$95,615!

$95,615!

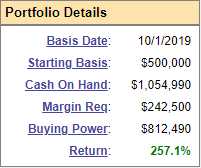

That is how a lot our Lengthy-Time period Portfolio has gained since our March 18th assessment and it is solely April ninth! We solely had $634,785 value of positions on the 18th and now they’re $730,400 (the remaining is over $1M in CASH!!!) so that may be a utterly insane acquire of 15% in 3 weeks. That is an annulized return fee of 260% – do you actually suppose that is sustainable?

I do know we maintain making an attempt to money within the LTP however then we maintain deciding the positions are excellent and we actually cannot argue with the outcomes however the entire thing merely has to break down in some unspecified time in the future. It is the market that’s inflicting this idiocy – our methods simply eggagerate the features as we use choices to leverage the upside momentum and, for the reason that broad market by no means goes down and we are inclined to make smart worth picks – we make outized features in our digital portfolios.

Beneficial properties are, in fact, pretty on paper however it’s important to ensure you maintain them and that is the trick because the Concern of Lacking Out on a contiued rally tends to maintain us from sensibly cashing in our features. We’re 2/3 CASH!!! within the LTP and most of our portfolios so think about what we might be making if we have been gung-ho bullish however we discovered our lesson in 2000 and 2008 that rallies can finish in a snap and you’ll’t merely unwind your positions on the first trace of bother – that is simply not the way in which it really works.

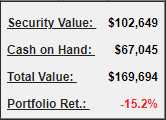

So we hedge utilizing our Brief-Time period Portfolio (STP) and, as I discussed on Wednesday, that $200,000 portfolio was down 3.1% and now, with the prolonged rally, it is down 15.2%, with the rally knocking us down by about $26,000 so the online acquire of our paired portfolios is “solely” about $70,000 for the month.

So we hedge utilizing our Brief-Time period Portfolio (STP) and, as I discussed on Wednesday, that $200,000 portfolio was down 3.1% and now, with the prolonged rally, it is down 15.2%, with the rally knocking us down by about $26,000 so the online acquire of our paired portfolios is “solely” about $70,000 for the month.

What which means although, is that the hedges are on gross sales and, since we simply make web $70,000, we must always actually be placing a portion of that cash to work shopping for extra hedges. The STP positions we now have in the intervening time gave us about $500,000 value of draw back safety however now we now have $95,615 in further positions to guard,…