The American Affiliation of Particular person Traders (www.aaii.com) surveys its members each week to see if they’re bullish, bearish or impartial. This week’s information, launched on Thursday, April 14, confirmed probably the most adverse bull-bear unfold since April 2013. The final time we noticed adverse sentiment like this within the AAII survey was in the summertime of 2020, as traders had been nonetheless frightened concerning the COVID Crash that had unfolded in March 2020. That fear helped to gas a protracted bull market. And the Fed’s QE helped loads too.

Some analysts criticize the AAII’s survey methodology, and with good motive. The contributors within the survey volunteer themselves, versus a random phone ballot for instance. And the contributors could change from week to week, as people resolve to solid a vote or not. This isn’t how a correct survey needs to be completed, however doing a correct survey is much more costly. And even a “correct” survey continues to be going to be a flawed illustration of the entire inhabitants; that is only a characteristic of any sort of survey.

With all that mentioned, we will transfer ahead and have a look at this week’s readings of 15.8% bulls and 48.4% bears, assured that these numbers aren’t going to be completely correct. However they will nonetheless in all probability be seen as helpful to ponder as a press release about investor sentiment. Sentiment displays a “situation”, not a “sign”.

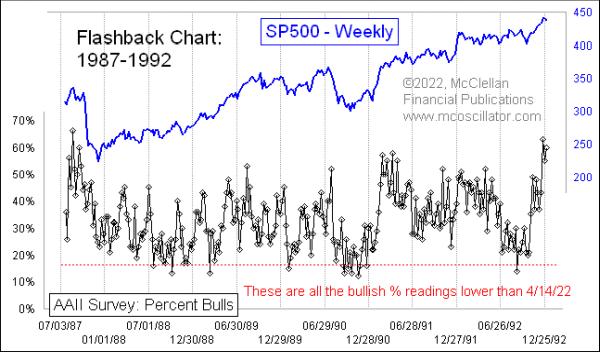

Much more noteworthy than the bull-bear unfold being the worst since 2013 is the remark that the bullish share alone was the bottom since 1992, and it was the ninth lowest bullish share ever. The AAII survey solely started in July 1987, so we have no idea what it might have advised us throughout any interval in historical past earlier than 1987.

I discover it fascinating that all the bullish share readings decrease than this week’s occurred between 1987 and 1992. Here’s a chart of that interval, only for enjoyable.

So why would the AAII members have been a lot extra pessimistic as a bunch again then versus newer years? One level to contemplate is that AAII members are usually older, as a result of individuals begin worrying extra about their investments once they understand they will have to take care of them. That doesn’t sometimes occur when a person is in his 20s. So the AAII survey respondents who participated within the late Nineteen Eighties have doubtless died off by now and been changed by others.

There was additionally a distinction in methodology years in the past. Now the survey is finished on the AAII’s web site. However there was no such factor as an internet site within the Nineteen Eighties.

The AAII members collaborating within the survey within the late Nineteen Eighties had all lived by the Crash of 1987, and heard all the tales about the way it was 1929 once more, and there was an amazing despair forward. Different indicators confirmed that the market was wholesome and recovering after the Dec. 4, 1987 retest low, however the narrative about one other Nice Melancholy remained within the public’s minds (and the media’s narratives) for a very long time. So it’s pure that traders might get momentarily scared into speeding out of their bullish opinions.

In 1990, these traders had an actual dwell taking pictures conflict to fret about when Iraq invaded Kuwait, and threatened to maintain on going into Saudi Arabia’s oil fields. So we noticed extra excessive readings of low charges of bullishness.

That older technology of survey respondents has since been changed by a inhabitants that features loads of buy-the-dippers, who know that each dip has (finally) been an amazing shopping for alternative. So regardless that they might get scared by market motion occasionally, they have a tendency to not get scared all the best way out like in these early years.

Till now. One thing has occurred right here in 2022 to trigger traders’ hearts to make a tough flip away from their once-bullish norms. The Fed considering bigger rate of interest hikes is assuredly one issue. The conflict in Ukraine with no obvious decision is one other. Add to {that a} 5.2% S&P 500 drawdown from the March 29 rebound excessive, and that was apparently sufficient to scare the AAII members into pondering that the sky actually is falling. However these survey respondents, like in most different surveys, have a wonderful monitor file of being improper once they all transfer collectively. That ought to imply a chance for costs to rebound, even when just for a short while, simply to shock the gang to the best extent potential.