For founders who need to work with individuals like them, New Period Capital Companions will match that invoice.

Gideon Argov, Ran Simha and Ziv Conen have been all constructing companies earlier than coming collectively at New Period.

Simha is an engineer by commerce, however went into finance at Lehman Brothers and a hedge fund earlier than taking a prestigious place as financial and know-how advisor for former Israeli president Shimon Peres. Conen is on the know-how facet in areas like protection, whereas Argov was on the helm of some know-how firms.

Argov says the agency’s major goal is to take Israeli firms to the subsequent degree — after which the one past that. New Period needs to specialise in scaling early-stage firms outdoors of Israel, serving to them discover and rent good individuals and arrange their group in components of the world the place they’ve by no means operated, in addition to kind strategic and funding partnerships.

“All of us consider in serving to Israeli firms with their early-growth section,” he added. “We assist them scale outdoors of Israel and develop into a world citizen. We have now been ESG-oriented from day one and are the primary Israeli VC to take the United Nations Ideas for Accountable Funding to coronary heart.”

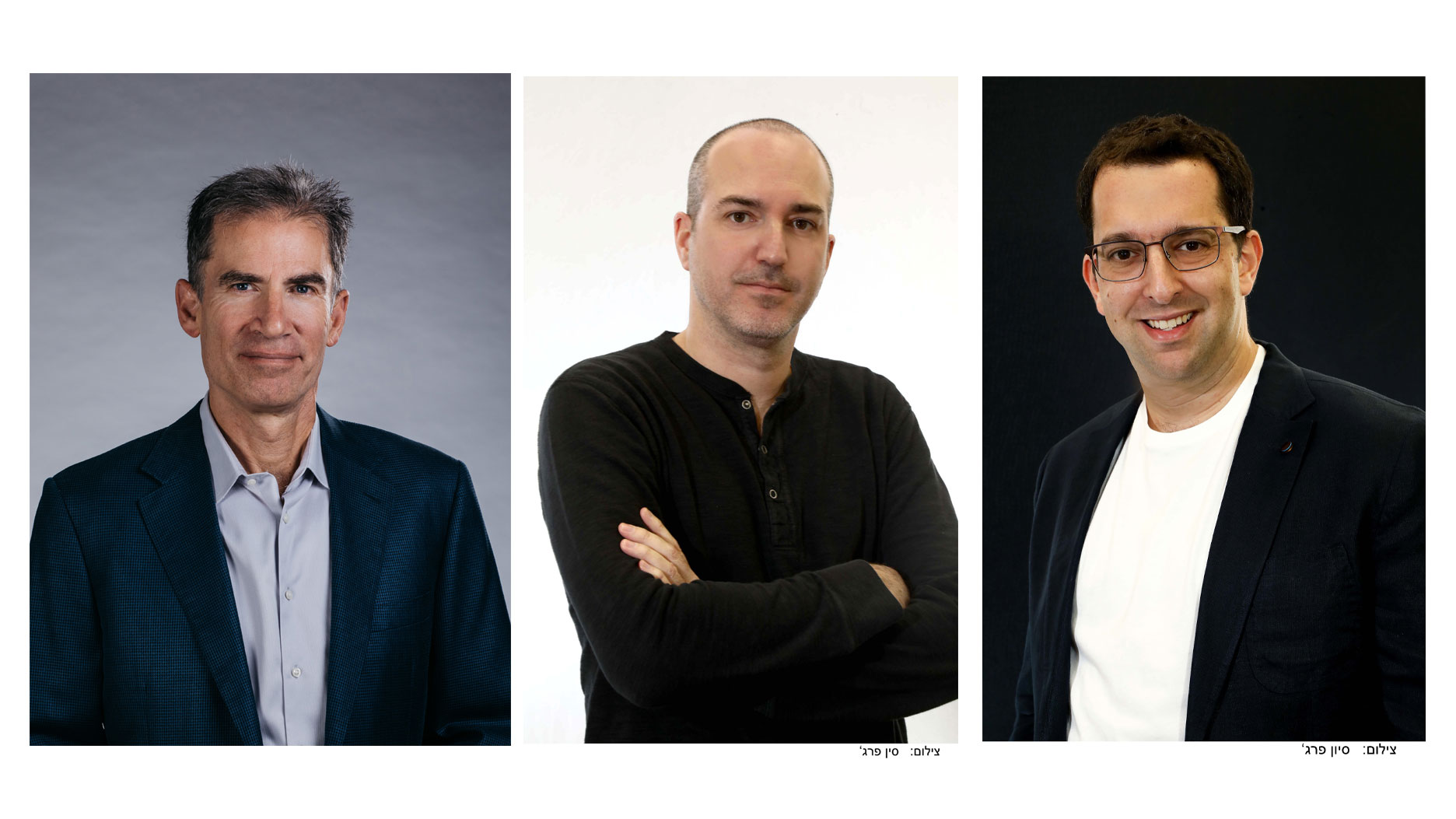

New Period Capital Companions co-founder and managing associate Gideon Argov, co-founder and managing associate Ran Simha and associate Ziv Conen. Picture Credit: Elad Malka and Sivan Farag

Conen famous, too, that with the battle for expertise extending from builders now to product individuals, New Period is exclusive in providing strategic problem-solving classes with founders to deal with their issues.

The agency is business agnostic, however a few of the sectors the group is attracted to incorporate fintech, HR tech, mobility, cybersecurity and improvement instruments. Throughout all of these industries sits synthetic intelligence, which Conen says the agency seems to be at as type of a “tech moat” that will give firms an edge over their rivals.

New Period raised $60 million for its first fund, the place the restricted associate make-up was largely high-net-worth people, household workplaces and founders of enormous non-public fairness and hedge funds within the U.S. and huge U.S. companies involved in investing within the Israeli ecosystem. It invested in 10 firms from that fund, which incorporates unicorn Papaya World and Workiz.

The agency raised $140 million for its second fund, and half of the LPs are U.S. and Israeli establishments — pension funds and insurance coverage firms — and the opposite half are the LPs from the primary fund. New Period can also be offering firms a chance to immediately co-invest with them through a particular objective car.

Out of the second fund, the agency expects to write down common examine sizes between $5 million and $8 million. It has already invested in 9 firms and is planning for 20 new firms total. Investments embody cybersecurity startup Neosec and ageing grownup firm Assured Allies.