Many people who find themselves not into buying and selling have totally different opinions about buying and selling. Some assume that buying and selling is simply playing with value actions. Others assume buying and selling may be very tough and is reserved just for the intellectually elite. Others assume that buying and selling is a straightforward cash, get wealthy fast kind of job that’s too good to be true. Any of those assumptions are a actuality for various merchants. Buying and selling will be became playing if not completed with a correct buying and selling technique. Buying and selling don’t require you to be a genius, but additionally it is very tough. If completed proper and when you’ve got discovered the best way to commerce, buying and selling is the simplest solution to earn some huge cash, but you need to pay your dues to get up to now.

Not all merchants would get wealthy fast with buying and selling. Nevertheless, it’s often those that are keen to place within the work who’re in a position to grasp the craft. Foreign currency trading is about grinding by your commerce course of day in and day trip from Monday to Friday. Those that are keen to grind might quickly be rewarded with the abilities to earn cash anyplace on the planet.

Nightcrawler Pattern Foreign exchange Buying and selling Technique is a pattern following technique which can be utilized by merchants to earn a living out of the foreign exchange markets. It makes use of some technical indicators which might assist merchants establish trending markets and grind by every wave that the pattern makes.

Stochastic Cross Alert

The Stochastic Oscillator is among the hottest technical indicators that merchants might use. It’s out there in any buying and selling platform and charting software program or web site. It is usually most likely one of many easiest indicators to make use of. But, regardless of its simplicity, it’s nonetheless a really efficient indicator which may present a ton of data.

The fundamental Stochastic Oscillator was developed to assist merchants establish short-term traits, pattern reversals and imply reversals. It’s composed of two strains which oscillate inside the vary of 0 to 100. Pattern is recognized primarily based on how the 2 strains are stacked. If the sooner line is above the slower line, then the pattern is bullish. If the sooner line is under the slower line, then the pattern is bearish. As such, crossovers between the 2 strains are thought of pattern reversal alerts.

Stochastic Oscillators additionally usually have markers at 20 and 80. Traces under 20 point out that value is oversold, whereas strains above 80 point out that value is overbought. Reversal alerts occurring at these situations have a robust chance to end in a imply reversal.

Stochastic Cross Alert indicator simplifies these entry alerts. It principally plots arrows at any time when it detects reversal alerts occurring whereas the underlying strains are both oversold or overbought.

Hull Transferring Common

The Hull Transferring Common (HMA) is a modified model of a shifting common aimed toward addressing the same old weaknesses of a Easy Transferring Common (SMA).

Transferring averages are often plagued with two widespread weaknesses. It’s both too lagging or is simply too inclined to market noise. Merchants would often handle this by rising the variety of intervals used within the shifting common line. This tends to smoothen out the shifting common line, but it additionally makes it much less responsive to cost actions. This makes most shifting common commerce setups both lagging or too inclined to false alerts resulting from market noise.

The HMA was developed to handle these two considerations. It manages to lower the lag considerably whereas enhancing the smoothing impact of its line on the similar time. This creates a shifting common line that may be very helpful for figuring out traits and pattern reversals.

This model of the HMA identifies pattern reversals and signifies it with the altering of its coloration. Inexperienced strains point out a bullish pattern, whereas darkish violet strains point out a bearish pattern.

Buying and selling Technique

This buying and selling technique produces commerce alerts primarily based on confluences coming from the Stochastic Cross Alert and Hull Transferring Common indicators, whereas aligning commerce alerts with the long-term pattern.

To establish the long-term pattern, we will likely be utilizing the 100-period Exponential Transferring Common (EMA). The pattern will likely be primarily based on the final location of value motion in relation to the 100 EMA line and the slope of the 100 EMA line.

Commerce alerts are generated at any time when the Stochastic Cross Alert indicator produces and arrow pointing the course of the pattern whereas being in confluence with the altering of the colour of the HMA line.

Indicators:

- 100 EMA

- Stochastic_Cross_Alert

- Hull-moving-average

Most popular Time Frames: 30-minute, 1-hour, 4-hour and day by day charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York classes

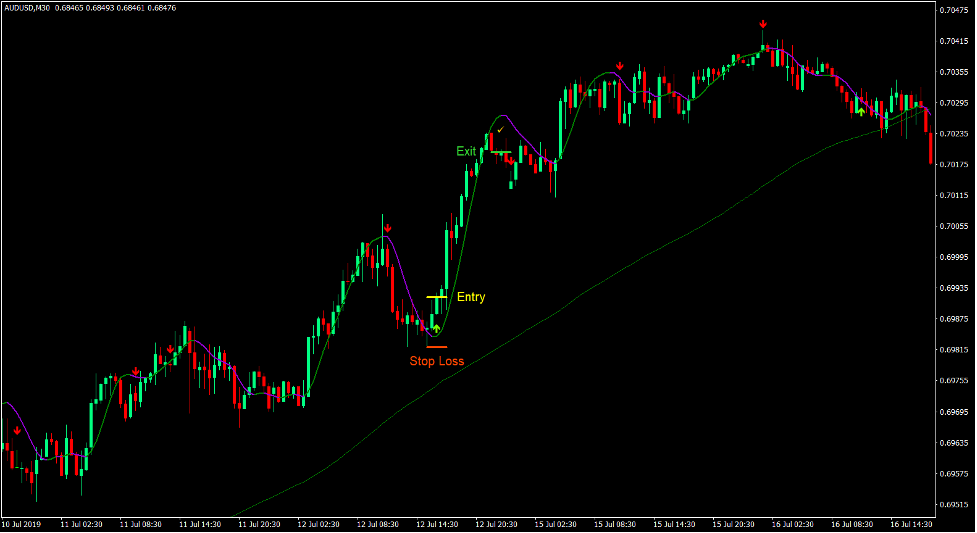

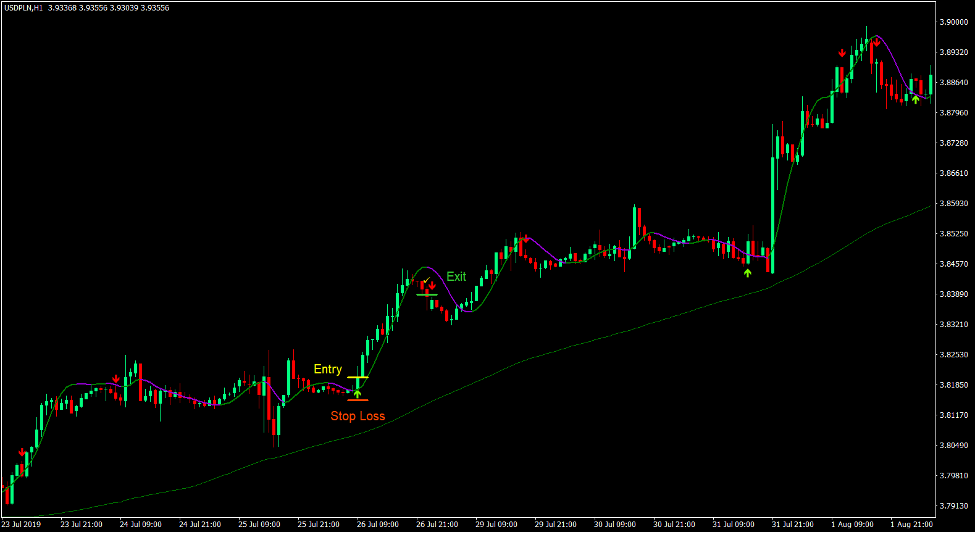

Purchase Commerce Setup

Entry

- The 100 EMA line ought to be sloping up.

- Value motion should be typically above the 100 EMA line.

- Value motion should be making larger swing highs and swing lows.

- The Stochastic Cross Alert indicator should plot an arrow pointing up.

- The HMA line ought to change to inexperienced.

- These bullish alerts ought to be carefully aligned.

- Enter a purchase order upon affirmation of those situations.

Cease Loss

- Set the cease loss on the assist stage under the entry candle.

Exit

- Shut the commerce as quickly because the Stochastic Cross Alert indicator plots an arrow pointing down.

- Shut the commerce as quickly because the HMA line modifications to darkish violet.

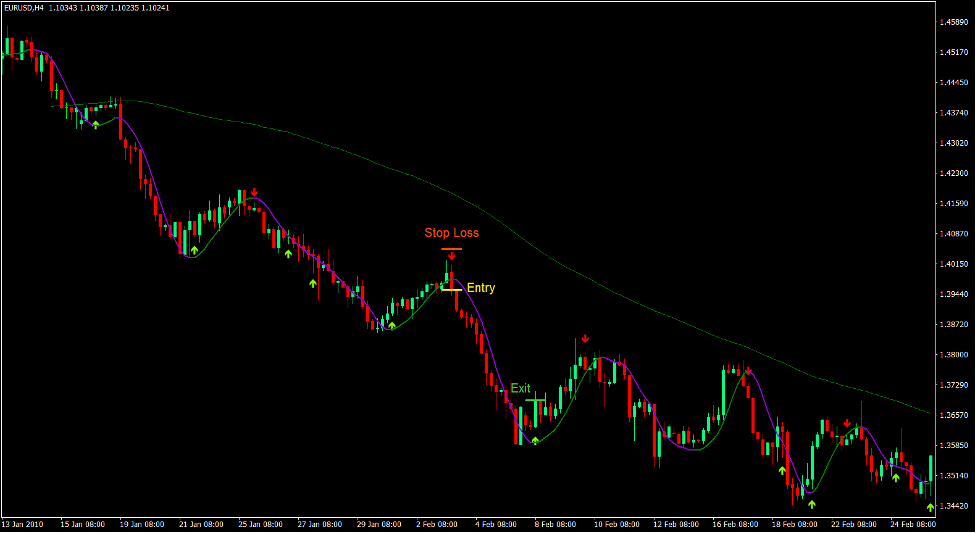

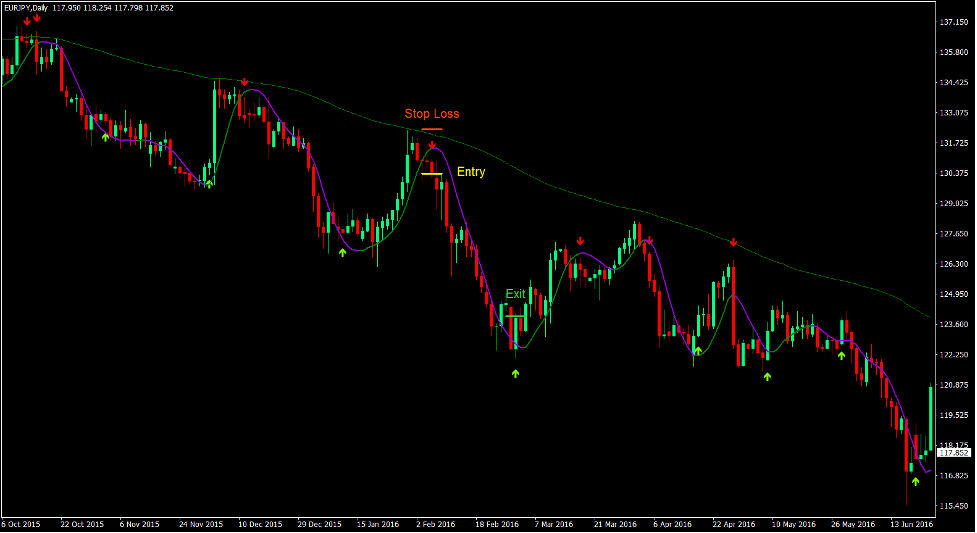

Promote Commerce Setup

Entry

- The 100 EMA line ought to be sloping down.

- Value motion should be typically under the 100 EMA line.

- Value motion should be making decrease swing highs and swing lows.

- The Stochastic Cross Alert indicator should plot an arrow pointing dwon.

- The HMA line ought to change to darkish violet.

- These bearish alerts ought to be carefully aligned.

- Enter a promote order upon affirmation of those situations.

Cease Loss

- Set the cease loss on the resistance stage above the entry candle.

Exit

- Shut the commerce as quickly because the Stochastic Cross Alert indicator plots an arrow pointing up.

- Shut the commerce as quickly because the HMA line modifications to inexperienced.

Conclusion

As a pattern following technique, this technique does produce a good win fee and reward-risk ratio. Merchants can constantly revenue from the foreign exchange market due to this.

Nevertheless, utilizing this technique within the unsuitable market situation could possibly be detrimental to an account. Its accuracy relies upon extremely on it being traded in a trending market situation.

As such, the important thing to profiting utilizing this technique is in figuring out the right market situation the place it could possibly be used.

Foreign exchange Buying and selling Methods Set up Directions

Nightcrawler Pattern Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to rework the accrued historical past information and buying and selling alerts.

Nightcrawler Pattern Foreign exchange Buying and selling Technique offers a chance to detect varied peculiarities and patterns in value dynamics that are invisible to the bare eye.

Based mostly on this info, merchants can assume additional value motion and modify this technique accordingly.

Really useful Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

Methods to set up Nightcrawler Pattern Foreign exchange Buying and selling Technique?

- Obtain Nightcrawler Pattern Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 information to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you need to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Nightcrawler Pattern Foreign exchange Buying and selling Technique

- You will note Nightcrawler Pattern Foreign exchange Buying and selling Technique is out there in your Chart

*Be aware: Not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain: