With the potential of a full recession looming within the coming quarters, traders are searching for defensive performs, akin to dividend-paying shares and companies extra resilient in financial downturns.

Taking a look at Tuesday’s market shut, XRT, a.okay.a. Granny Retail, was up 1.1%, together with Costco (1.22%), Walmart (2.59%), Kroger (3.52%), and Goal (0.91%). But the S&P 500 closed decrease by 0.54%, whereas the NASDAQ fell by 1.20%.

We all know that in powerful instances, folks want dependable services they’ll rely on. Our two featured shares right this moment could profit by providing high-demand items even when the financial system is struggling.

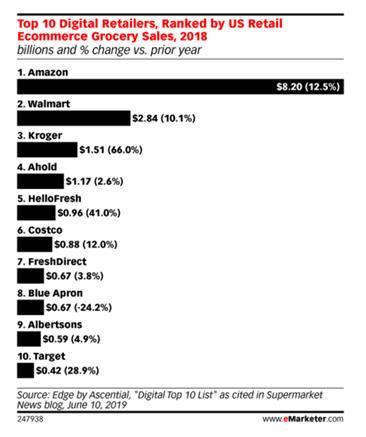

Grocery e-commerce is a fast-growing class nonetheless, and most traders concentrate on Amazon (AMZN), but Kroger (KR) and Walmart (WMT) are additionally leaders. Each corporations have proven resilience and are anticipated to proceed recovering and performing nicely even because the financial system weakens.

Walmart, the worldwide low cost chief in retail and on-line purchasing, and Kroger, a diversified grocer working to seize extra offline and on-line market share, need to increase their attain on this difficult setting.

Walmart continues to be rising retailer income, grocery gross sales, and e-commerce. The corporate has made a number of acquisitions to enhance buyer expertise. Essentially the most notable is the e-commerce platform Flipkart, an Indian e-commerce enterprise platform that rivals Alibaba. Walmart+ can also be a rising power, with the addition of Paramount+ streaming, and Walmart+ members spend virtually double compared to common clients. Walmart has seen low however steady progress in shopper gross sales, which stands out from different sectors of the financial system.

Taking a look at Kroger, which is predicated in Cincinnati and is the second-largest grocer by income, the corporate operates supermarkets below varied banners, together with Kroger, Metropolis Market, Dillons, Meals 4 Much less, Fred Meyer, Fry’s, Harris Teeter, Jay C, King Soopers, Mariano’s, Decide n Save, QFC, Ralphs and Smith’s. Kroger can also be the most important floral retailer within the US and the fifth-largest pharmacy. Kroger manufactures and sells private-label items, so it’s positioned to learn from rising meals prices.

Kroger additionally operates comfort shops and superb jewellery shops below names like Fred Meyer Jewelers and Littman Jewelers.

Kroger and Walmart each have billion-dollar repurchase inventory plans, which function extra catalysts for progress, and every gives a lovely dividend.

Regardless of issues about inflation, stock, and provide chain disruptions, Walmart and Kroger reported comparatively sturdy earnings of their most up-to-date quarters. Walmart and Kroger nonetheless have potential enterprise dangers, primarily attributable to Granny Retail’s unsure resilience, which might be impacted negatively in a prolonged recession. Nevertheless, items akin to meals and private merchandise that customers depend on every day, are likely to generate stable income for choose retail chains even in weak financial circumstances.

Do you need to know commerce the inventory market throughout a recession? You do not need to be caught in a market crash – or miss out on potential income. Subscribe to Mish’s Day by day for market insights.

It’s also possible to join a free session with Rob Quinn, our Chief Technique Guide, by clicking right here to study extra about Mish’s top-rated threat administration buying and selling service.

Mish’s Upcoming Seminars

The Cash Present: Be part of me and lots of fantastic audio system on the Cash Present in Orlando, starting October thirtieth working via November 1st; spend Halloween with us!

Dealer’s Summit: Mish speaks with Helene Meisler on October twenty third at 12pm ET. Study extra right here.

Comply with Mish on Twitter @marketminute for inventory picks and extra. Comply with Mish on Instagram (mishschneider) for every day morning movies. To see up to date media clips, click on right here.

Learn Mish’s newest article for CMC Markets, titled “Are We Due One other Supercycle in Miners and Treasured Metals?“.

Mish talks hedges and inventory picks below the present setting on this look on BNN Bloomberg.

- S&P 500 (SPY): 355 assist, 360 resistance.

- Russell 2000 (IWM): 165 assist, 171 resistance.

- Dow (DIA): 290 assist, 296 resistance.

- Nasdaq (QQQ): 260 assist, 265 resistance.

- KRE (Regional Banks): 58 is assist, 61 resistance.

- SMH (Semiconductors): 174 assist, 180 resistance.

- IYT (Transportation): 196 assist, 203 resistance.

- IBB (Biotechnology): 116.59 is now assist, 120 resistance.

- XRT (Retail): 57 is now assist, 60 resistance.

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Schooling

Wade Dawson

MarketGauge.com

Portfolio Supervisor

Mish Schneider serves as Director of Buying and selling Schooling at MarketGauge.com. For practically 20 years, MarketGauge.com has offered monetary info and training to 1000’s of people, in addition to to massive monetary establishments and publications akin to Barron’s, Constancy, ILX Methods, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many prime 50 monetary folks to comply with on Twitter. In 2018, Mish was the winner of the Prime Inventory Decide of the yr for RealVision.