In the present day after the bell, regionally centered social community Nextdoor reported its fourth-quarter earnings. The corporate mixed with a SPAC final November, making at this time its first quarterly report since going public.

In excellent news for each Nextdoor buyers and the overall SPAC market, the corporate managed to greatest income expectations, resulting in modest share-price appreciation in after-hours buying and selling this afternoon. Whereas nonetheless sharply beneath its pre-combination worth of $10 per share — Nextdoor’s inventory is price $6.50 after its small after-hours positive aspects — the corporate’s outcomes are usually optimistic and price our time to unpack.

Nextdoor’s This autumn

Within the fourth quarter of 2021, Nextdoor recorded revenues of $59.3 million, up 47.9% from its year-ago tally of $40.1 million. Nevertheless, the corporate additionally had an costly quarter, with working prices of $88.6 million — up sharply from a year-ago mark of $55.5 million — resulting in a bigger web lack of $29.3 million within the quarter, up from $14.9 million in This autumn 2020.

What drove the massive acquire in prices that led to Nextdoor’s profitability taking successful? Partially a large uptick in share-based compensation prices, one thing that we regularly see in firms that not too long ago went public. For that cause, adjusted EBITDA could also be a extra affordable revenue metric for Nextdoor for this explicit quarter. By that metric, Nextdoor misplaced a far-smaller $7.8 million, up solely marginally from a year-ago adjusted EBITDA deficit of $7.6 million.

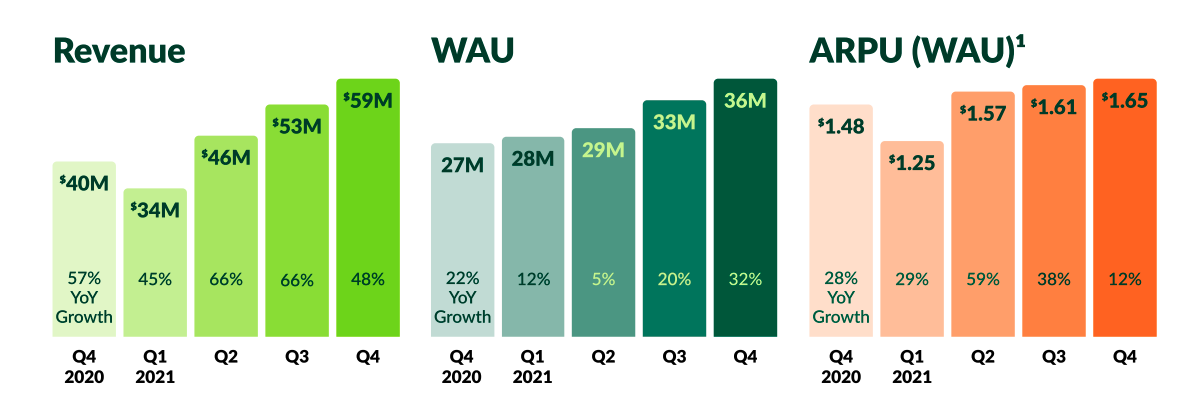

Social networks have a tendency to supply a set of user-focused metrics to associate with their uncooked monetary information, giving buyers a glance contained in the mechanics of their group. Nextdoor is not any completely different. I current to you a set of colourful bar charts:

Picture Credit: Nextdoor investor presentation

Income now we have mentioned, so let’s deal with the opposite two datasets. WAU, or weekly energetic customers, is a key metric for Nextdoor; if its person rely falls, it possible received’t have the ability to shut a income hole by merely squeezing extra top-line from remaining customers. Recall that Meta is having this difficulty to some extent. In excellent news for Nextdoor, WAU development appears fairly stable in its previous few quarters.

Much more, the corporate set what’s a minimum of an area most in its ARPU per WAU. What does that imply? The metric tracks common income per person for weekly energetic customers. I suppose we might name this ARPWAU? Which, by the way, is similar sound that one would possibly make if somebody threw a bowling ball into their abdomen.

Regardless, extra WAU and extra ARPU per WAU means extra income. Which is what Nextdoor desires.

The long run

Traders had anticipated Nextdoor to report $55.4 million in income in This autumn 2021, per Yahoo Finance information. The corporate beat that mark.

Wanting forward, buyers anticipate income of $48.41 million in Q2 2022 and $260.0 million for the 12 months. In its earnings report, Nextdoor mentioned that it expects $48 million price of income for the present quarter and “between” $254 million and $256 million in income for the 12 months, up from a previous goal of $252 million.

Why aren’t shares of Nextdoor appreciating extra in mild of its income beat and usually OK-looking person exercise outcomes? Maybe the slight hole between its full-year 2022 steering and avenue expectations. Traders like sturdy trailing outcomes, however in addition they covet forecasts that greatest expectations, and Nextdoor didn’t handle to each in its newest report.