Like in any career, merchants additionally use instruments. This simplifies their buying and selling course of and supplies goal data which merchants might use to help their buying and selling evaluation. These instruments are what we name technical indicators.

Technical indicators are a giant a part of buying and selling for many technical merchants. It permits us to learn the market, establish traits and momentum, spot doable provide and demand zones, in addition to possible breakout areas.

There are various various kinds of technical indicators. There are the development following and momentum indicators, channel indicators, oscillators and various kinds of shifting averages. All of those indicators have totally different makes use of and may very well be utilized in several market situations. These indicators even have various levels of effectivity. Not all indicators are made equal. Some are usually more practical than others.

As retail merchants, we search edges that might improve our probabilities of profiting towards the foreign exchange market. Top-of-the-line methods to enhance our edge is by utilizing the instruments that {many professional} merchants use.

Pivot Level Break and Take a look at Foreign exchange Buying and selling Technique is a method that makes use of an indicator that skilled institutional merchants use.

Auto Pivot Plotter Weekly

The Pivot Level indicator might be probably the most well-liked technical indicators utilized by skilled merchants. Merchants from massive banks would typically pay attention to pivot level ranges as a result of they know that the market might do attention-grabbing issues at any time when worth attracts close to to those ranges.

A pivot level is a technical indicator used to establish mechanical help and resistance ranges on the value chart. It’s composed of a midline referred to as the Pivot Level (PP), three Resistance traces (R1, R2 and R3) plotted above the Pivot Level, and three Assist traces (S1, S2 and S3) plotted under the Pivot Level.

The Pivot Level is just the typical of the excessive, low and shut of the earlier interval. The varied help and resistance ranges are computed as follows:

- R1 = (P x 2) – Low

- R2 = P + (Excessive – Low)

- S1 = (P x 2) – Excessive

- S2 = P – (Excessive – Low)

These help and resistance ranges are important worth factors which the market respects. It is because these are static worth factors that institutional merchants think about.

Value would normally bounce off a help or resistance stage particularly when worth is already overextended. Value additionally tends to maneuver in direction of these ranges earlier than consolidating. Value might additionally breakout of those ranges. Nonetheless, worth would typically retest the extent previous to persevering with the route of the momentum breakout.

Many profitable merchants base their commerce plans on how worth reacts to those ranges. They both search for breakouts or bounces from these ranges. Others see it as a doable impediment which worth ought to overcome, so they might fairly both keep away from buying and selling towards these ranges or do protecting cease loss administration as soon as worth touches these ranges.

Superior Oscillator

The Superior Oscillator (AO) is a well-liked technical indicator utilized by many beneficial merchants. It’s a development following indicator used to measure market momentum.

The Superior Oscillator is a straightforward technical indicator calculated primarily based on the distinction between a 5 interval Easy Transferring Common (SMA) and a 34 interval Easy Transferring Common (SMA). Nonetheless, as a substitute of utilizing the closing worth as the premise for the computation, it makes use of the midpoint of the bars.

The outcomes are then displayed as histogram bars. Constructive bars point out a bullish development bias, whereas detrimental bars point out a bearish development bias. The indicator additionally signifies the power of the development primarily based on the colour of the bars. Constructive inexperienced bars point out a strengthening bullish development, whereas optimistic crimson bars point out a weakening bullish development. Then again, detrimental crimson bars point out a strengthening bearish development, whereas detrimental inexperienced bars point out a weakening bearish development.

As a result of the AO is virtually primarily based on the crossing over of two shifting averages, the indicator is primarily used to establish development route and development reversals. Merchants might filter out trades that aren’t inline with its development bias. Merchants might additionally use the crossing of the bars over its midpoint, which is zero, as a sign of a possible development reversal.

Buying and selling Technique

This buying and selling technique trades on breakouts of the help and resistance traces of the weekly pivot factors. It makes use of the Auto Pivot Plotter Weekly indicator to mechanically plot the pivot factors.

To commerce this technique, we can be on the lookout for markets which have robust momentum and is more likely to break by way of a pivot level help or resistance stage. We then await worth to interrupt by way of such ranges and retrace again a bit after the breakout. In the course of the retest section worth ought to present indicators of worth rejection on the help or resistance line. That is characterised by lengthy wicks pushing towards the help or resistance stage. We then await worth motion to indicate that worth is selecting up momentum within the route of the breakout. That is characterised by momentum candles.

The Superior Oscillator is used to verify the development bias. Trades are filtered primarily based on whether or not the AO histogram bars are optimistic or detrimental.

Indicators:

- Auto-Pivot_Plotter_Weekly_V2_1

- Superior

Most well-liked Time Body: 15-minute chart solely

Foreign money Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York periods

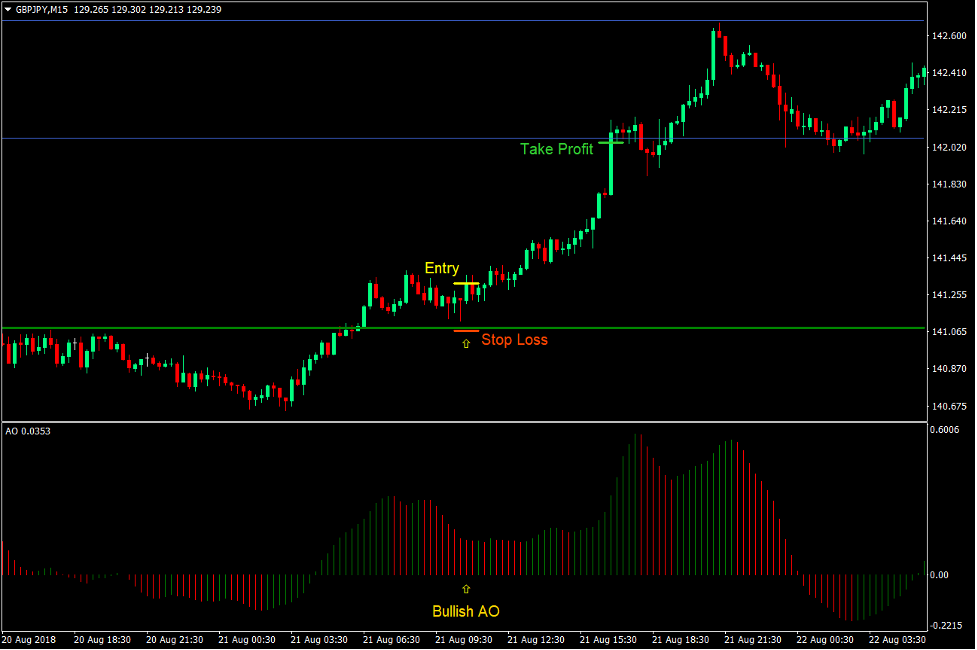

Purchase Commerce Setup

Entry

- The Superior Oscillator bars needs to be optimistic.

- Value ought to break above the Pivot Level or Assist ranges.

- Value ought to retest the Pivot Level or Assist ranges.

- Enter a purchase order as quickly as a bullish momentum candle completes.

Cease Loss

- Set the cease loss under the Pivot Level or Assist stage.

Exit

- Set the take revenue goal under the subsequent Resistance stage.

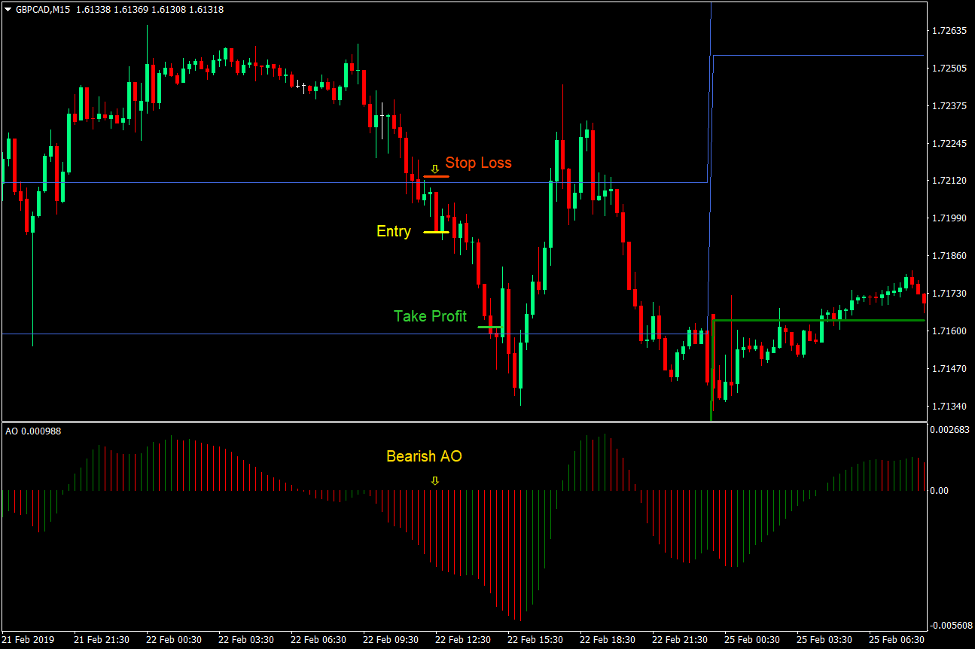

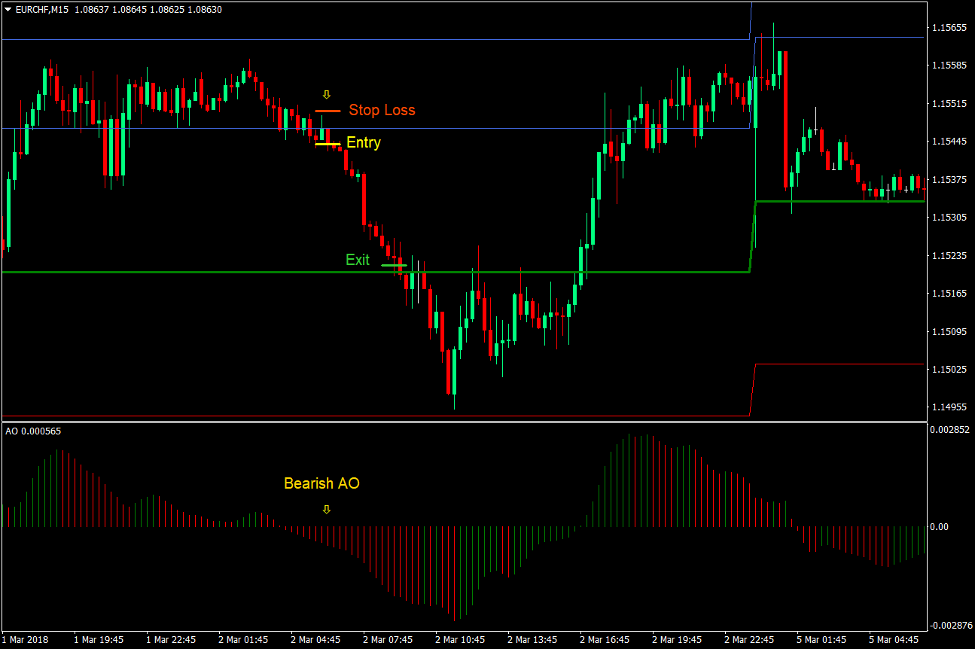

Promote Commerce Setup

Entry

- The Superior Oscillator bars needs to be detrimental.

- Value ought to break under the Pivot Level or Resistance ranges.

- Value ought to retest the Pivot Level or Resistance ranges.

- Enter a promote order as quickly as a bearish momentum candle completes.

Cease Loss

- Set the cease loss above the Pivot Level or Resistance stage.

Exit

- Set the take revenue goal above the subsequent Assist stage.

Conclusion

Pivot Factors are distinctive ranges on the value chart. These areas are the place many of the motion happens. Value would both bounce off or break by way of these ranges. Both manner, each presents alternatives for merchants to revenue.

The query is that if worth would break by way of or bounce off the extent. The Superior Oscillator is a superb software to make use of to verify the power and route of the development. This enables us to filter out trades which might be both shedding momentum or are going towards our development bias.

Buying and selling the breakout and retest technique on Pivot Level help or resistance ranges is a examined and confirmed buying and selling technique. Merely including affirmation to the combo makes the chance of a worthwhile commerce even higher.

Foreign exchange Buying and selling Methods Set up Directions

Pivot Level Break and Take a look at Foreign exchange Buying and selling Technique is a mixture of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the amassed historical past knowledge and buying and selling alerts.

Pivot Level Break and Take a look at Foreign exchange Buying and selling Technique supplies a possibility to detect numerous peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Based mostly on this data, merchants can assume additional worth motion and regulate this technique accordingly.

Beneficial Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

How one can set up Pivot Level Break and Take a look at Foreign exchange Buying and selling Technique?

- Obtain Pivot Level Break and Take a look at Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 information to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you need to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Pivot Level Break and Take a look at Foreign exchange Buying and selling Technique

- You will notice Pivot Level Break and Take a look at Foreign exchange Buying and selling Technique is obtainable in your Chart

*Notice: Not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain: