Ask any craftsman the key to excellence, and you’ll possible hear that, along with ability, the craftsman wants the correct instruments for the venture.

The identical might be mentioned for finance groups as they work on operational reporting. Essentially the most expert finance professionals nonetheless want the correct instruments to get the job achieved nicely.

insightsoftware partnered with Hanover Analysis to find which instruments finance professionals use most for operational reporting and the way they really feel about these instruments. In a survey of 500 finance decision-makers throughout a number of industries around the globe, we discovered that 89 % of finance professionals should not glad with the instruments they use for operational reporting. Solely 23 % are capable of produce all of the operational experiences required.

A Fast Overview of the State of Operational Reporting

Operational reporting, typically known as enterprise reporting, provides useful enterprise intelligence to decision-makers all through the enterprise. These experiences concentrate on short-term realities and draw from low-level information throughout a number of enterprise programs to supply a transparent and concise view of each day operations.

Finance groups generate many forms of operational experiences for departments throughout the group. Though finance and accounting are essentially the most frequent customers of those experiences, different high departments that use operational reporting repeatedly embrace:

- Gross sales

- Analytics

- Buyer Providers

- Human Assets

- Advertising

Because of the nature of operational reporting, finance professionals discover themselves creating many operational experiences on a recurring foundation. Half of economic decision-makers create recurring experiences at the very least weekly, and 12% of respondents to our survey create some experiences each day.

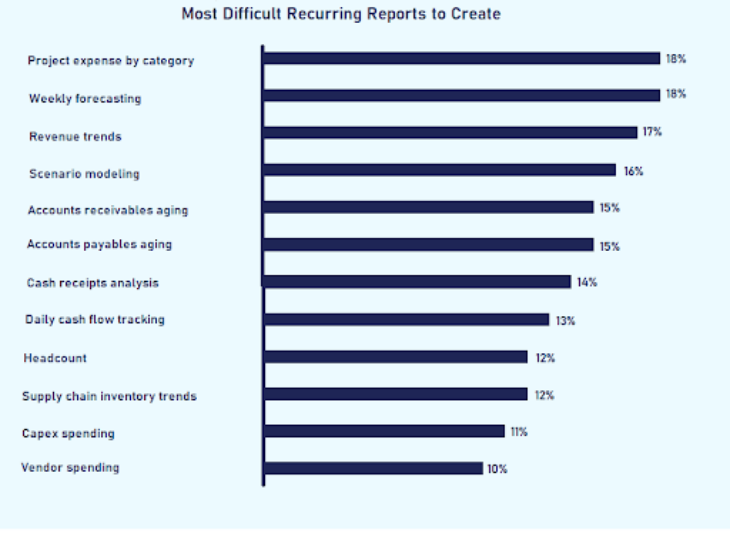

Among the many recurring experiences requested, finance groups most frequently cite accounts receivable getting older, accounts payable getting older, and each day money circulate monitoring as the highest three most typical recurring experiences.

Creating every of those experiences comes with some challenges, however the experiences most frequently recognized as being problematic to supply are product expense by class, weekly forecasting, and income developments.

Instruments in Use for Operational Reporting

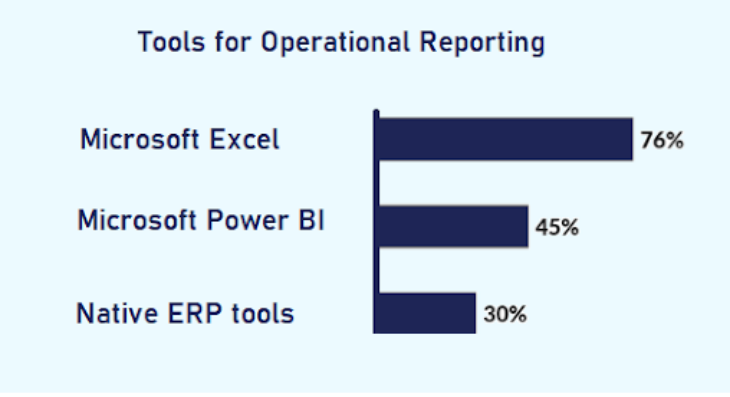

The three most typical instruments used for operational reporting, in keeping with survey respondents, are:

- Microsoft Excel

- Microsoft Energy BI

- Native ERP reporting instruments

General, 76% of respondents use Microsoft Excel, possible due to familiarity with it. Microsoft Excel is a go-to instrument for finance groups that manually generate their experiences. Since virtually one-third of respondents are nonetheless producing experiences both all or principally manually throughout all report sorts, Microsoft Excel is, by far, essentially the most generally used instrument for operational reporting.

Forty-five % of respondents use Microsoft Energy BI. Amongst these firms with fewer than a thousand staff, 40% use this instrument, whereas amongst firms with greater than a thousand staff, use of Microsoft Energy BI rises to 50%.

Thirty % of respondents use the out-of-the-box instruments out there with their enterprise useful resource planning (ERP) instrument.

These instruments are all nice instruments for his or her supposed function. However, bear in mind the craftsman talked about on the outset? If you’ll use a instrument appropriately, it should be used for its supposed function. Not one of the instruments talked about above are purpose-built for operational reporting. Therein lies the issue.

Why Solely 11% of Finance Professionals Are Comfortable With Their Instruments

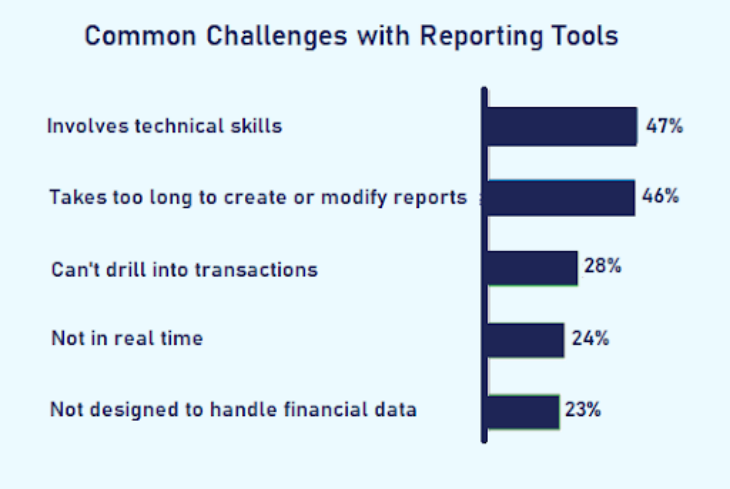

When requested to determine the challenges they face with operational reporting, 23% of respondents talked about the truth that the instruments they’re utilizing should not designed to deal with monetary information.

What does that imply in sensible phrases? Finance information has inherent dimensionality and usually needs to be flattened into two dimensions for consumption by commonplace enterprise intelligence instruments. This requires finance groups to manually transfer the related information right into a instrument that enables them to govern and current the info in an comprehensible means. This will contain loading information into a knowledge warehouse. On this state of affairs, producing experiences turns into a time-intensive, demanding job. Moreover, while you create a report on this means, the info is not linked to the supply system, that means that the report is outdated the second it’s created.

With no dwell hyperlink to supply information, finance groups can’t produce real-time experiences, nor can they drill down into the minute particulars that matter for operational reporting.

To make issues tougher, a few of the instruments used require important technical expertise, which ends up in a dependence on IT. Contemplating the sheer quantity and velocity of operational experiences required, dependence on IT makes well timed report era out of attain for a lot of organizations.

How one can Deal with Operational Reporting Challenges

What’s the takeaway for finance groups? It’s clear that finance groups should consider carefully about their selection of instruments for monetary reporting. To deal with the commonest challenges, finance decision-makers ought to search for instruments that:

- Enable non-technical customers to generate experiences simply.

- Automate recurring reporting.

- Enable customers to drill right down to a granular transactional stage.

- Allow real-time entry to supply information from present enterprise programs.

- Are purpose-built to deal with monetary information.

insightsoftware permits streamlined operational reporting for finance groups in a number of industries and geographies with instruments which are purpose-built for monetary and operational reporting. We work with firms globally to facilitate sooner, extra correct reporting throughout the enterprise.