One of many hottest Canadian shares during the last yr has been BlackBerry (TSX:BB)(NYSE:BB), particularly after the numerous rallies it has seen during the last 12 months. Nonetheless, regardless of BlackBerry being a extremely fashionable inventory, there are a number of corporations which might be significantly better to personal and which you’ll be able to plan to carry for years till retirement.

The important thing to discovering companies you possibly can have faith proudly owning is to determine ones which have robust aggressive benefits and may proceed to develop and earn enticing money flows for many years.

And though BlackBerry may finally turn into that sort of inventory, in the intervening time, it faces many challenges along with important competitors.

So in the event you’re trying to discover high-quality Canadian development shares that you could personal till retirement, listed here are two of the very best to think about over BlackBerry in the present day.

A prime Canadian infrastructure firm

Probably the greatest development shares in Canada for long-term traders must be Brookfield Infrastructure Companions (TSX:BIP.UN)(NYSE:BIP). Brookfield owns a large portfolio of utility, transportation, midstream, and knowledge infrastructure property in international locations worldwide.

This portfolio of property isn’t just distinctive. It’s additionally managed by a high-quality group of pros. So there are a number of causes to purchase Brookfield over BlackBerry inventory in the present day.

First off, as a result of it has many fastened prices, however a lot of its income is tied to inflation, Brookfield can truly profit from the present financial atmosphere.

As well as, whereas tech shares, like BlackBerry, are falling out of favour, Brookfield is a wonderful funding for this atmosphere. It’s a prime defensive inventory because of all of the important providers its property present, however the way in which the fund is managed additionally makes it a prime development inventory.

Administration is constantly recycling money and discovering new investments. Brookfield ideally seems for property which might be undervalued or underperforming however have potential. It will possibly then are available in, enhance the operations, which assist to develop the valuation meaningfully.

These improved property can then generate extra earnings for the fund, or if the worth is true, Brookfield can determine to promote the property and use the money to spend money on new alternatives. For this reason its acknowledged funding goal is to develop traders’ capital by 15% over the long term.

It’s a superb inventory for long-term traders. There could also be a yr or two of decrease development, however in the long term, it can develop your capital exceptionally effectively, all whereas being extremely dependable and defensive.

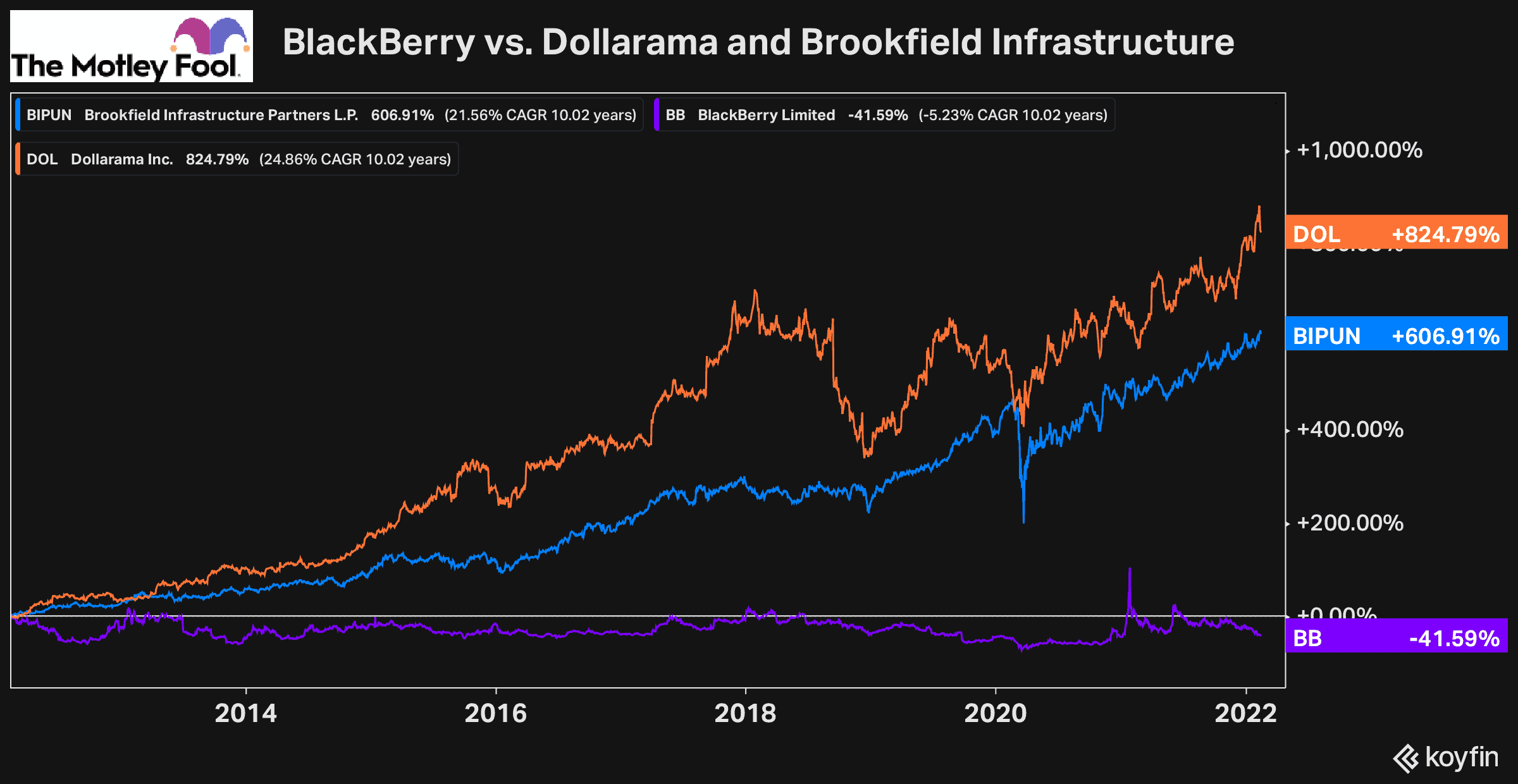

It has massively outperformed BlackBerry inventory during the last yr, the final three years, the final 5 years, and the final 10 years. And I’d anticipate that to proceed going ahead.

So slightly than speculate on BlackBerry inventory in the present day, Brookfield Infrastructure Companions looks like a no brainer funding.

A prime Canadian retail inventory to purchase as a substitute of Blackberry

Along with Brookfield, Dollarama (TSX:DOL) is one other glorious development inventory that additionally has a number of the explanation why it’s value a purchase in the present day.

First off, like Brookfield, it may well additionally carry out effectively on this financial atmosphere. Whereas Dollarama may even see prices rise with inflation, it can probably see gross sales volumes rise as extra customers look to offset inflation by purchasing at greenback shops slightly than dearer big-box rivals.

This is among the causes Dollarama has grown so quickly during the last decade. Along with glorious execution and merchandising internally, shopper developments and habits have inspired buyers to buy round and get monetary savings on important items, subsequently having extra cash to both save, or spend on discretionary gadgets. This development ought to solely proceed, which is why there may be such a shiny future for Dollarama.

After such a robust growth throughout Canada during the last 15 years, although, you possibly can argue that the expansion will finally decelerate. Nonetheless, Dollarama already seems to be addressing this by investing in greenback retailer chains outdoors of Canada, comparable to Greenback Metropolis, a Latin-American greenback retailer chain.

Attributable to this robust execution by Dollarama, similar to Brookfield, it has massively outperformed BlackBerry inventory in all the identical durations. And as you possibly can see by the 10-year chart above, even with the large spike BlackBerry’s inventory noticed final yr, these two proceed to outperform.

So in the event you’re trying to purchase a high-quality development inventory you possibly can personal till retirement, Brookfield Infrastructure and Dollarama are two of the very best.