an estimate for March 2022:

The massive RED “.31” studying for March 2021 will seemingly get replaced by a better March 2022 studying, which is able to elevate the annual fee of core inflation to the 6.5% space. I’ve used the massive GREEN “.60” studying as an estimate. The precise quantity will clearly change each the March 2022 month-to-month and annual numbers.

Subsequent, I would like you to concentrate on the upcoming April, Could and June numbers. They are going to be changing the month-to-month numbers from 2021 that I’ve included in large BLACK numbers. These are extraordinarily excessive readings that we have not seen since. Each studying since June 2021 has been decrease than these 3, which means that the annual inflation fee will transfer notably decrease over the following 3 months. That is why I have been saying that Tuesday’s studying very nicely might be the height of this pandemic-related inflation surge. It is also why I consider the Fed will again off of its rate-raising marketing campaign. They’ve introduced to the world that they are on “inflation watch”, which helped calm the hyper-inflation worries of the Seventies. Because the economic system naturally slows, probably tipping right into a recession, I see the post-pandemic demand slowing, whereas provide chain points reduce, successfully squashing inflation worries. As this takes place over the summer time months, anticipate the Fed to hit the brakes on their “12 fee hikes forward” rhetoric. That, in flip, could have traders pouring again into treasuries, sending the yields again down. As this transpires, anticipate development shares to SOAR later this yr because the secular bull market regains energy like a hurricane over heat waters.

However endurance might be required for this situation to unfold.

Homebuilders, Truckers and Banks…..Oh My!

In the event you do not consider the inventory market is prepping for a doable recession, then you have not been watching these three teams. Increased treasury yields and mortgage charges are considerably reducing the expectations of residence building corporations ($DJUSHB). Take one have a look at this chart and let me know for those who see one thing completely different than me:

Discover how, even on the absolute value excessive in December 2022, the DJUSHB was shedding relative energy? And 2022 has been downright horrific for residence building, free falling when it comes to relative energy.

Are you anticipating our economic system to strengthen in 2022? Or a minimum of be steady? Nicely, inform that to the truckers ($DJUSTK). Their enterprise mannequin is very easy to grasp: they ship items. When the economic system strengthens or is anticipated to strengthen, they ship MORE items. When the other is in play, they ship LESS items. Test their chart out:

What the heck occurred in mid-March? Simply because the inventory market bottomed and rallied strongly, the truckers’ wheels fell off. In three weeks, the DJUSTK moved from a 3-year relative excessive to 3-year relative low. Clearly, Wall Avenue has undergone a whole makeover and truckers aren’t part of their present plan. Should not we take discover?

Lastly, we’ve got the banks ($DJUSBK). There’s loads of discuss an inverted yield curve because the 2-year treasury yield ($UST2Y) has moved above the 10-year treasury yield ($UST10Y). Having audited banks in my prior profession as a CPA, I might moderately observe the 3-month treasury ($UST3M) vs. the 10-year treasury, which seems to be a lot stronger. However irrespective of how we slice it, banks are performing very poorly, and that is a significant concern:

The 2 “inverted yield curve” calculations are a lot completely different. The previous, utilizing the 2-year treasury yield because the comparability, exhibits that yields did invert (small purple circle), whereas the latter exhibits the yield unfold at its highest stage previously two years. Which one is right? I consider the underside one is suggesting that, when the mud settles, banks might be a superb alternative through the subsequent section of this secular bull market. However within the very near-term, watch the important thing value assist zone from 510-540. That is the place promoting has been contained many instances over the previous yr. A breakdown beneath this assist space might result in a lot additional promoting and, finally, a a lot better shopping for alternative.

It is Not All Bearish

I completely do NOT wish to paint an excellent bearish image. I stated we would get off to a poor begin in 2022 and, certainly, quarter one was not fairly. Perhaps the worst is behind us. Lengthy-term traders ought to keep the course, in my view, as any additional weak spot in 2022 is prone to be adopted up by a really robust rally later this yr and into 2023. In fact, that is simply my opinion. Everyone knows something can occur. However based mostly on my work, analysis, and research of historical past, I am satisfied the percentages level to a really robust rebound as soon as this present mess clears.

On Monday, I plan to put in writing an EB Digest article about one space of the market that I anticipate to flourish within the second quarter. Wall Avenue has endorsed the group as a frontrunner, so do not be shocked to see additional energy within the weeks forward. In the event you’re not presently an EB Digest subscriber, CLICK HERE to begin your FREE subscription with solely a reputation and e-mail handle. There isn’t any bank card required and it’s possible you’ll unsubscribe at any time.

Pleased buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person traders. Tom writes a complete Day by day Market Report (DMR), offering steerage to EB.com members every single day that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a basic background in public accounting as nicely, mixing a singular ability set to method the U.S. inventory market.